Back

Vishu Bheda

•

Medial • 6m

Not capitalists, Manish 😅—it’s governments and central banks that print money. Doesn’t matter if it’s capitalist or socialist, too much money + too little stuff = inflation...

Replies (1)

More like this

Recommendations from Medial

Tushar Aher Patil

Trying to do better • 9m

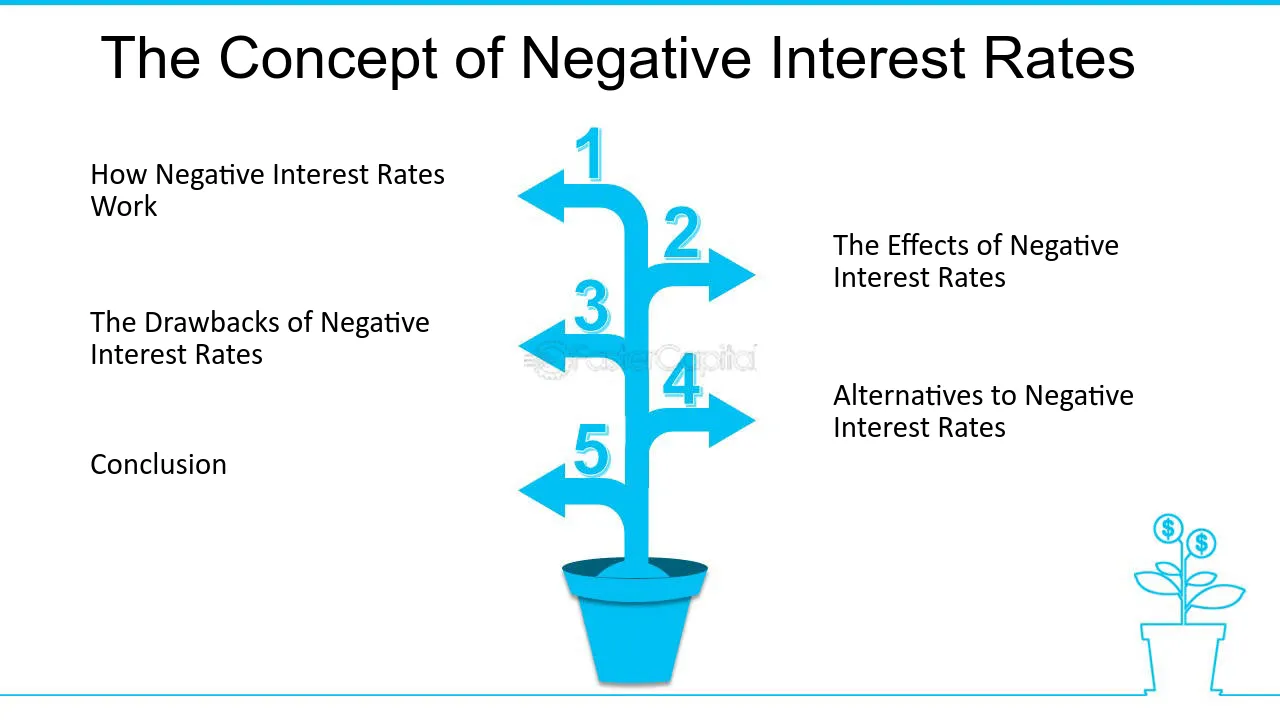

Exploring Negative Interest Rate Policy (NIRP) Have you ever wondered about central banks setting interest rates below zero? This is known as Negative Interest Rate Policy (NIRP). Here's a quick look at this unconventional monetary tool: ✍️ What is i

See More

Tarun Suthar

CA Inter | CS Execut... • 4m

How The World is Drowned in a $300 Trillion Debt Bubble Three Times Its Size. 👀🤯 You've noticed something unsettling: Early every major country, from the US and China to the UK and India, is drowning in Debt. The US owes $36 trillion, and while

See More

Pulakit Bararia

Founder Snippetz Lab... • 11m

We think of banks as places that store our money and keep it safe. But that’s not really what’s going on. When a bank gives out a loan, they don’t get poorer. They simply type new money into your bank account. It’s brand-new money that never exis

See MoreSukhveer Singh

Contact number 62831... • 5m

Cryptocurrency: The Digital Revolution in Finance Cryptocurrencies, such as Bitcoin, Ethereum, and thousands of altcoins, represent a paradigm shift in money and investment. Built on blockchain technology, they offer decentralized, borderless, and t

See More

Anurag Bhardwaj

ECE student | Entre... • 9m

Today’s insight: Use other people’s money! 🚀 The rich get richer by leveraging— Banks lend for assets like properties. Landlords buy homes, Airbnbs cash flow. It’s not their money—it’s the bank’s! They profit while others pay the loan. How will you

See MoreSairaj Kadam

Student & Financial ... • 1y

This Thing Will Actually Blow Your Mind. Click on This. "Inflation is taxation without legislation." - Milton Friedman Inflation: A Major Concern in India Inflation remains a pressing issue in India, with the state of Odisha facing the highest r

See More

Tushar Aher Patil

Trying to do better • 1y

Day 4 About Basic Finance Concepts Here's Some New Concepts Financial Markets and Institutions Stock Markets: Where shares of publicly traded companies are bought and sold (e.g., New York Stock Exchange) Bond Markets: Markets where debt securitie

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)