Back

Replies (1)

More like this

Recommendations from Medial

Deepak Kumar

Founder @erizo.in • 7m

koi CA ya accountant ho toh mere ek sawal ka jawab dijiye maan lijiye amazon par kisi seller ka Rs.100 ka saman sale hota hai aur uski item ki MRP bhi 100 hai jisme 28% GST included hai, amazon sirf delivery fee aur platform fee le sakta hai, amazon

See MoreGyana Ranjan Dash

•

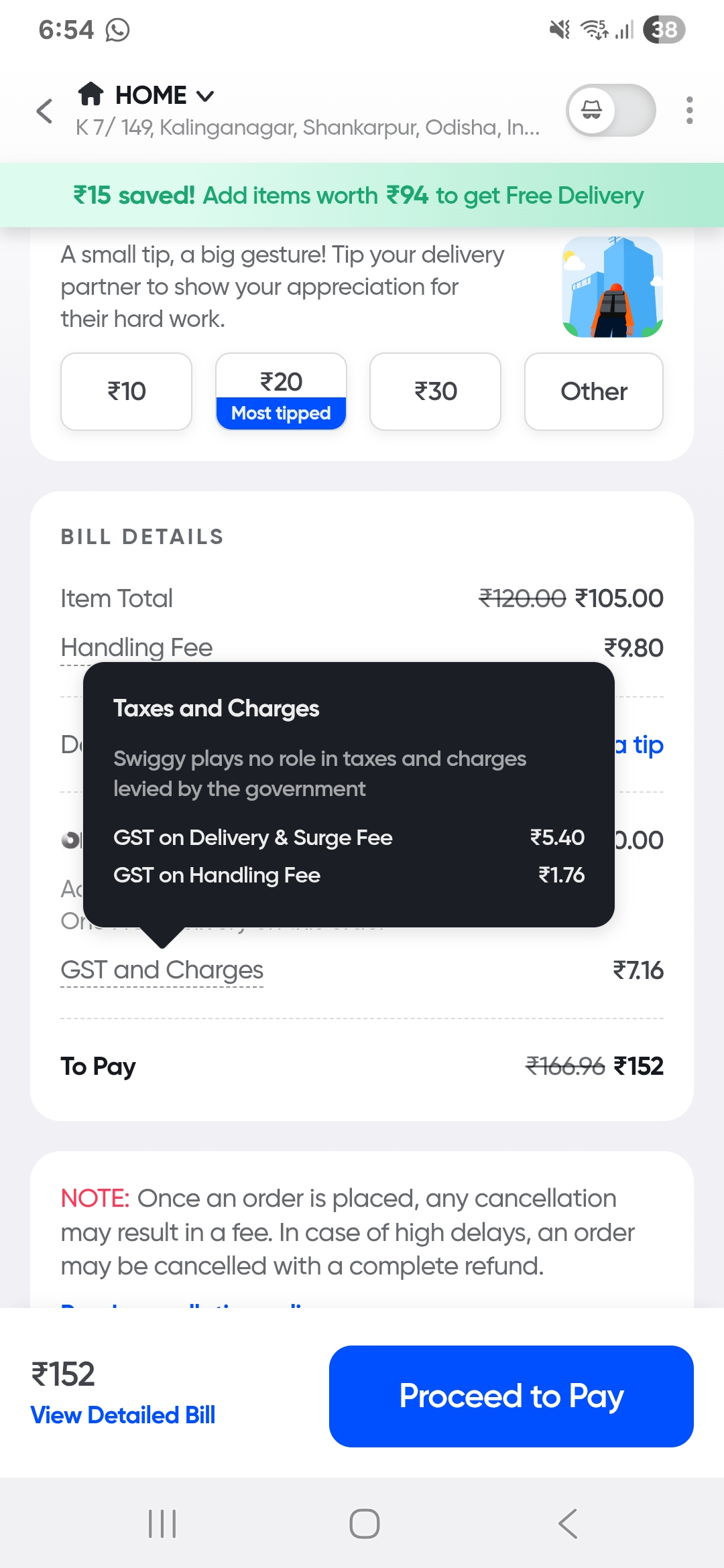

Gameberry Labs • 1y

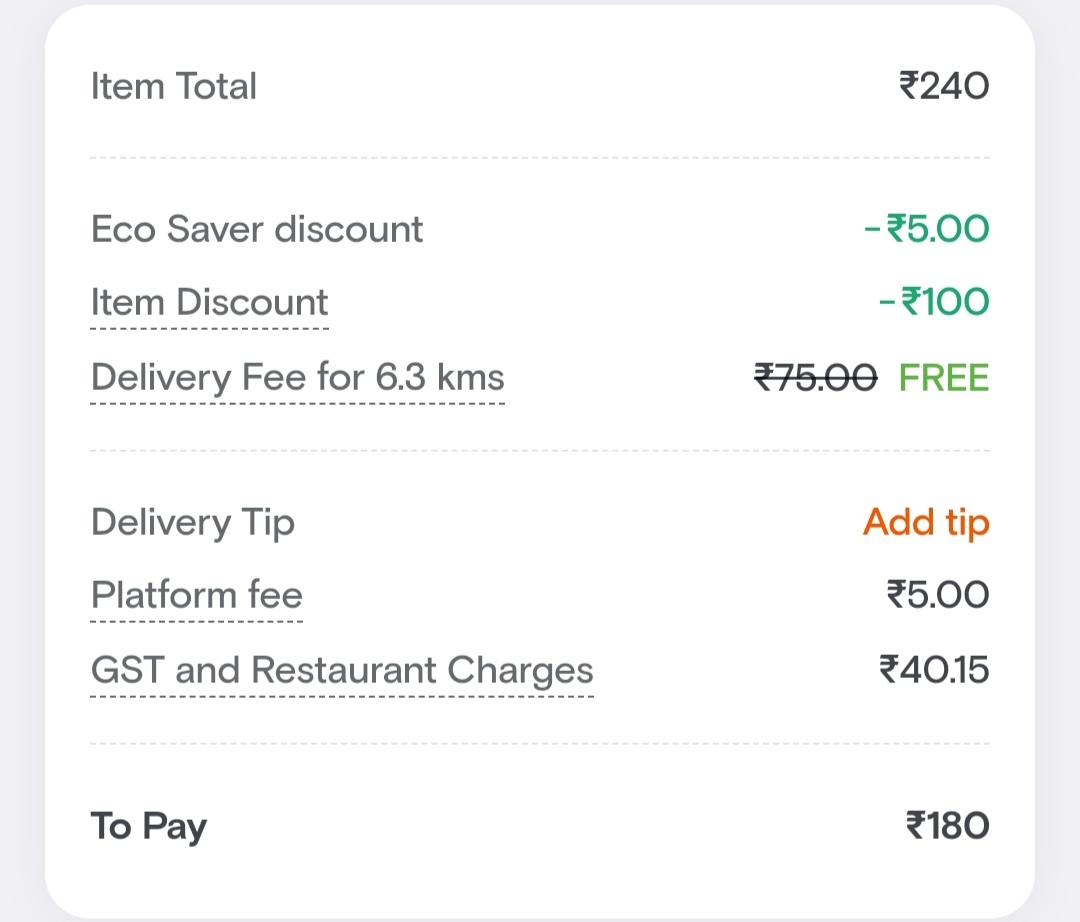

Yo, I'm a bit confused about something. I'm ordering a packaged food item, and the MRP (Maximum Retail Price) is supposed to include all taxes, right? But why is Swiggy charging me GST (Goods and Services Tax) on top of that? There's also a platform

See More

AASHIRWAD DEVELOPER GROUP

The business should ... • 1y

Attention GST taxpayers: November 30, 2024 is last day to claim pending input tax credit by filing GSTR 3B November 30, 2024, is the last date to claim any pending input tax credit (ITC) or amend any errors or omissions in compliance with the Goods

See More

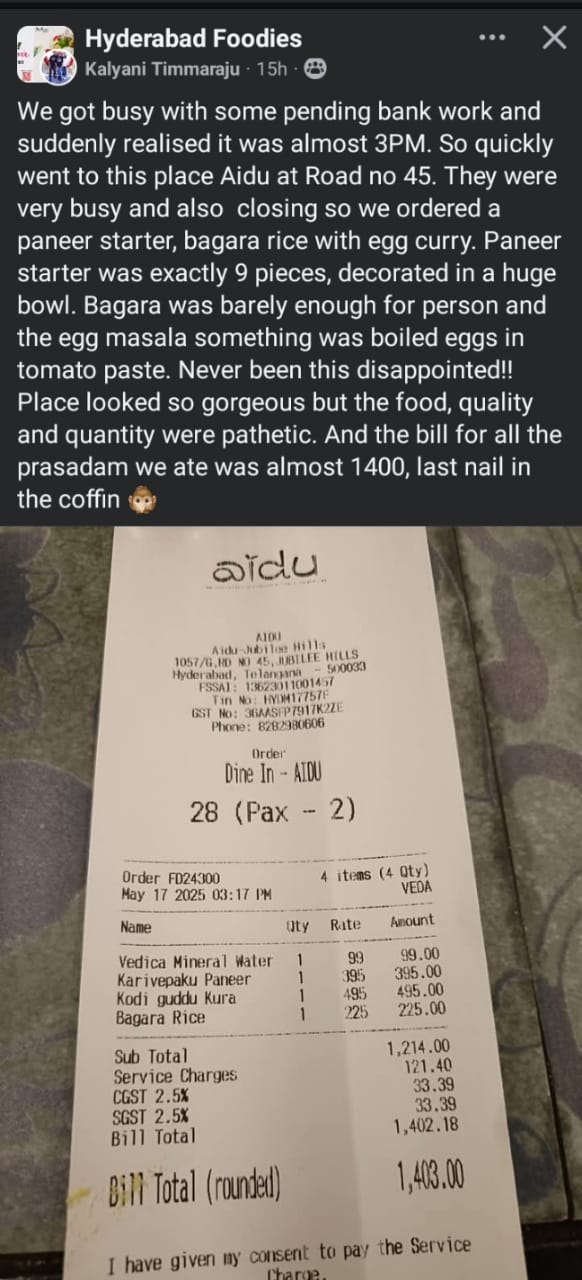

Account Deleted

Hey I am on Medial • 9m

Why should you pay gst and sgst on service charges? That is illegal. If you are not happy why should you agree to pay service charges? I see they got cheated.. Tax should be on bill.. which means 1214 * 5% which 60.70 but they added gst on service c

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)