Back

Rohan Saha

Founder - Burn Inves... • 8m

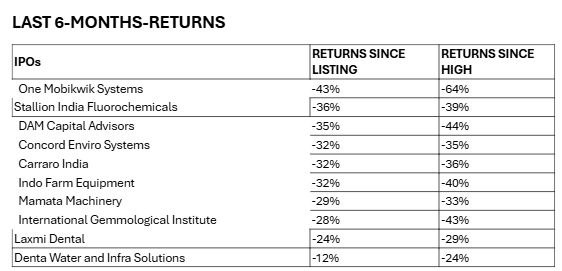

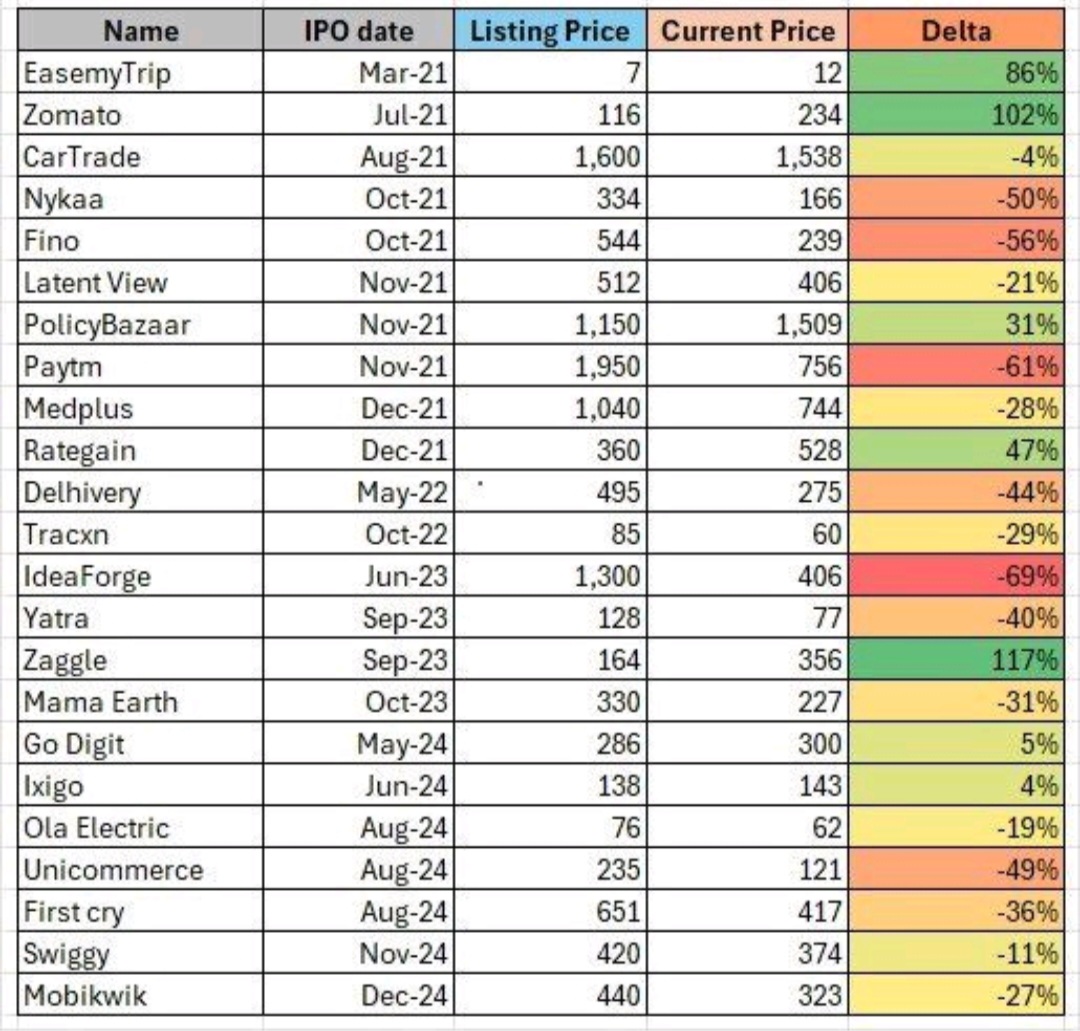

At the present time, IPOs have become useless. Right now all the companies are worried about their valuation, they have nothing to do with what will happen to the share value or share price after listing, and due to this, those companies that are coming to the market with the right valuation are at a loss. People often ignore it by considering it as overvalued.

More like this

Recommendations from Medial

Kimiko

Startups | AI | info... • 9m

Around 101 mainboard companies that raised money through IPOs since 2024 , majority of them haven't been able to improve upon their listing gains.. As per ETG analysis, about 16% of the companies earned 50% or higher listing gains, while around 9%

See More

Rohan Saha

Founder - Burn Inves... • 1y

Okay, I was just checking the valuation of our Indian stock market and I noticed something interesting. Despite the heavy sell-off in October, FMCG, IT, and small-cap stocks are still overvalued. I understand why IT stocks are overvalued because the

See MoreRohan Saha

Founder - Burn Inves... • 7m

Like I said yesterday the defence sector had a good chance to do well today and that’s exactly what happened but it’s also true that defence stocks are quite overvalued right now. Still we can’t make decisions based only on valuation we have to look

See More

Rohan Saha

Founder - Burn Inves... • 9m

Alright, IPOs have returned to the Indian market again. Next week, some companies are launching their IPOs, and some mutual fund houses are also coming out with new fund offers (NFOs) on a decent scale. For now, we just need to focus on FII (Foreign

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)