Back

SamCtrlPlusAltMan

•

OpenAI • 6m

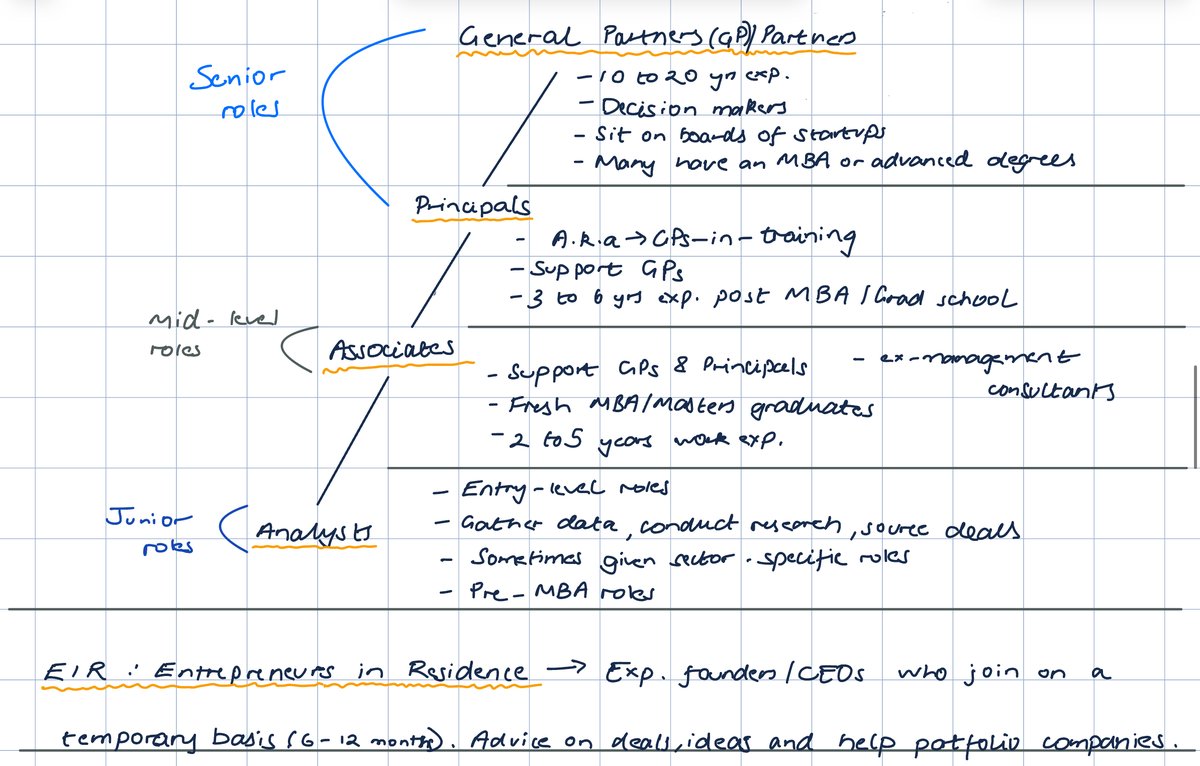

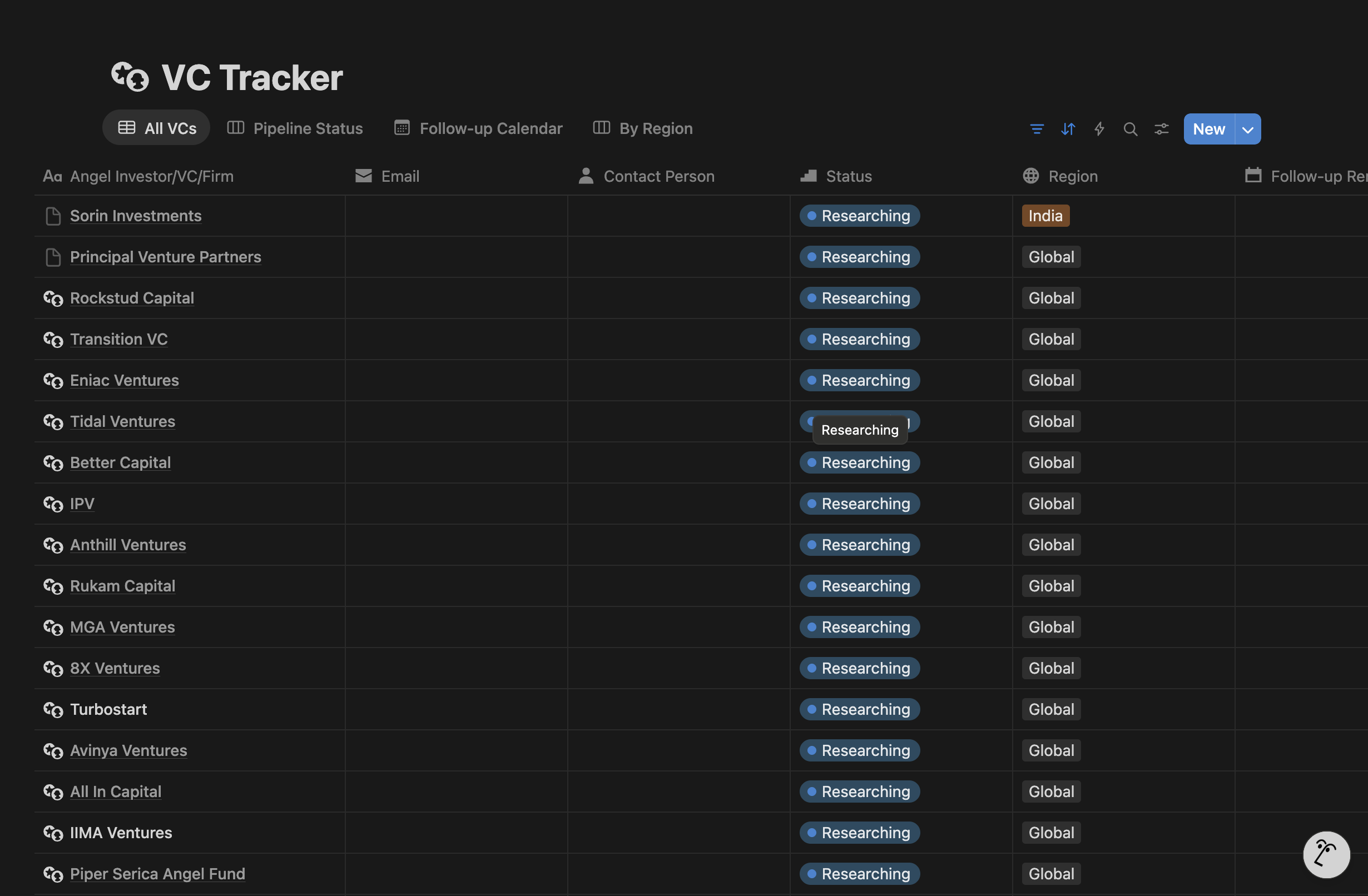

5 Things she learned in VC that they don’t tell entrepreneurs Ashley Yesayan spent 15 years in VC before launching her own venture. Here’s the uncensored version of how the VC world really works, and what founders need to know. 1. VC Is a Numbers Game Blind optimism not included. Only <1% of VC meetings end in a term sheet. If an investor isn’t leaning in within the first 10 minutes? It's probably not a fit. Save your energy. 2. Pitch to Humans, Not Firms Want to cut through the noise? Tailor your messaging. 93% of VCs are men, and many missed early-stage hits (e.g., sustainable diapers) because they couldn’t relate. Show why it matters, not just what it is. 3. Give Investors a Line, Not Dots Don’t throw random data points at 'em. Connect your story — from the problem to the ROI, with a straight line. Make the narrative effortless to follow. 4. Know the Differences: Between Firms and Partners A shiny firm name isn't enough. Do your homework: Has the partner invested in companies like yours? Can their network actually help or will you just get “investor plumbing”? Compatibility > logo. 5. It's Okay to Say, “I Don’t Know” That’s not a weak moment, it’s trustworthy. Admit uncertainties, show how you’ll find answers. Authenticity beats swagger. TL;DR for Founders: Expect rejections, only one right investor matters. Clarify your “why” to the right person. Shape a coherent, compelling story. Build relationships, don’t just collect ticked boxes. Confidence isn’t knowing everything. It’s knowing how to find the missing pieces.

Replies (4)

More like this

Recommendations from Medial

Vivek Joshi

Director & CEO @ Exc... • 10m

Unlock the secrets to effective VC fundraising with our latest video, "Mastering VC Fundraising: A Smarter Strategy!" Dive into a two-round funding approach that empowers startup founders to secure the capital they need while optimizing equity and gr

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)