Back

Anubhab Mowar

Founder VedaBits | ... • 7m

it's applicable if you register your startup under the startup india scheme. and you get selected. you can choose to not pay taxes for any 3 years in the initial 10 years of your company

More like this

Recommendations from Medial

Account Deleted

Hey I am on Medial • 1y

Hi guys recently I have started a fintech startup so i am looking for fundraising campaign and recently I have got a call from some x company and told why don't register under startup india scheme and get 20L grant funding for your fintech startup so

See More

Sanskar

Keen Learner and Exp... • 1y

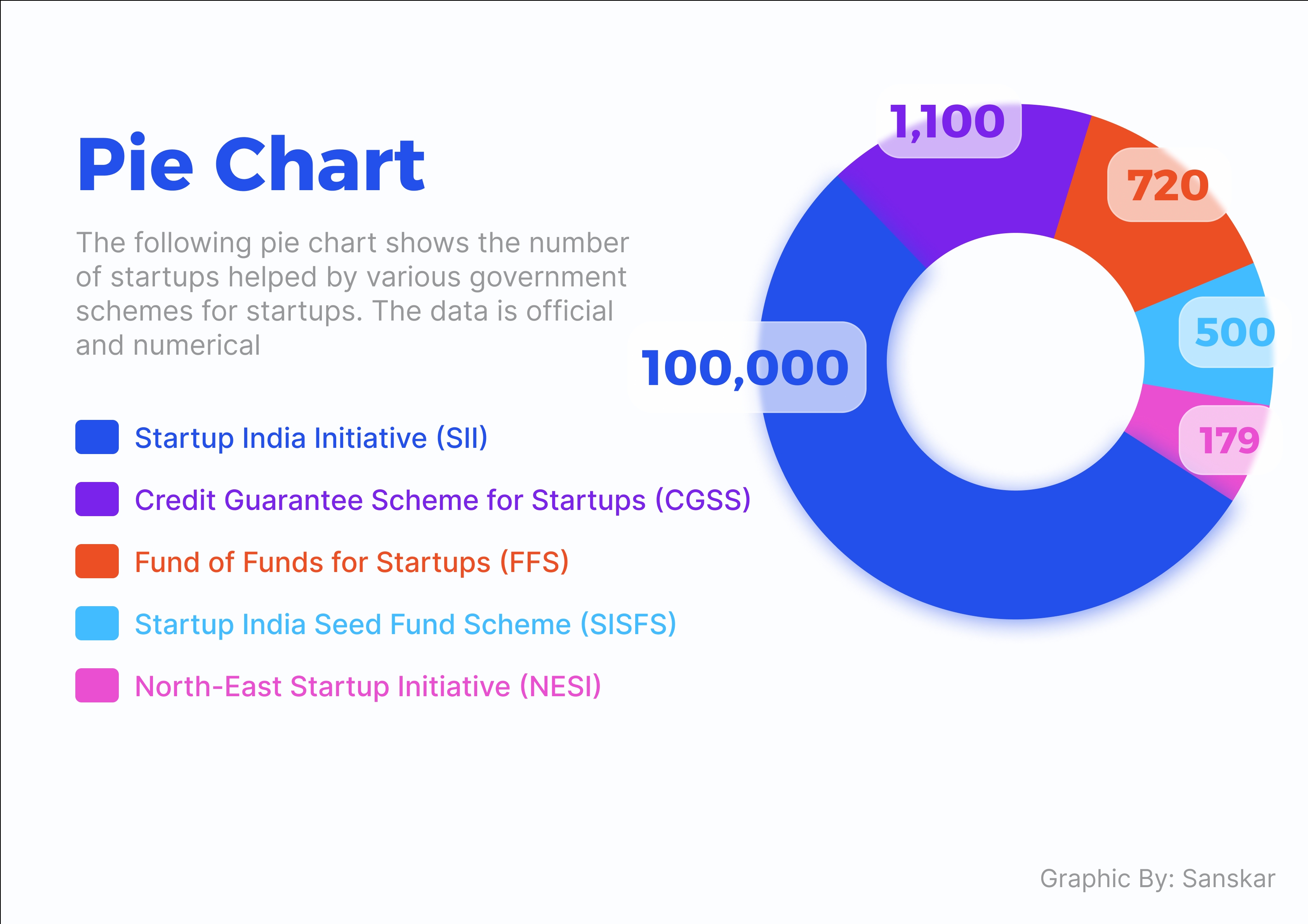

How many of these government schemes to support the startup ecosystem are you aware of? 1. Startup India Initiative (SII) [2016] - This scheme offers three years tax holiday and reduced regulatory burden along with access to a Fund of Funds worth ₹1

See More

Government Schemes Updates

We provide updates o... • 6m

Internship Opportunity will be provided by the Ministry of Information and Technology to eligible students under the MeitY Digital India Internship Scheme. Internship of 2 months with a monthly stipend of Rs. 10,000/- per month is also applicable. Re

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)