Back

Pulakit Bararia

Founder Snippetz Lab... • 6m

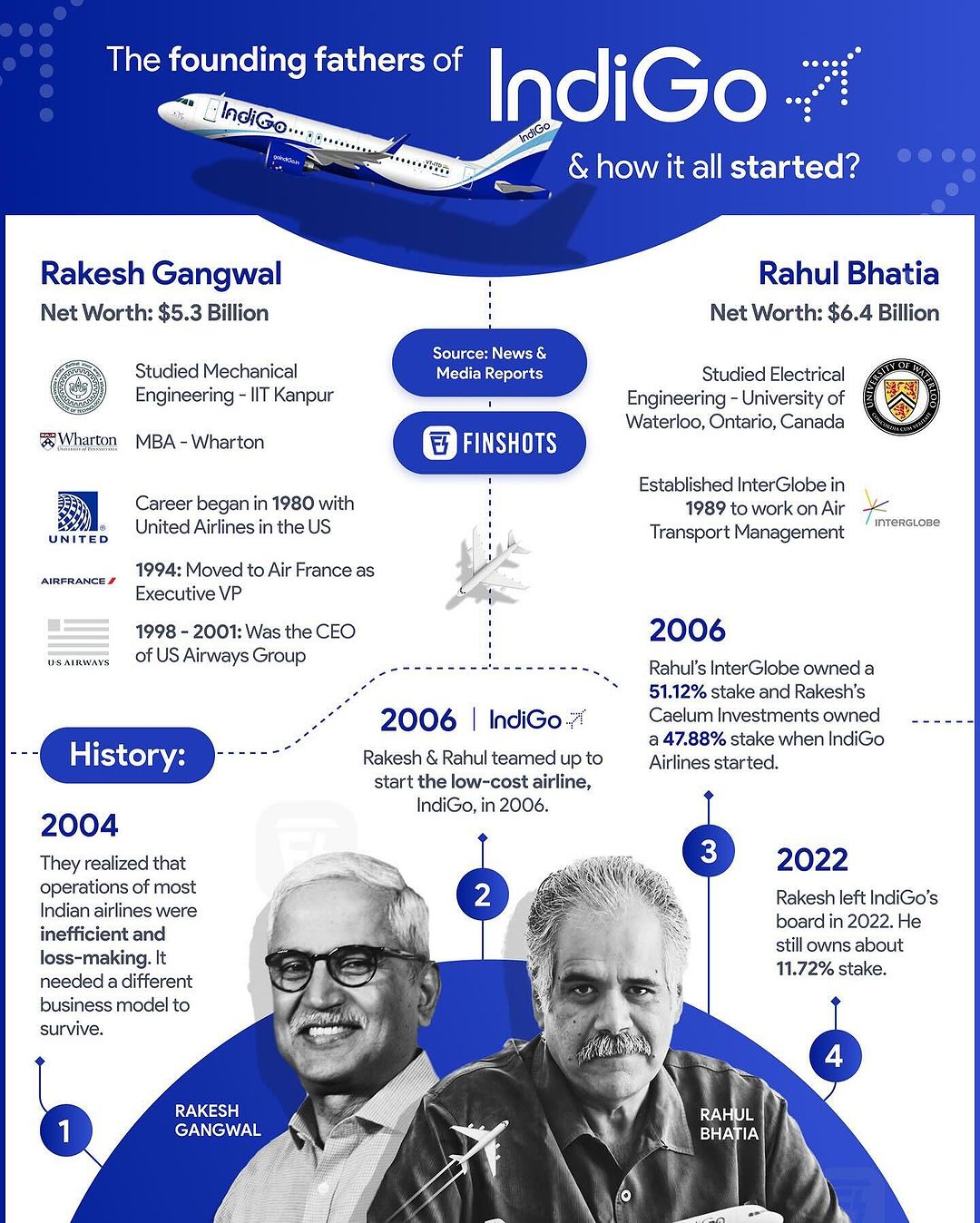

In 2005 indigo were the underdog with not a single plane in the skies. Now they control 52.7% of India's domestic market — more than the combined total of the next five airlines — and have been profitable for 10 consecutive years in one of the world's most brutal industries. Where others dispensed free entertainment and meals, Indigo provided customers what they truly required — a seat, space to stretch their legs, and punctuality. In an environment where most air travellers will take a ₹1,000 discounted ticket over a superior departure time, they knew the Indian traveller better than anyone else. a $6 billion order for 100 Airbus jets in bulk before ever carrying a single passenger. Purchased at what insiders estimated was as much as a 50% discount, then sold through a sale-and-leaseback arrangement for an immediate profit and no maintenance risk. That tied up cash, maintained low levels of debt, and facilitated rapid growth without draining capital. Their hub-and-spoke model allowed 38 planes to serve the same market share that required Kingfisher 66 planes with Lower fuel consumption, fuller flights, more convenient maintenance While others were bleeding when oil prices went from $76 to $132 a barrel in 2008, Indigo turned a ₹234 crore loss into an ₹82 crore profit — and then skyrocketed 400% to ₹480 crore the following year. They even stole 200–300 trained pilots from competitors in 6 months, saving crores of rupees in training expenses.

More like this

Recommendations from Medial

Jayant Mundhra

•

Dexter Capital Advisors • 6m

Since Trump slapped 50% tariffs on us and called us a DEAD economy, many have foolishly called on the Indian government to ban the use of Boeing planes. And this is just so stupid, and a clear sign of zero understanding of how this will hurt India m

See More

Jayant Mundhra

•

Dexter Capital Advisors • 1y

3k crore of taxpayer money burnt in the last two years 📛📛 And Modi Govt is set to burn another Rs 1.2k crore in FY25 for what is clearly another Air India in the making. For what? And worse, this time, there may be no buyers either. .. FY23: Go

See More

Jayant Mundhra

•

Dexter Capital Advisors • 5m

It's crazy that IndiGo enjoys a complete/near-monopoly on 35/66% of its domestic routes! I mean, everyone focuses on the brutal price wars on major routes. We see the fight for Delhi-Mumbai or Bangalore-Chennai. This is the visible, noisy part of th

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)