Back

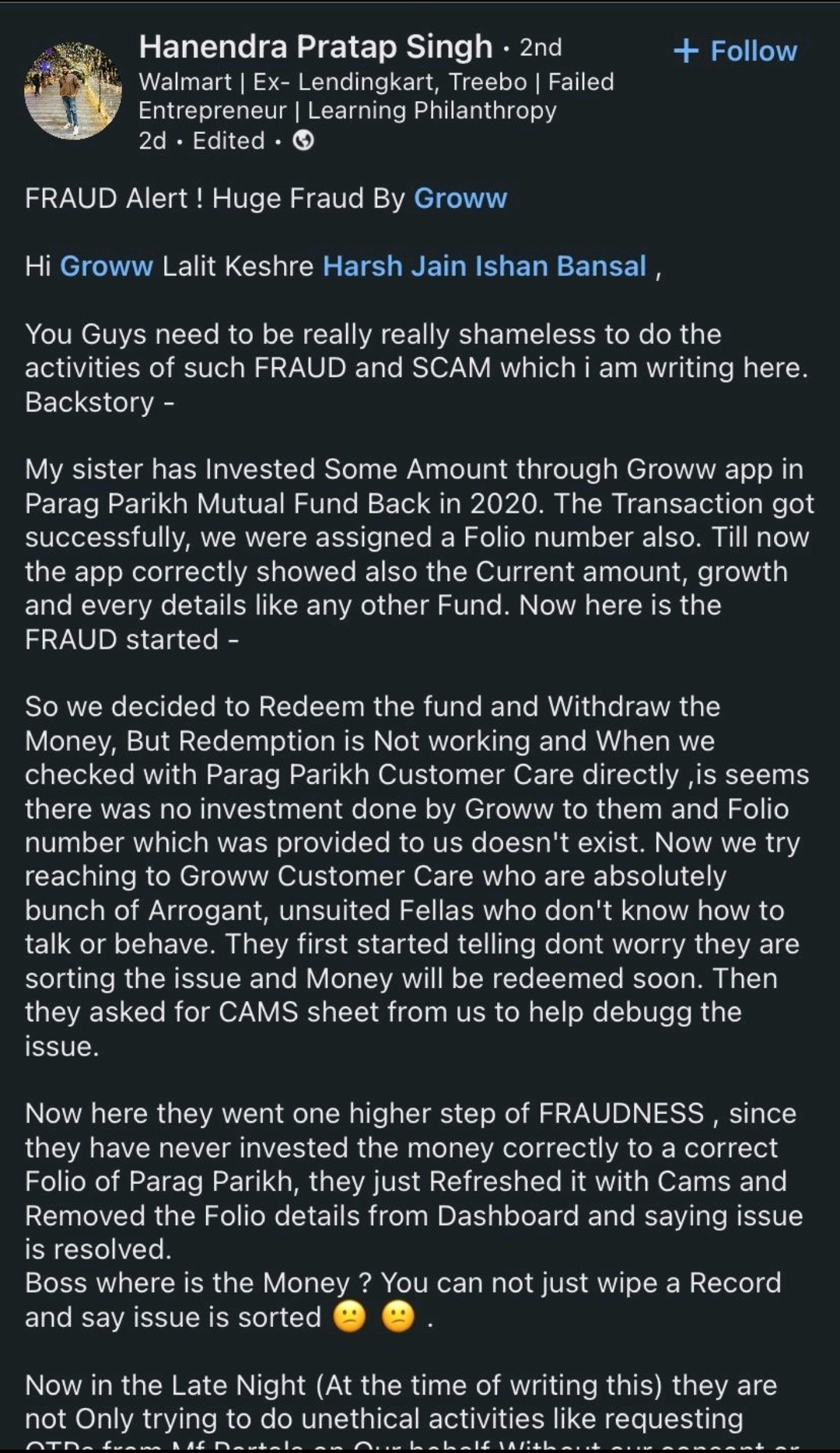

Jayant Mundhra

•

Dexter Capital Advisors • 4m

I wrote a comprehensive, in-depth analysis five months ago explaining why I began investing some small funds in bonds. However, now the trend is becoming too evident to overlook 🚀🚀 A subtle yet significant shift is occurring in Indian retail investing towards corporate bonds. And with the entry of India’s biggest stockbroker into this game, the shift is bound to accelerate. Here’s why! .. See, for decades, bonds were off-limits for most of us. You needed a substantial ticket size, often Rs 1 lakh or more, and the process was complicated. It was a playground for institutions, not everyday investors. But, with big brokers like Groww entering the market democratisation of the asset class had begun - and I have data to show. You see, as per Moneycontrol, Groww has facilitated bond issuances from three companies so far. - In each case, around 12% of the total bonds were issued to investors who used Groww - If you think of it, most of these investors would’ve likely never have considered bonds if Groww - probably their default trading/investment app - hadn’t presented the option to them .. But, this becomes even more interesting. Why? Groww has achieved around 12% share without much fanfare, marketing, or promotions. To me, this indicates a significant potential for growth in retail investments in bonds, as access is made more democratic and visibility is increased through such platforms, whether it be Groww, Wint Wealth, Stable Money, or any other. It suggests that if you provide people with a straightforward way to invest, many will take advantage of it. .. Furthermore, it helps that SEBI itself aims to promote corporate bond investing. The most significant step to boost this asset class was SEBI reducing the minimum bond investment from a lakh to just Rs 10,000. This 2024 move by SEBI opened up the market, and platforms like Groww and others are now developing the distribution channels. The outcome is that millions of people now have access to assets offering 9-12% returns - not as high, but also more stable and less volatile. Therefore, there is a very promising outlook for the corporate bond markets. What do you think?

Replies (1)

More like this

Recommendations from Medial

Rohan Saha

Founder - Burn Inves... • 9m

These days, as more retail investors step into the bond market, high yield bonds are getting harder to find. I remember being able to buy AA rated bonds on the exchange with returns as high as 24% to 30%. Now, those same bonds hardly go beyond 12% or

See MoreAccount Deleted

Hey I am on Medial • 1y

The Year of Indian Startups' IPOs Series : 1. Groww -> • Groww is planning an IPO to raise approximately ₹6,000 crore, aiming for a valuation between $6 billion and $8 billion. • In FY24, Groww reported ₹3,145 crore in revenue from operations, do

See More

Three Commas Gang

Building Bharat • 1y

Groww just made a mess! Instead of investing the money apparently they created a fake folio! This is scary. And worst of all, it is alleged that instead of issuing an apology, they are demanding the post to be deleted. Did this give the necessary n

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)