Back

Nishant Mittal

Entrepreneur, musici... • 7m

A rising tide lifts all boats. Sometimes a lot of garbage with it, too. Right now Indian market is that rising tide. What this means is that many companies which would have otherwise drowned or basically been "untouchable" just a few months ago, might just get "saved" by the Indian retail investors in days to come. But why? Just because India is "hot" right now. Think about it. OYO is a dumpster fire on steroids; with complicated legal cases, extraordinary debt overhang, and a questionable business with cooked financials on its back. If it doesn't get to IPO within the next few months, its founder's personal debt covenants will be breached and he'll be out of the company. And then some of the company's assets might have to be sold to pare the debt at the corporate level. But. If it gets to IPO, it'll sail through. And all its sins will be washed away. The company will find redemption, and its investors exit. Now ideally, such a company should not get to IPO. But no matter how strange it sounds, OYO's IPO will probably go through, and successfully. Why? Because a rising tide lifts all boats. And Indian market is that rising tide right now. And not just OYO, many other companies are looking at going public. The bubble of all bubbles - Sharechat (with cumulative losses of over ₹7500 Cr at a revenue of ₹960 Cr in just last three years, but still unworldly shamelessness to show off an "adjusted EBITDA loss" of ₹793 Cr at a revenue of ₹718 Cr with a PR campaign), Ola Cabs (perpetually "profitable", but not really), Curefoods (Thrasio for food with over ₹1,600 Cr raised, but only ₹80 Cr left), Lenskart (a great company in comparison, but net negative at the scale of ₹5,427 Cr and looking at a $10 Billion valuation), and so on. All of these dreams, might just come true. Not because of genius of these companies, but because stars are aligning perfectly at this pretty moment. Just look at it. India's retail inflation has softened to 2.82%, lowest in six years. Crude prices are benign, hovering at <$70. RBI is sounding great with the rates cut by .50% and another .25% cut on the way. Forex reserves are at an all-time high. The CAD is in control. So is the Buffett indicator. The only problem has been slow domestic consumption, but that's also seeing early signs of revival. Overall, amidst all the terrible news of the global economy, India is just beautiful. And all that macroeconomic beauty of India might just help all these companies (and many more), to get "anything" they want. Anything. What is this? It's yet another confirmation of something spoken by Nithin Kamath Sir when he said, “In any case, the range of outcomes in business is mostly driven by luck and being at the right place at the right time.” More than validation, it’s luck. It’s timing. It’s liquidity. Of a euphoric market, at the time when it's most needed. Let's see till when the wave keeps on. After all, the market has a life of its own, as shown in November 2021. Remember Paytm?

More like this

Recommendations from Medial

Linkrcap Studio

A digital news platf... • 18d

At the upper end of the price band, the IPO values the company at about INR 15,480 Cr (about $1.7 Bn). Anchor bidding for the issue will take place on Friday (February 6), while the IPO will close on Wednesday (February 11). The company filed its r

See More

VIJAY PANJWANI

Learning is a key to... • 1m

About 200 Companies are either Approved or in the Pipeline for the IPO✨ ✅ About ₹2.5 Lakh Crore Potential Fundraise! ✅ Here are some Awaited Big Sized IPOs for 2026: 👉 Reliance Jio IPO - Expected by to be India's Biggest Ever IPO (₹40,000 Cr+)

See More

Nandishwar

Founder @StudyFlames... • 1y

INDIA'S IPO BOOM: A JOURNEY THROUGH YEARS! 🚀 India’s IPO market has been on fire, witnessing a massive surge in companies going public and raising huge funds. Here’s how the IPO trend evolved from 2017 to 2024: 📊 The Highlights 1️⃣ 2024: The B

See More

Devanand Siddhardha Gangeli

Aspiring entrepreneu... • 1y

researching FirstCry’s latest strategic moves, I find its ₹300 Cr investment in Digital Age Retail Private Limited (DARP) intriguing. While the expansion of modern stores is promising, the closure of 38 outlets raises questions was it just footfal

See More

Mohd Rihan

Student| Passionate ... • 11m

Zomato Finances of this year::: Revenue: 5405 cr Expenses: 5533 cr Loss:128 cr Non operating income (invested in FD, IPO and from other places): 252 cr Income- Loss=124 cr After tax: 59 cr Means, Zomato is earning from interest and FD's than actual

See More

gray man

I'm just a normal gu... • 9m

Ahead of filing its draft red herring prospectus (DRHP), consumer services unicorn Urban Company’s founders cumulatively sold shares worth nearly INR 779.08 Cr through secondary transactions. According to the DRHP filed with SEBI on April 28 for a p

See More

VIJAY PANJWANI

Learning is a key to... • 1m

🚀 BIG IPOs COMING IN 2026! 📈💰 India’s startup & tech giants are lining up for the stock market 🔥 From PhonePe to Zepto, OYO, and more — 2026 could be a blockbuster year for IPO investors! 📊 Expected Mega IPOs: ✅ PhonePe – ₹13,500 Cr ✅ Zepto –

See More

Rohan Saha

Founder - Burn Inves... • 8m

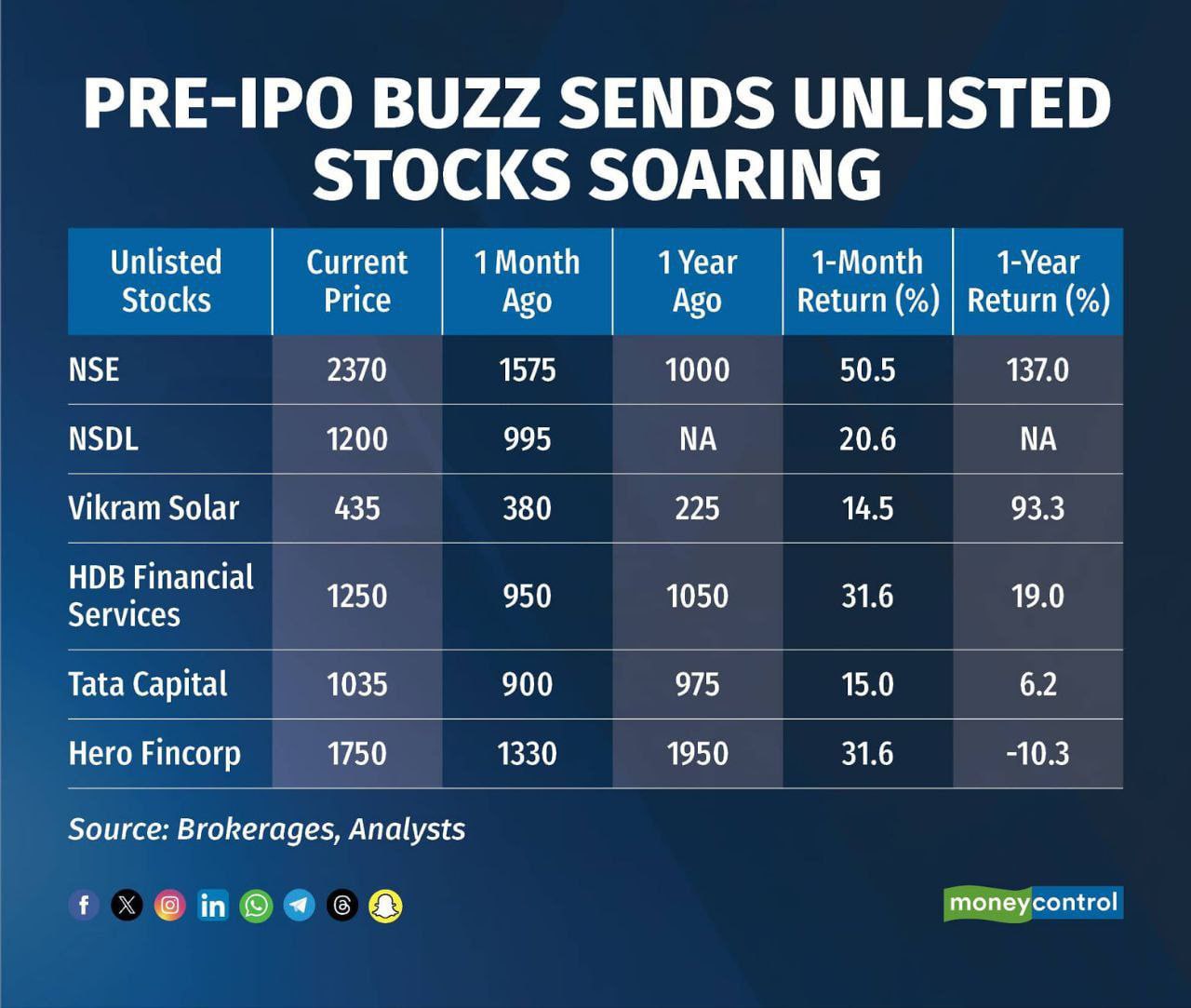

NSE has been on a crazy run in the unlisted market it's given over 100% returns in just a year, all because of the hype around its IPO. And the funny thing is, they haven’t even announced the IPO date yet. Once that happens, who knows how much higher

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)