Back

S A G N I K

Do. Fail. Learn. Mov... • 4m

I think having approval and license from RBI is must also NPCI will provides you the license for specifically for UPI.

More like this

Recommendations from Medial

Gyananjaya Behera

Helping an Idea to S... • 1y

UPI Transactions Jump 5% MoM In May To 1,404 Cr Monthly Growth: UPI transactions rose 5% month-on-month in May to 14.04 billion, with transaction volume increasing 4.1% to INR 20.45 lakh crore. Yearly Growth: Year-on-year, transaction count surged

See More

Account Deleted

Hey I am on Medial • 1y

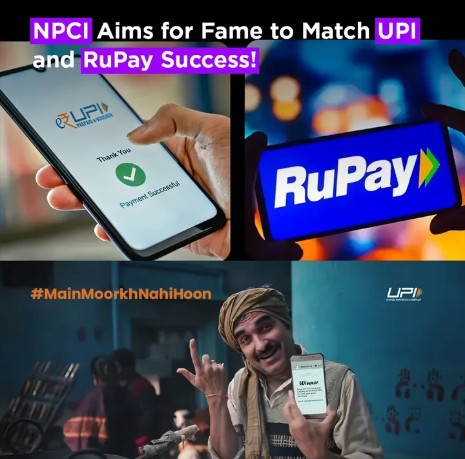

NPCI, the name behind UPI & RuPay, plans to take its brand recognition to new heights in 2025! 🚀 Key updates: 📍 Big push for rural UPI adoption with Pankaj Tripathi as ambassador 💳 RuPay gears up to challenge global giants 📺 IPL sponsorship & di

See More

Poosarla Sai Karthik

Tech guy with a busi... • 7m

UPI on Credit? PhonePe’s Boldest Bet Yet In partnership with HDFC Bank and NPCI, the card is powered by Rupay and allows UPI payments through credit. NPCI had enabled this back in 2022, but PhonePe had to wait almost ten months to get RBI approval.

See Moregray man

I'm just a normal gu... • 10m

The Reserve Bank of India (RBI) has announced that it will soon revise the transaction limits for Unified Payments Interface (UPI) payments made to merchants, also known as person-to-merchant (P2M) transactions. This move is aimed at enhancing the ef

See More

Dr Sarun George Sunny

The Way I See It • 6m

The National Payments Corporation of India (NPCI) is developing UPI 3.0, an upgrade to its UPI that will enable payments through smart devices. The new system will be Internet of Things (loT) -enabled, allowing automated transactions via devices such

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)