Back

Varun Mathur

Business Process Lea... • 5m

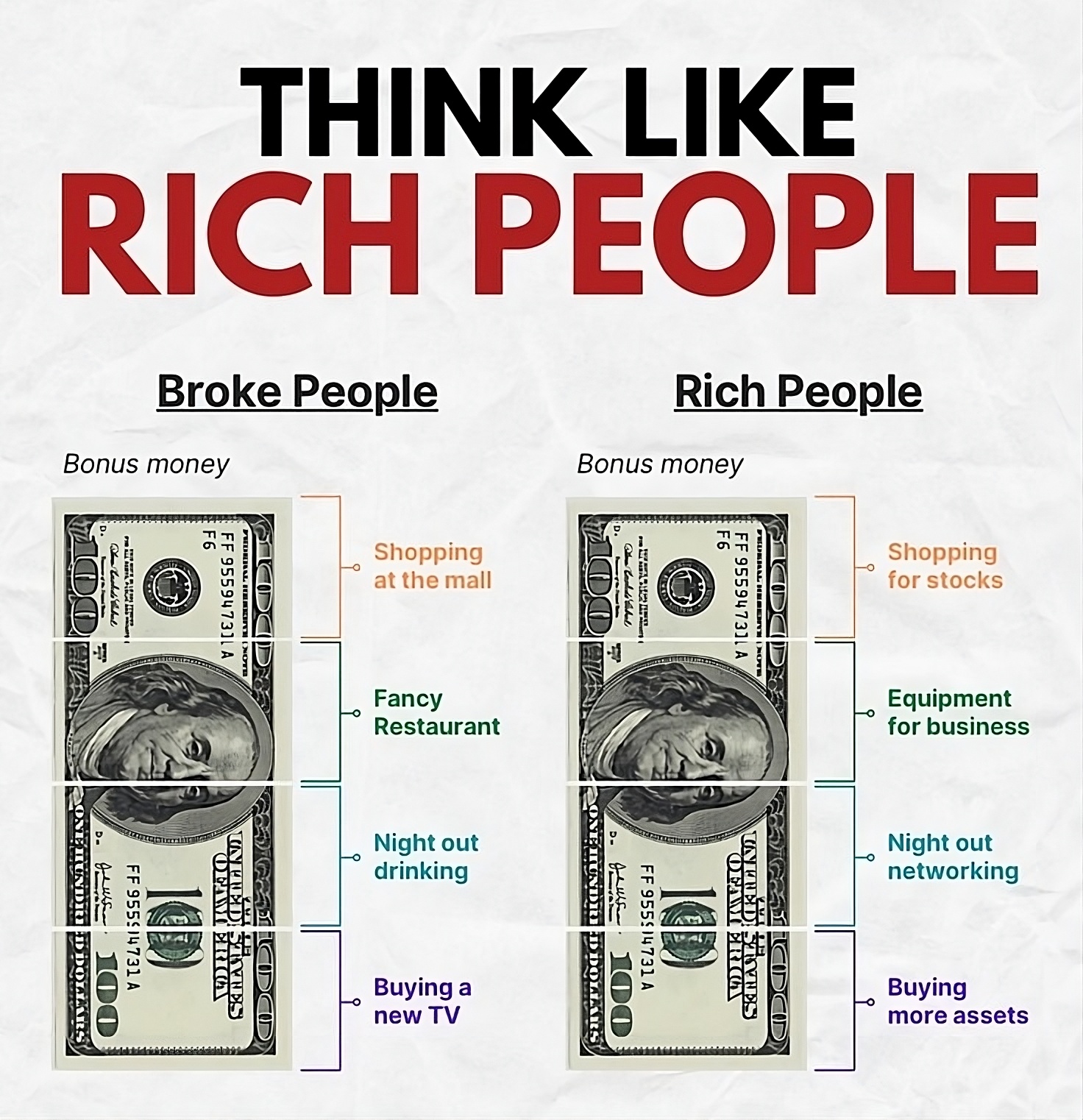

✋ Stop before you scroll. This matters. 💡 Most apps today make it super easy to spend with one tap (thanks UPI!) or push you straight into investments. But what’s missing is an app that helps you save first, spend wisely, and only then invest. Because without this, many of us face 👇 🔹 Living paycheck to paycheck 🔹 Overspending via UPI swipes & instant payments 🔹 Salary gone before month-end, no savings left 🔹 Emergency funds used for non-essentials 🔹 Missed bills → penalties 🔹 No visibility on where money really goes 🔹 Struggling with budgets & priorities The real culprit? Lack of oversight + no saving-first habit. Maybe it’s time for a money app that ensures: Save → Spend → Invest. 💬 What’s your biggest money challenge?

Replies (2)

More like this

Recommendations from Medial

Varun Mathur

Business Process Lea... • 5m

I’m building FrugoPay — a money app designed to solve a problem most of us face daily: 💸 Living paycheck to paycheck ⚡ Overspending through UPI & instant payments ❌ No consistent savings or visibility Unlike traditional payment apps that make spend

See MorePranjal Majumdar

Hey I am on Medial • 1y

If you have no connections, build them. If you have no money, work, save, invest. If you have no friend, be a better person. If you have no talent, practice more. If you have no idea, walk more. If you have no confidence, commit more. If you ha

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)