Back

Vishwa Lingam

Founder of Simulatio... • 6m

Is Joining an Accelerator Program Really Worth It? Or Just an Expensive Gamble? Startup accelerators have become the go-to dream ticket for early-stage founders. They promise funding, mentorship, investor access, and sometimes network effects often in exchange for equity or hefty participation fees. But here’s the question every founder should be asking before they sign that term sheet: Are accelerator programs truly worth it… or are you paying for hype? Let’s break down the reality. 1. The High Fees Nobody Talks About While some accelerators (like Y Combinator, Surge, etc) invest in you and take equity, many regional or niche accelerators charge thousands of dollars in “program fees” without guaranteeing results. Typical range of ₹5,000 – ₹5,00,000+ for 3–6 months Often positioned as “cost-sharing” for workshops, coworking, and expert time. Payment deadlines arrive before you see any ROI 2. Investment Probability Is Way Lower Than You Think Accelerators often market their “investment potential” as a reason to join — but here’s the fine print: Most programs don’t invest directly; they just “connect you” to investors For those that do invest, average funding probability can be under 10% for follow-on rounds A shiny Demo Day doesn’t guarantee a cheque Founders get wowed by success stories, but you’re seeing the 1-10% that made it, not the 90-99% still struggling. 3. From Soft Commitments to Hard Reality A common pain point: accelerators make soft commitments during recruitment — “We’ll help you raise”, “We have investor partners”, “We’ll open doors for you.” Once you’re inside: Introductions are email intros you could’ve made on LinkedIn Mentorship sessions get replaced with generic group calls Promised “guarantees” quietly vanish in the fine print This isn’t to say all accelerators are bad — but due diligence is everything. 4. When Accelerators Are Worth It An accelerator can be worth it if: It has proven alumni who scaled after graduation The mentors are actively engaged and relevant to your industry The equity/fee trade-off is clearly outweighed by tangible results (customers, funding, partnerships) The brand name adds credibility in your market 5. The Founder’s Checklist Before You Apply ✅ Check alumni reviews (off-the-record, if possible) ✅ Ask about exact investor conversion rates ✅ Calculate cost vs. realistic outcomes ✅ See if you can get 80% of the benefits for 0% of the cost — through networks, LinkedIn, and free pitch events Bottom Line Accelerator programs aren’t inherently good or bad — they’re tools. But just like tools, they can be powerful in the right hands… or useless if you’re sold on shiny marketing. Before you commit your equity, cash, and months of time, remember: A bad accelerator is just an expensive distraction.

Replies (1)

More like this

Recommendations from Medial

Account Deleted

Hey I am on Medial • 9m

6 Government Accelerators & Programs to Apply For 1. Startup India Seed Fund Scheme (SISFS) https://seedfund.startupindia.gov.in/ 2. Atal Innovation Mission (AIM) https://aim.gov.in/ 3. SAMRIDH Accelerator Program (MeitY) https://meitystartuphub.i

See More

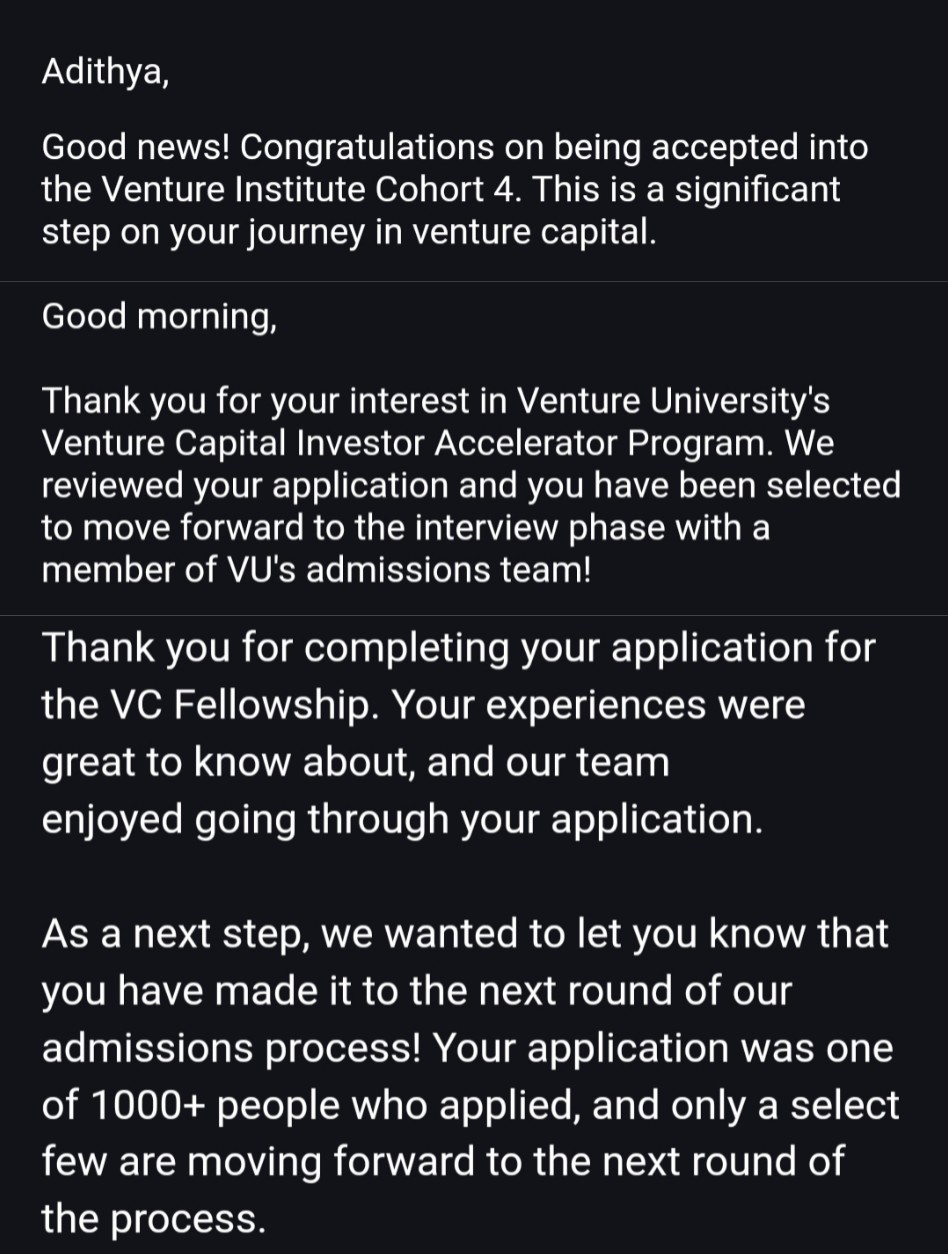

Adithya Pappala

Busy in creating typ... • 1y

🔥 I have been Selected for the Top VC Accelerators in the world & India, But not for 1 or 2, It's 3🎯 This Week is a Mind-Blowing🤯 7 Days Back, I got a Shortlisting Mail of VC Lab Cohort based out of the USA(World's largest VC Accelerator) 3

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)