Back

Dinesh H

Let's work together • 26d

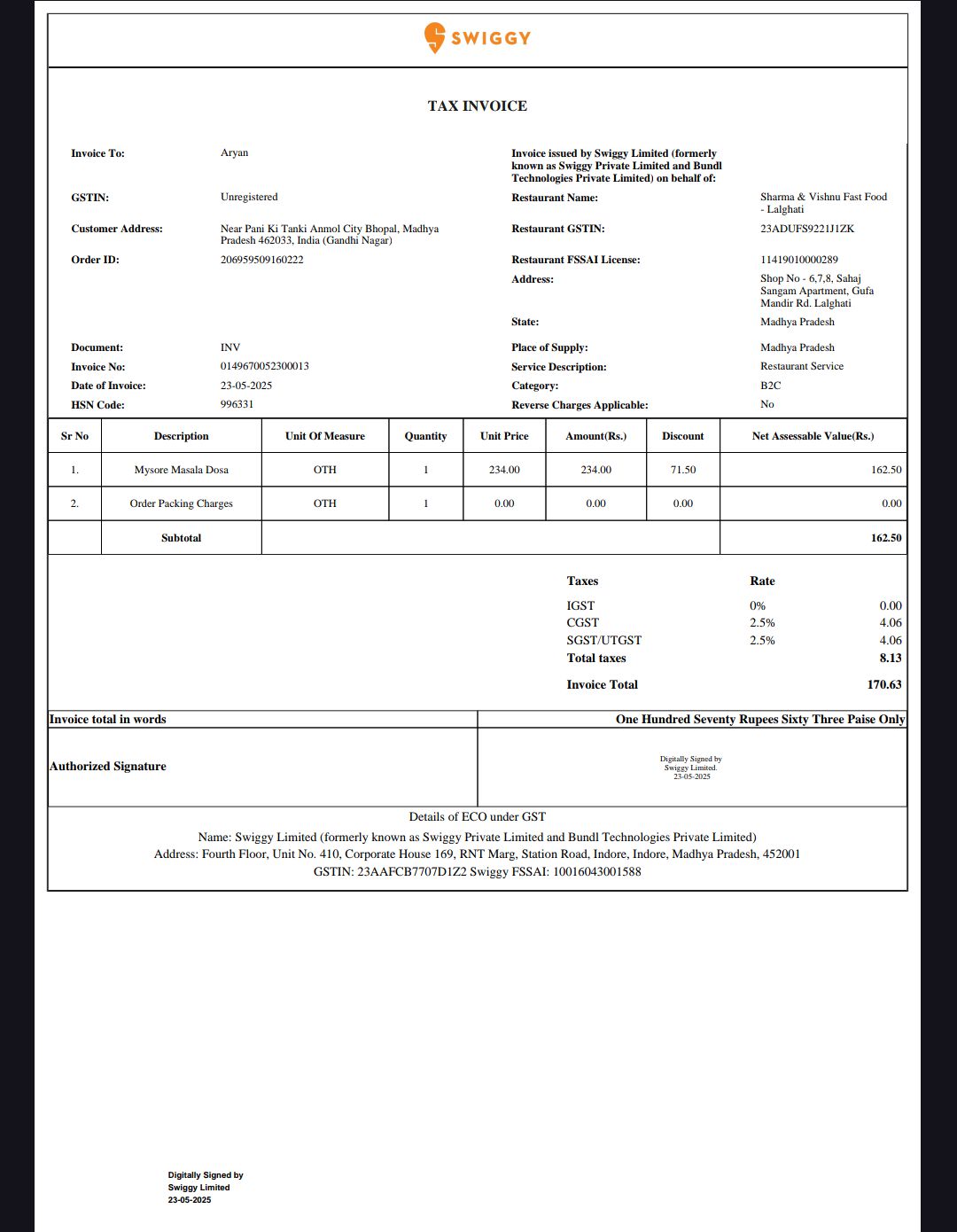

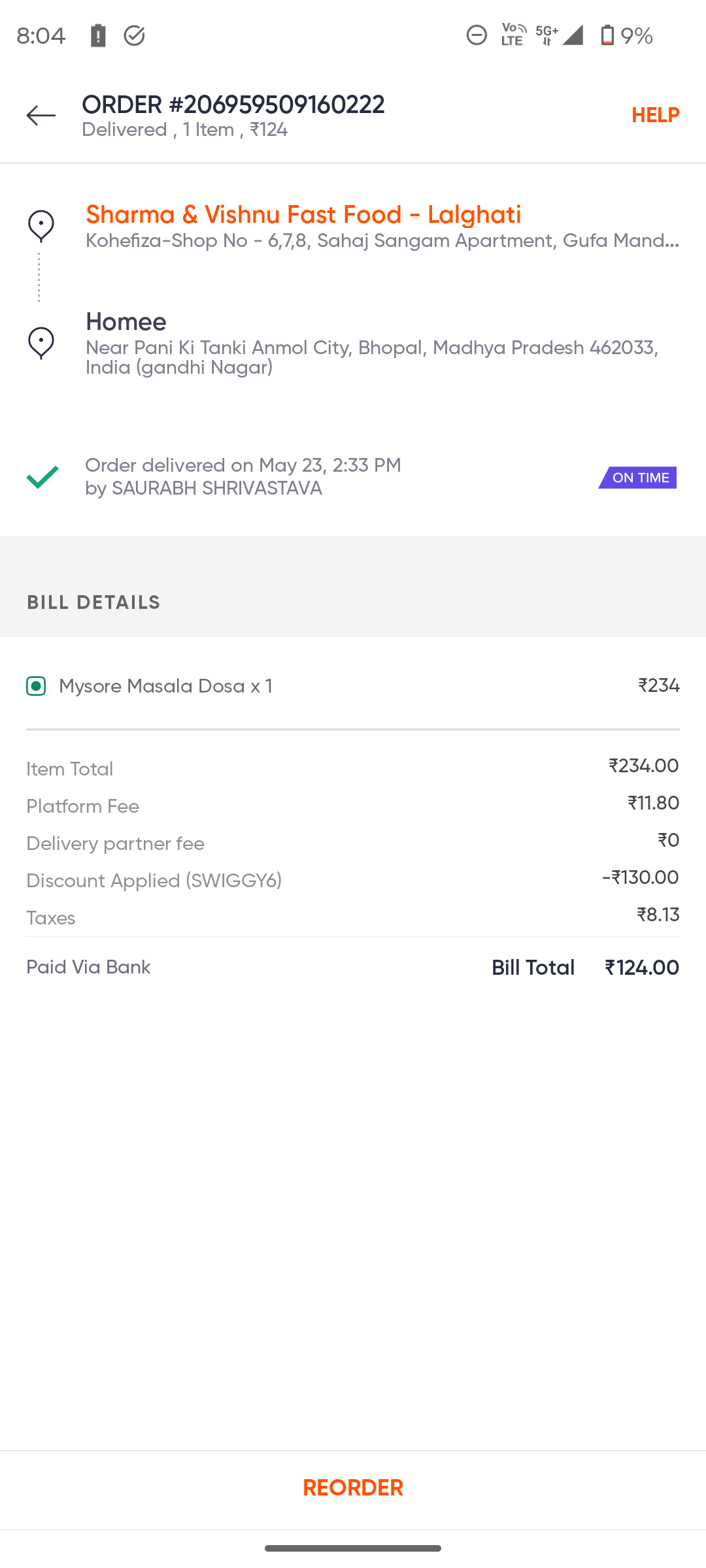

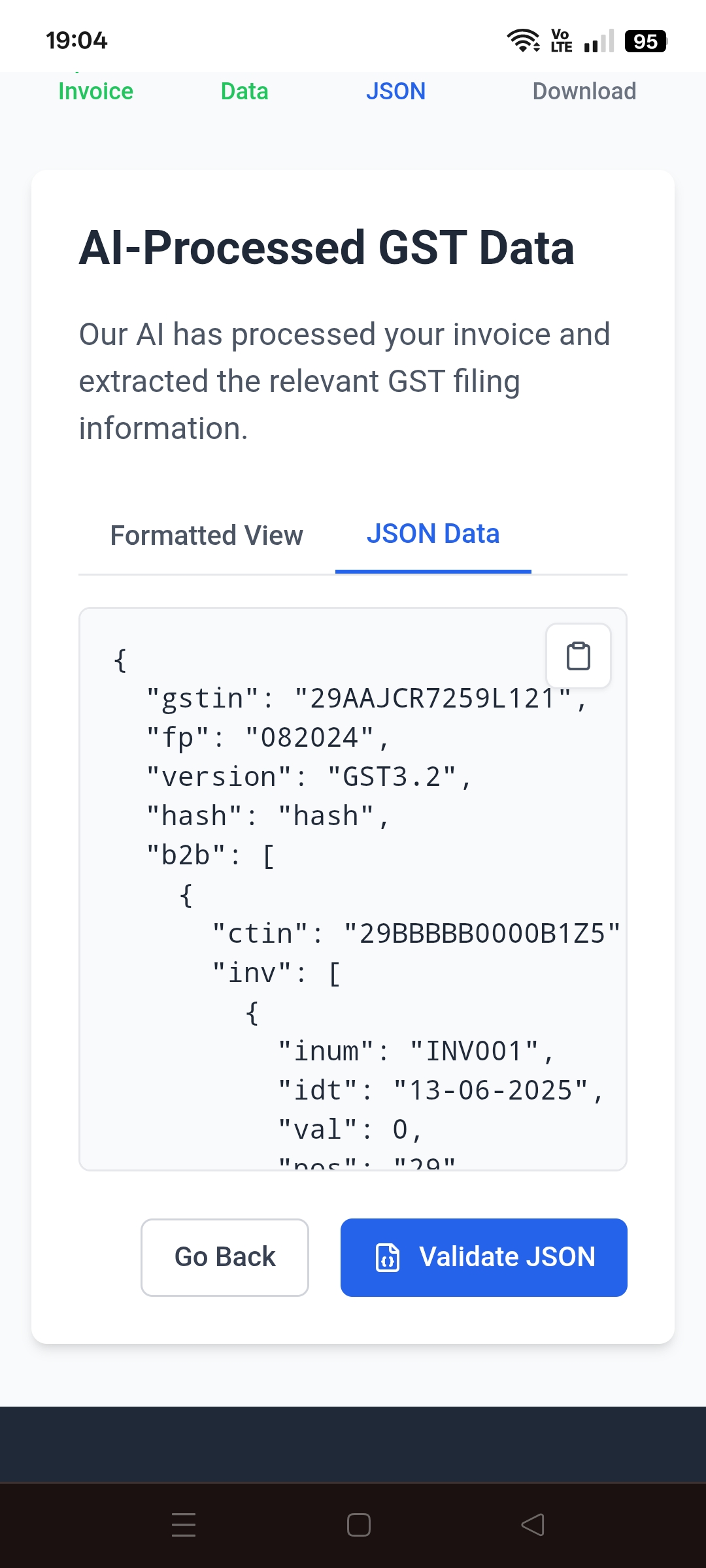

Filing GSTR-1 feels harder than earning the money you’re paying tax on. And yet, freelancers & shop owners are expected to: • Understand confusing formats • Handle invoice data entry • Pay ₹500–₹1500 every month to get it filed 😣 That’s exactly why I built this. A simple tool where you can: 🧾 Upload invoice or even just its photo ⚙️ It auto-extracts the details using AI 📁 Gives you a valid GST JSON file — ready to upload ✅ No more rejected uploads ✅ No more dependency on others ✅ No ongoing charges If you’ve ever felt stuck or overcharged while filing GST, this MVP is made for you. 👉 Try it now: https://candid-cascaron-632b71.netlify.app Would love your feedback 🙏

More like this

Recommendations from Medial

Saurabh Mishra

Building a tech gian... • 14d

🚀 Now offering complete Tax, Compliance & Bookkeeping Services for Startups, Freelancers & Small Businesses! ✅ Income Tax Return (ITR) Filing ✅ GST Registration & Returns ✅ ROC/MCA Compliance ✅ Bookkeeping & Monthly Accounting ✅ MSME, Startup India

See MoreCA Chandan Shahi

Startups | Tax | Acc... • 3m

Here are 10 important accounting tasks to complete before 31-03-2025 to ensure a smooth financial year-end closing and compliance: ✅ 1. Reconcile All Bank Accounts Ensure that bank statements match the books of accounts. Resolve any discrepancies b

See Morecalculus

Your Bottom Line Our... • 17d

Ravi's Hassle-Free GST Journey Ravi, a small business owner running a hardware store in Bengaluru, was always stressed when it came to GST filing. Every month-end, he found himself tangled in invoices, confused over HSN codes, and worried about pena

See More

CA Jasmeet Singh

In God We Trust, The... • 3m

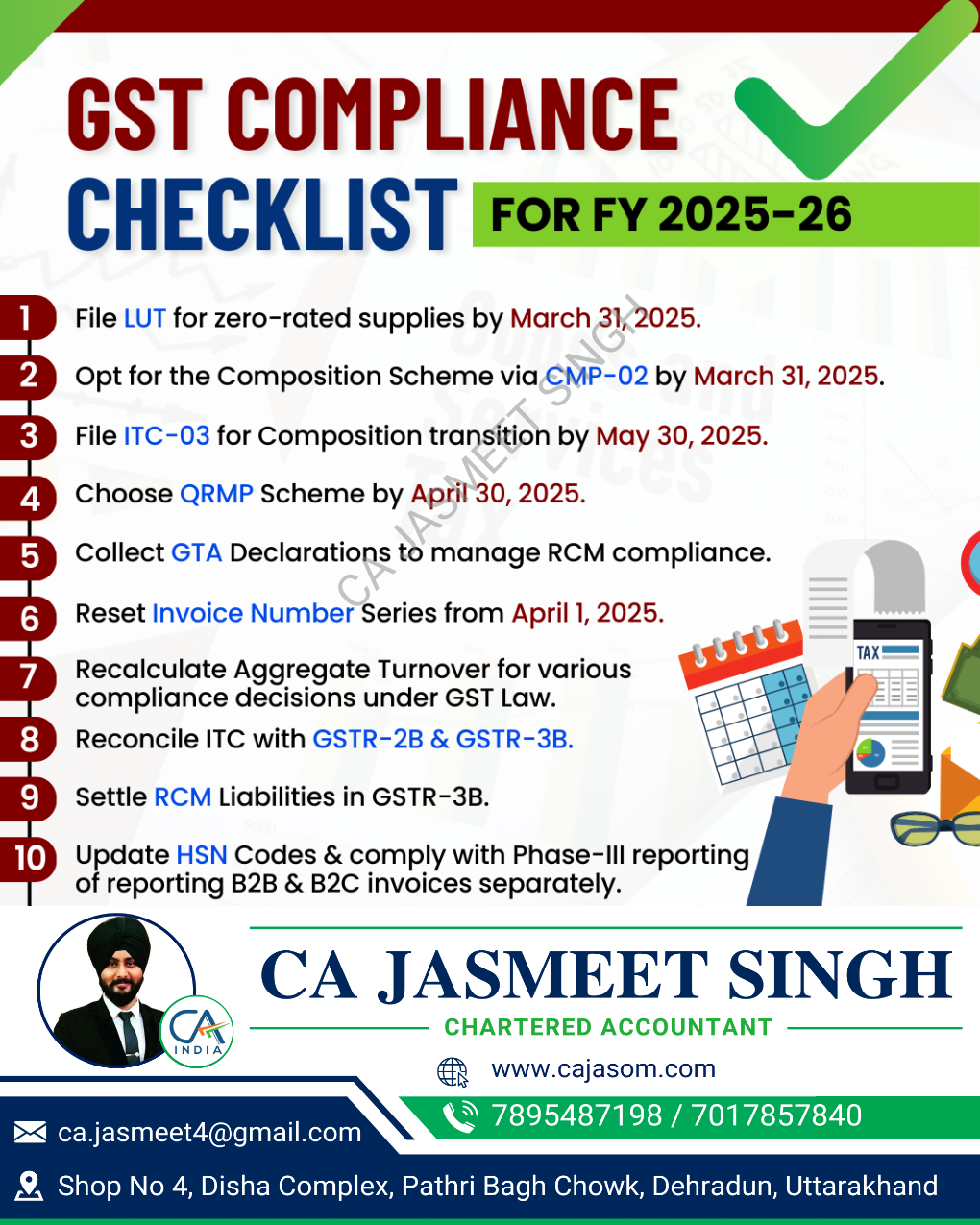

🚀 GST Compliance Checklist for the New Financial Year ✅ A new financial year means a fresh start for your GST compliance! 📆✅ Stay ahead of deadlines, avoid penalties, and ensure smooth tax filings with this essential checklist. 📊💼 🔹 Review GST

See More

AFFORDABLE TREND

The business should ... • 7m

Attention GST taxpayers: November 30, 2024 is last day to claim pending input tax credit by filing GSTR 3B November 30, 2024, is the last date to claim any pending input tax credit (ITC) or amend any errors or omissions in compliance with the Goods

See More

Download the medial app to read full posts, comements and news.