Back

More like this

Recommendations from Medial

Aanya Vashishtha

Drafting Airtight Ag... • 10m

Angel Investors vs. VCs: Who’s the Better Bet for Your Startup? Choosing between angel investors and VCs? Early branding gives founders a killer edge. Angels want passion and hustle—your authentic story online hooks them fast. VCs dig data and

See MoreAccount Deleted

Hey I am on Medial • 8m

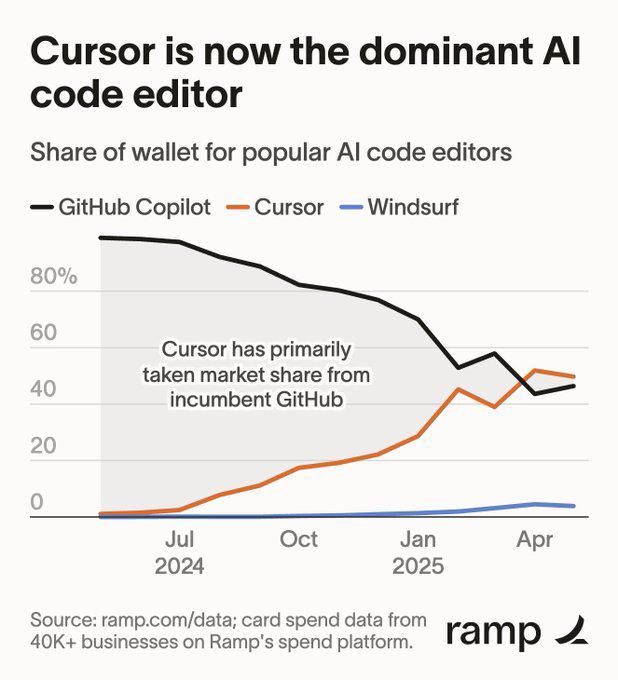

AI code editors are changing super fast Cursor is now used more than GitHub Copilot. In months, Cursor went from zero to top. This shows developers switch fast for better tools GitHub Copilot led for a long time. But Cursor took users with a sharpe

See More

Account Deleted

Hey I am on Medial • 10m

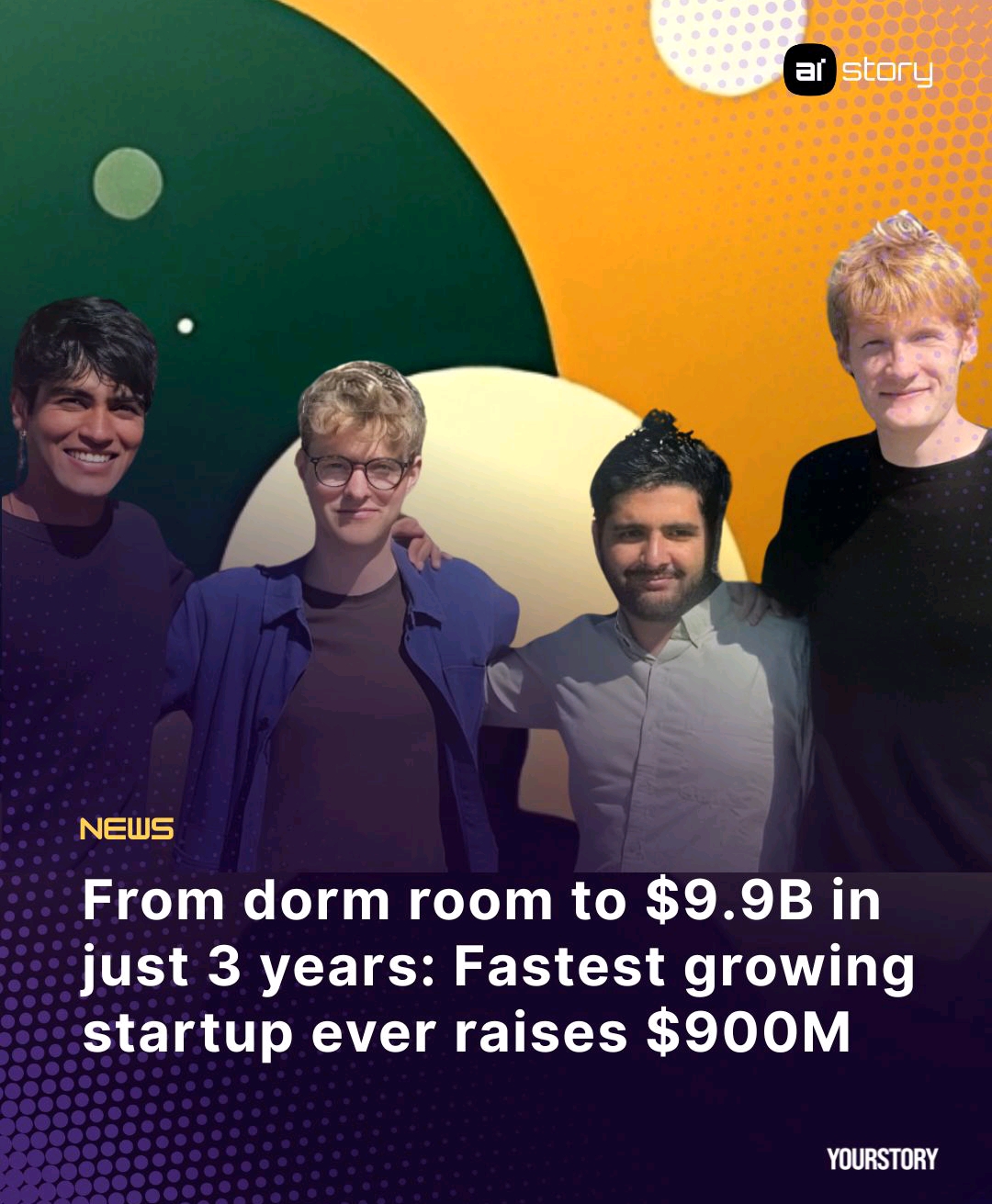

Every funding round tells a story. Not just of product-market fit, but of founder-market fit. Not just of capital raised, but conviction earned. Look closer and you’ll see the patterns: 1) AI startups aren’t raising because they’re AI. They’re ra

See MoreAccount Deleted

Hey I am on Medial • 10m

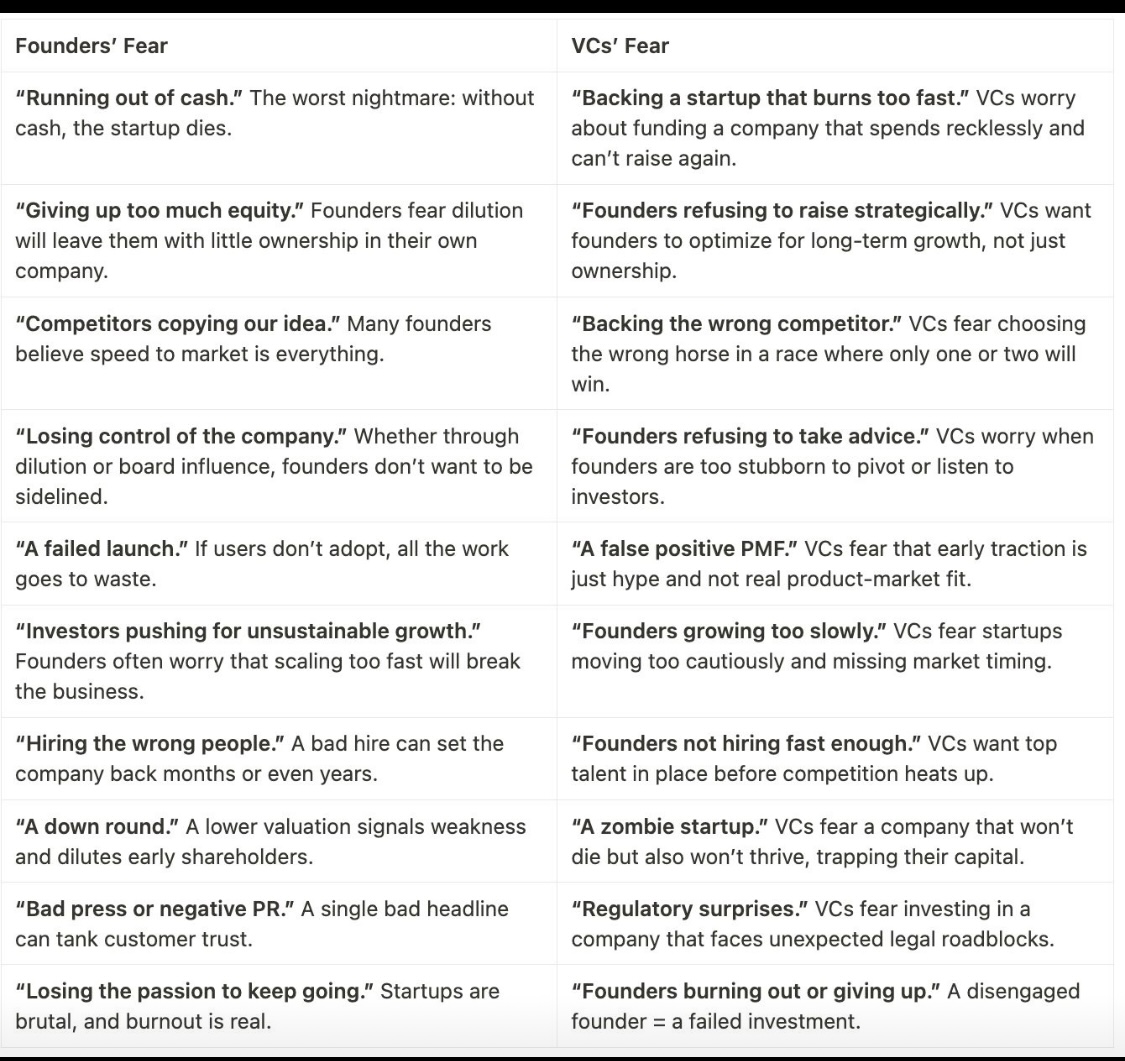

Raising VC Money? Tips No One Tells You : 1) Don’t Chase VCs, Attract Them - Build something so good they can’t ignore you. 2) Traction > Decks - Fancy pitch decks don’t matter if your numbers don’t add up. 3) Investors Follow Other Investors - G

See MoreCA Vamshi

Practicing Chartered... • 9m

90% of startup founders overestimate their valuation. The other 10%? They raise smart, retain more equity, and stay investor-ready at every stage. Valuation isn’t just about numbers — it’s about narrative, traction, and timing. It reflects how well

See MoreAccount Deleted

Hey I am on Medial • 10m

A lot of founders think funding = validation, but that’s just step one. If you can’t turn that capital into real, sustainable growth, it’s just a countdown to running out of cash. Just because a startup raises VC money doesn’t mean it’s successful. V

See MoreVivek Joshi

Director & CEO @ Exc... • 7m

Beyond the Buzzwords: India’s Revenue-Making Startups & the VC Lens India’s startup scene isn’t just about hype—it’s about real, revenue-generating ventures ready to scale. Founders who’ve proven product-market fit and built solid revenue engines no

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)