Back

Jayant Mundhra

•

Dexter Capital Advisors • 7m

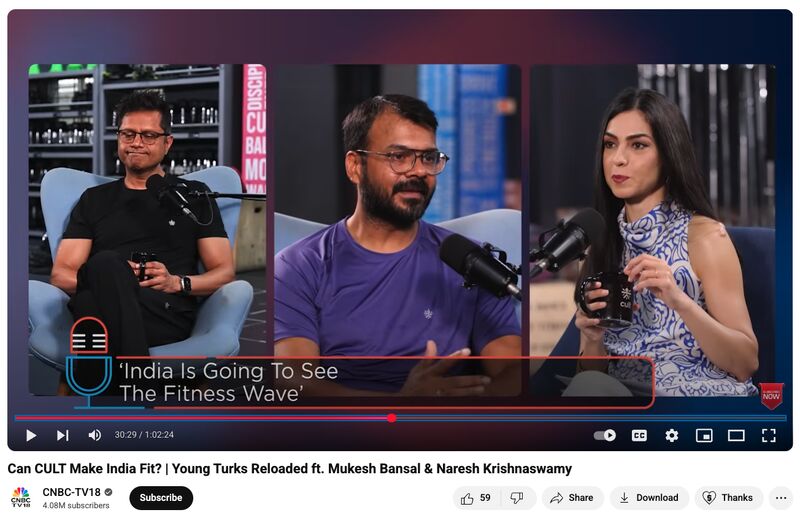

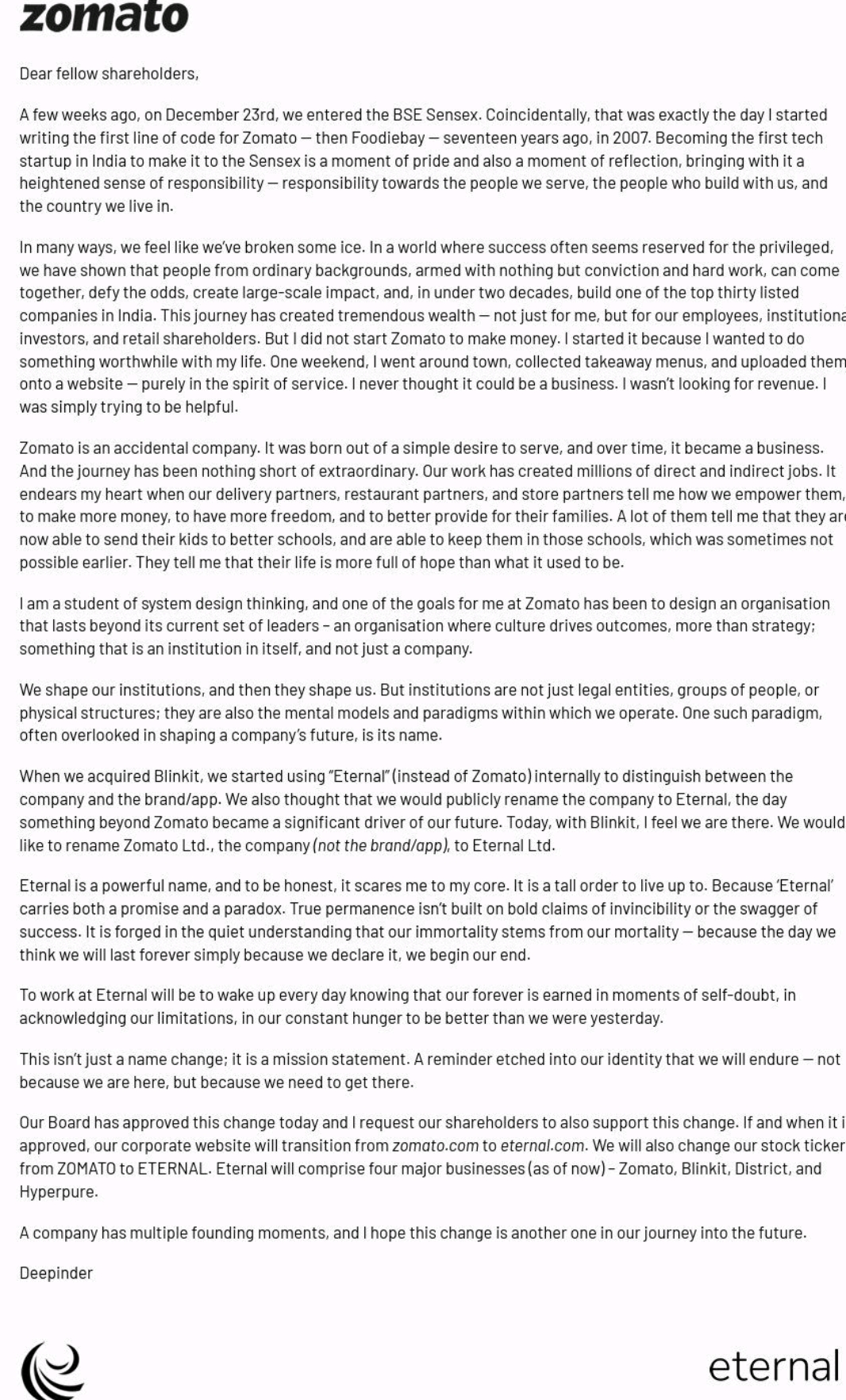

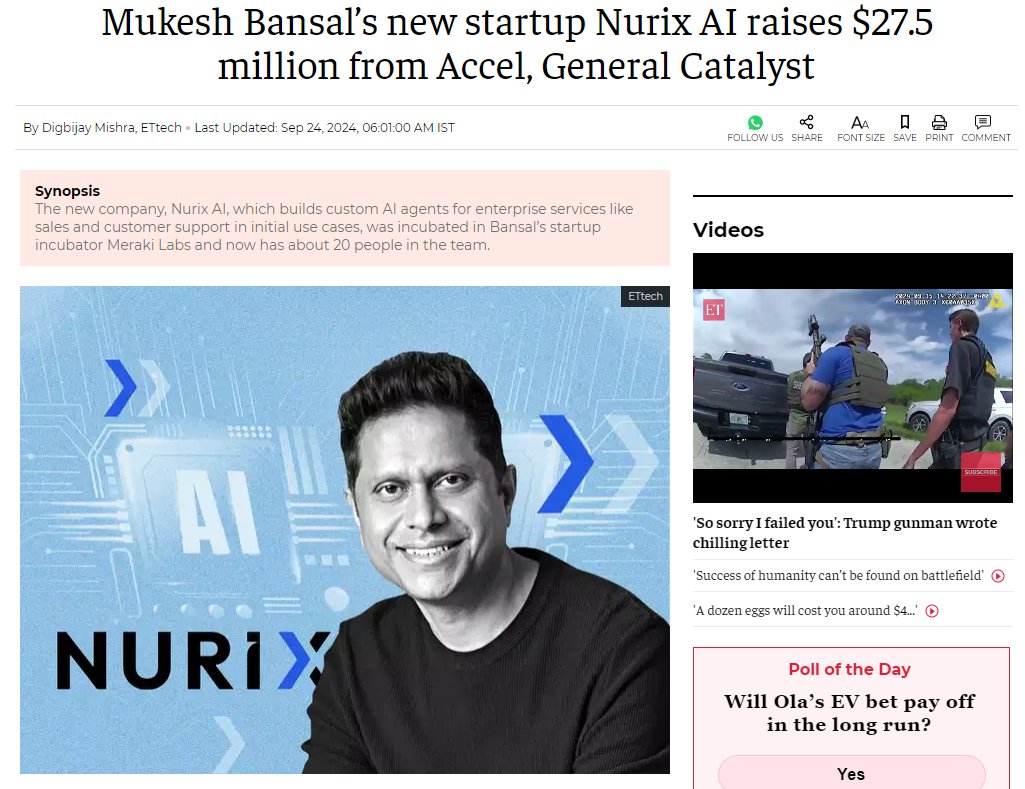

This is about Cult, and its founder (Mukesh Bansal) - someone I deeply admire 🙏🙏 You see, it's perplexing when a company's leadership, on national television, declares profitability, only for its founder to state days later that profitability is still away. .. Just days ago Bansal and Cult's CEO Naresh Krishnaswamy were featured on CNBC TV18's Young Turks. - There, Krishnaswamy proudly told Shereen Bhan (the anchor) that the company's topline was over $250mn, growing at 30-35% annually, and that they were profitable now. - And this was great. After all, this is the kind of clear, positive update that investors and admirers love to hear However, it was all bogus. .. Yday, The Ken published a report, whcih featured Mukesh Bansal stating: - The company is not yet profitable - It may get there in 2025 after successfully halving its losses in FY25 My point: While the path to profitability is commendable, the blatant contradiction of its current fiancial status is unsettling. Why claim to have reached a milestone on television when you haven't? .. The confusion doesn't end with profitability. The CEO's revenue claim of over $250mn also seems to buckle under scrutiny. Let's break down the numbers. - According to a report by Entrackr, Cult's revenue for FY24 stood at Rs 927 crore - Hitting a $250mn topline, which translates to roughly ~Rs 2.1k crore, by FY25 would require a staggering growth of over 120% in about a year .. This is where the narrative falls apart. This calculated 120% growth directly clashes with the CEO's own stated growth rate of 30-35% per year. The math simply does not add up, raising serious questions about the accuracy of the figures shared on a highly publicised platform. And, please know that this isn't an indictment of the company's potential or its founder's legacy. Mukesh Bansal is a celebrated figure, and for good reason. And, it is precisely because of this admiration and the high regard in which he and his ventures are held, that these inconsistencies are so jarring. The goal isn't to criticise, but to hold our icons accountable to the high standards they set for themselves and the industry 🙏🙏

Replies (5)

More like this

Recommendations from Medial

gray man

I'm just a normal gu... • 9m

Vedantu, the edtech startup, has announced its profitability in the fourth quarter of fiscal year 2024-25 (Q4 FY25). According to cofounder and CEO Vamsi Krishna, the company's collections saw a significant 67% year-over-year (YoY) increase, reaching

See More

Ashish Singh

Finding my self 😶�... • 1y

PhonePe is set to launch its IPO, showcasing impressive revenue growth of 74% year-on-year, reaching INR 5,064 crore in FY24. With a 50% market share in India's UPI transactions, it faces competition from Google Pay and Paytm. While the company's lea

See MoreTheLuhas

Never take anyone as... • 1y

Nike is going to crash? Nike is currently facing financial challenges due to significant losses attributed to the high costs of opening and maintaining its Direct-to-Consumer (D2C) stores. This strategic shift has led to operational difficulties, as

See More

Medial Startup Trivia

Trivias Around start... • 1y

Pets.com: The Rise and Fall of a Dot-com Era Icon In the late 1990s, the dot-com boom was in full swing, and investors were eager to get in on the latest internet startups. One such company that captured the attention of investors and pet lovers ali

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)