Back

Anonymous 1

Hey I am on Medial • 6m

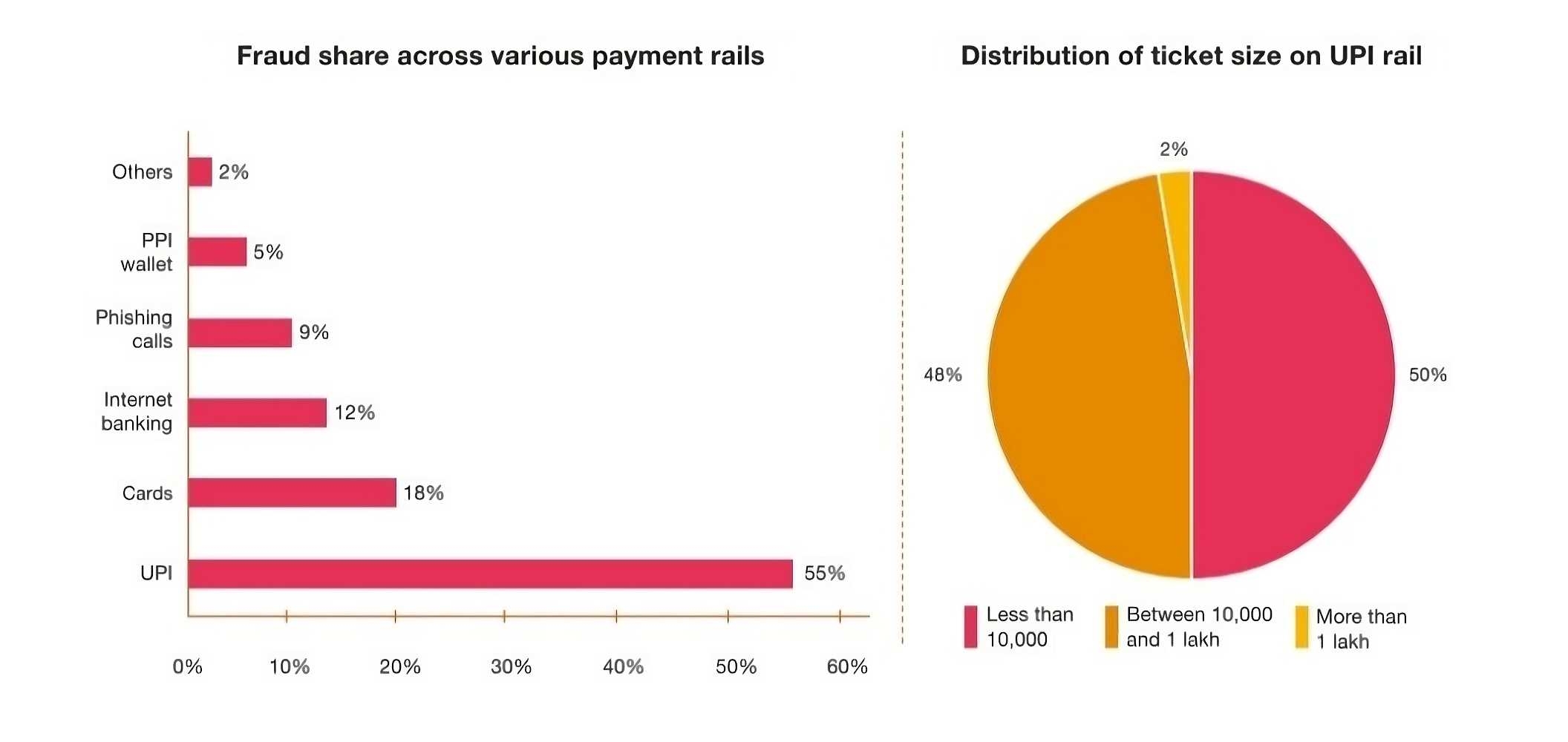

1. In the options given he/she no where mentioned about shaddy site ? And in site you can't get a payment like UPI done, UPI has certain sets of rules and regulations to be followed in consideration of not allowing companies to use "Shaddy" techniques in UPI payment processing. 2. Use the one's which are better, then you will know. Have you ever used Indian NetBanking portals ? They seem old, traditional websites. Try using Chase, Wells Fargo, BOA, Swedbank online banking portals you will know how much better they are :) 3. India is a digital banking economy, 95% transactions are processed digitally in India. You can check it on PIB reports issued by DII - Digita infrastructure of India.

Replies (1)

More like this

Recommendations from Medial

Siddhant Soni

Hey I am on Medial • 1y

UPI has revolutionised the payment scenerio in India and indeed UPI involved complex tech and India is also giving this technology to other countries like Ghana. So my question is that, why countries like USA, Japan and other European countries are s

See MoreLinkrcap Studio

A digital news platf... • 18d

To further expand UPI internationally, the union government and the Reserve Bank of India (RBI) are reportedly in discussions with global digital payment giant Ant International to link its cross-border digital payment, Alipay+, with UPI. As per a R

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)