Back

Devansh Choudhary

Dream big. Do bigger... • 6m

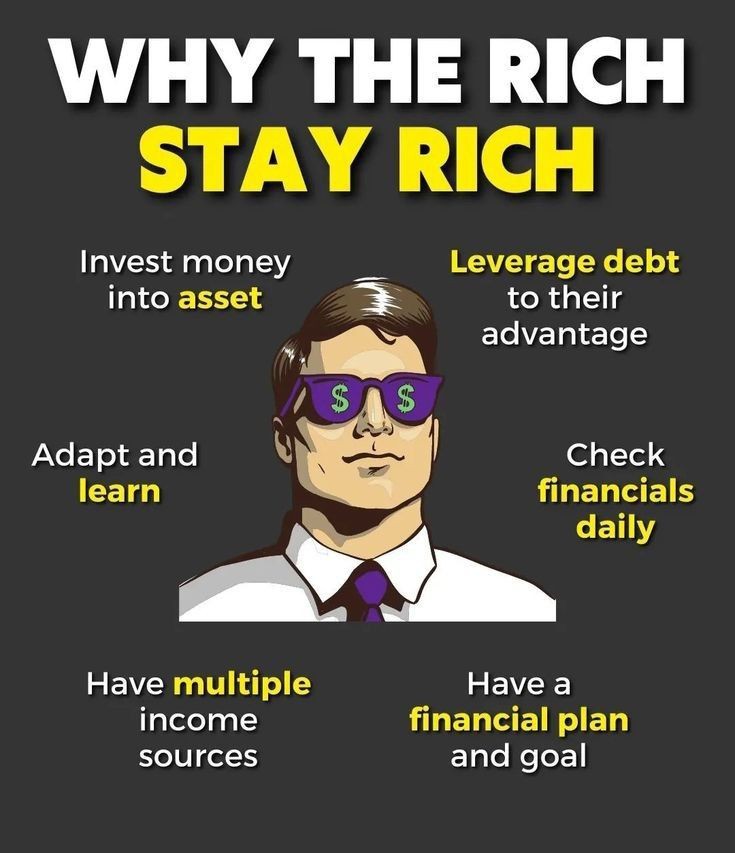

Why The Rich Stay Rich (And It's Not What You Think) Just saw this breakdown and it hits different 🔥 Here's what separates the wealthy from the rest: ✅ They invest in assets, not liabilities - While most people buy things that lose value, rich folks buy things that make them money ✅ They leverage debt smartly - Poor people fear debt, rich people use it to buy income-generating assets ✅ Multiple income streams - One job = one point of failure. They diversify their money sources ✅ Daily financial check-ins - They track their money like it's their lifeline (because it is) ✅ Continuous learning - Markets change, they adapt. Always learning, always evolving ✅ Clear financial goals - They don't just "save money" - they have specific targets and timelines The mindset shift is real. It's not about working harder, it's about working differently 💯 What's one financial habit you want to build in 2025? Drop it below 👇

Replies (1)

More like this

Recommendations from Medial

Thakur Ambuj Singh

Entrepreneur & Creat... • 1y

Why the Rich Stay Rich 💰 💼 Invest in assets, not just income. 📈 Leverage debt smartly. 📊 Review finances daily. 📚 Never stop learning and adapting. 💡 Diversify with multiple income streams. 🎯 Set clear financial goals and plans. Wealth isn't

See More

Tarun Suthar

•

The Institute of Chartered Accountants of India • 1y

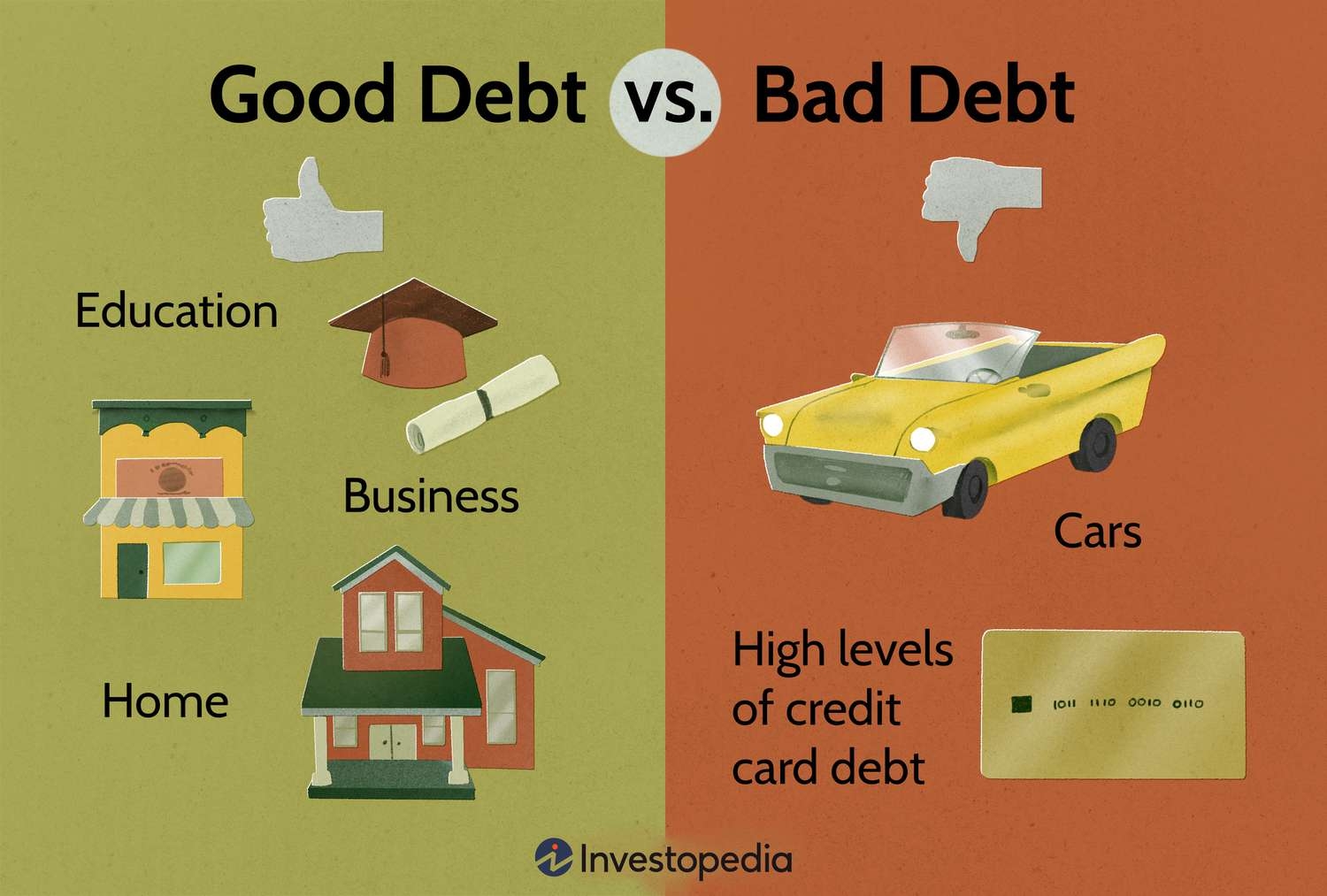

Have you read the book "Rich Dad, Poor Dad" written by "Robert Kiyosaki" . he is a genius. He admitted to having more than $1.2 billion in debt 🤯. you might have watched his yt Shorts claiming that. He views this debt as a strategic move and a par

See More

Anurag Bhardwaj

ECE student | Entre... • 9m

Today’s insight: Use other people’s money! 🚀 The rich get richer by leveraging— Banks lend for assets like properties. Landlords buy homes, Airbnbs cash flow. It’s not their money—it’s the bank’s! They profit while others pay the loan. How will you

See MoreNARESH Rathore

Hey I am on Medial • 11m

💡 What if I tell you that you can master financial literacy & wealth building in a gamified way? 🚀 Introducing Financity – India's first AI-powered financial education & money management platform! ✅ All income sources + step-by-step implementatio

See MoreShivam Singh

"Igniting My Startup... • 1y

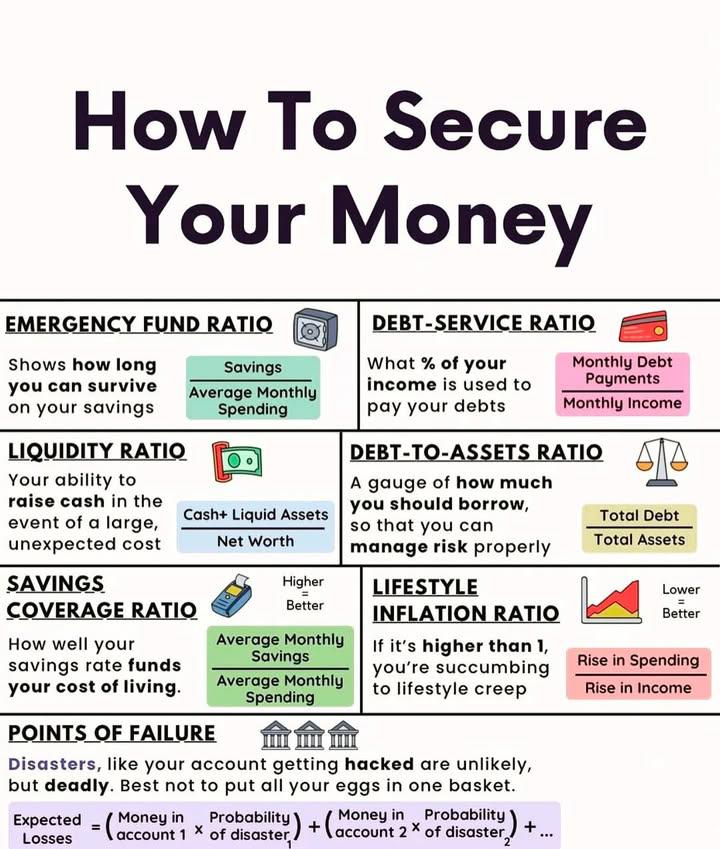

Fundamental Challenges of Finance #Valuation . How are financial assets valued? How should financial assets be valued? How do financial markets determine asset values? How well do financial markets work? #Management . How much should I save

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)