Back

Poosarla Sai Karthik

Tech guy with a busi... • 6m

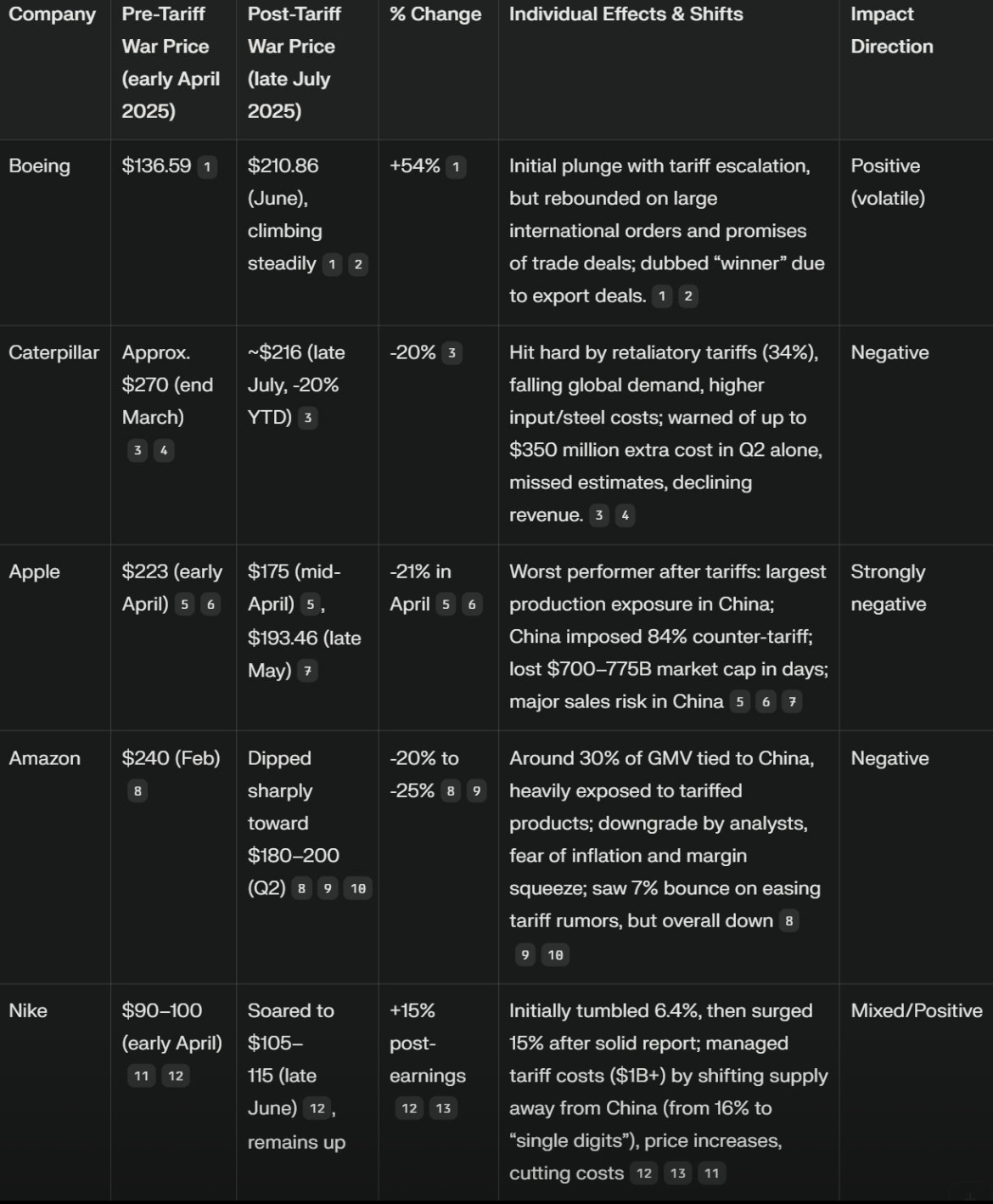

Boeing: Faced early losses as China hit back with tariffs, but bounced back on major global orders (Qatar, UK) and stronger export support. Despite policy-driven volatility, long-term momentum stayed positive. Caterpillar: Crushed by China’s 34% import duty, the stock tumbled 20% in 2025. Rising costs ($350M in Q2) and weak forecasts added pressure, making it one of the year’s worst industrial performers. Apple: Took the hardest hit. Shares dropped 19 to 21 percent in a week, erasing $700B in value. With 90 percent of supply tied to China and no tariff relief, Apple became ground zero for trade war fallout. Amazon: Squeezed on both sides with higher retail costs and heavy exposure to Chinese sellers. Stock fell over 20 percent, with only a mild recovery as tariff talks resumed. Outlook stayed cautious. Nike: Started with a 6.4% drop but rebounded 15% later. Nike quickly reduced China dependence, raised prices, and cut costs. A strong example of supply chain agility under pressure.

More like this

Recommendations from Medial

ProgrammerKR

Founder & CEO of Pro... • 10m

iPhone Prices May Rise Due to Tariffs Tariff tensions may lead Apple to increase iPhone prices for the first time in years. Analysts watch closely as supply chains and consumer markets brace for impact. #Apple #iPhone #Tariffs #TechEconomy #Consume

See MoreProgrammerKR

Founder & CEO of Pro... • 10m

Trump Imposes Heavy Tariffs, China and EU Retaliate Former U.S. President Donald Trump has introduced a 104% tariff on Chinese imports and new duties on electronics, leading to retaliation from China and the European Union. Global markets responded

See MoreVijay Sekuru

Founder Of WMAD Pvt ... • 1y

Renewable Energy in 2025: A Strategic Investment Global Growth: Renewable energy investment hit $728B in 2024 (+14.7% YoY), outpacing fossil fuels 2:1. Solar/wind lead, with renewables set to supply one-third of global electricity by 2025. AI Effic

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)