Back

Priyadarshi M

𝗦𝘁𝗮𝗿𝘁𝘂𝗽 𝗖𝗮�... • 5m

𝗙𝘂𝗻𝗱𝗶𝗻𝗴 𝗗𝗶𝗽 𝗖𝗵𝗮𝗹𝗹𝗲𝗻𝗴𝗲𝘀 𝗜𝗻𝗱𝗶𝗮’𝘀 𝗦𝗲𝗲𝗱 𝗮𝗻𝗱 𝗘𝗮𝗿𝗹𝘆-𝗦𝘁𝗮𝗴𝗲 𝗙𝗼𝘂𝗻𝗱𝗲𝗿𝘀 In early 2025, India’s startup funding dipped—seed rounds tightened, investors raised scrutiny, demanding more substantial traction, sharper execution, and higher founder accountability. 𝗞𝗲𝘆 𝗧𝗿𝗲𝗻𝗱𝘀 & 𝗙𝗶𝗴𝘂𝗿𝗲𝘀 • Tech startup funding in India dropped to US$4.8 billion in H1 2025, a 25% YoY decline from H1 2024 (US$6.4B). • Seed-stage funding plunged ~44% to US$452 million in H1 2025 vs H1 2024. • Early-stage (Series A/B) funding fell 16% YoY to about US$1.6 billion. • In Karnataka, seed funding dropped 39–41%. Early-stage saw a slight half-year uptick but remains below last year’s figures. (Indian Startup News, Angel One) 𝗪𝗵𝗮𝘁 𝗙𝗼𝘂𝗻𝗱𝗲𝗿𝘀 𝗦𝗵𝗼𝘂𝗹𝗱 𝗗𝗼 𝗡𝗼𝘄 ✅ Demonstrate clear traction with solid revenue, user growth, and unit economics. ✅ Tighten budgets and extend runway—fewer seed dollars mean the need to achieve more with less. ✅ Prioritise investors who understand your sector and risk profile. ✅ Craft a compelling narrative focused on sustainability and profitable growth, not just scale. 𝗪𝗵𝘆 𝗧𝗵𝗶𝘀 𝗜𝘀 𝗛𝗮𝗽𝗽𝗲𝗻𝗶𝗻𝗴 Investor caution is up due to macroeconomic challenges, global uncertainty, and a maturing ecosystem. Founders now need more than just good ideas—execution, discipline, and transparency are must-haves. 𝗪𝗵𝗮𝘁 𝗡𝗲𝘅𝘁 Sharpen your strategy, refine your pitches, strengthen your metrics, and build resilience—prepare for tougher investors. Reach out for pitch reviews or investor guidance. #SeedFundingIndia #EarlyStageStartups #StartupFunding2025 #IndiaTech #Founders #VentureCapital #FundingCrunch #InvestorDueDiligence #StartupEcosystem #ScaleWithProof

Replies (1)

More like this

Recommendations from Medial

Account Deleted

Hey I am on Medial • 8m

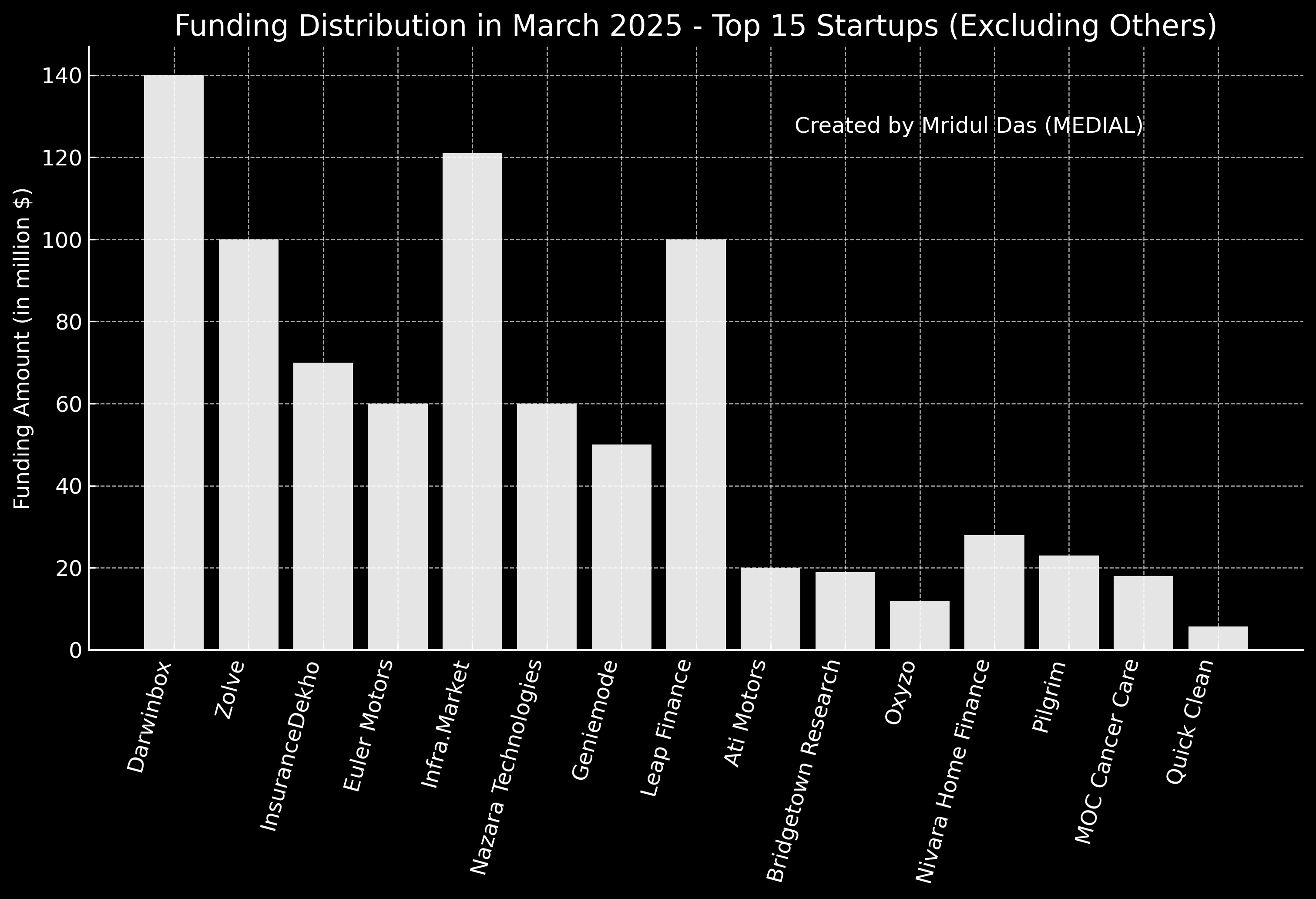

PE/VC Flows in India - Q1 2025 Recap Despite a tough funding environment in #Asia, India’s startup ecosystem showed resilience in early 2025. Indian startups raised around $2.5-3.1B in Q1, up ~8-9% YoY. Deal flow remained healthy, with ~270 deals,

See MoreAccount Deleted

Hey I am on Medial • 8m

Navigating the 2025 Fundraising Landscape Breaks down how early-stage founders should approach raising money in 2025 — with real strategies, pitfalls to avoid, and investor psychology. Link: https://www.rightsidecapital.com/blog/navigating-the-202

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)