Back

Jayant Mundhra

•

Dexter Capital Advisors • 8m

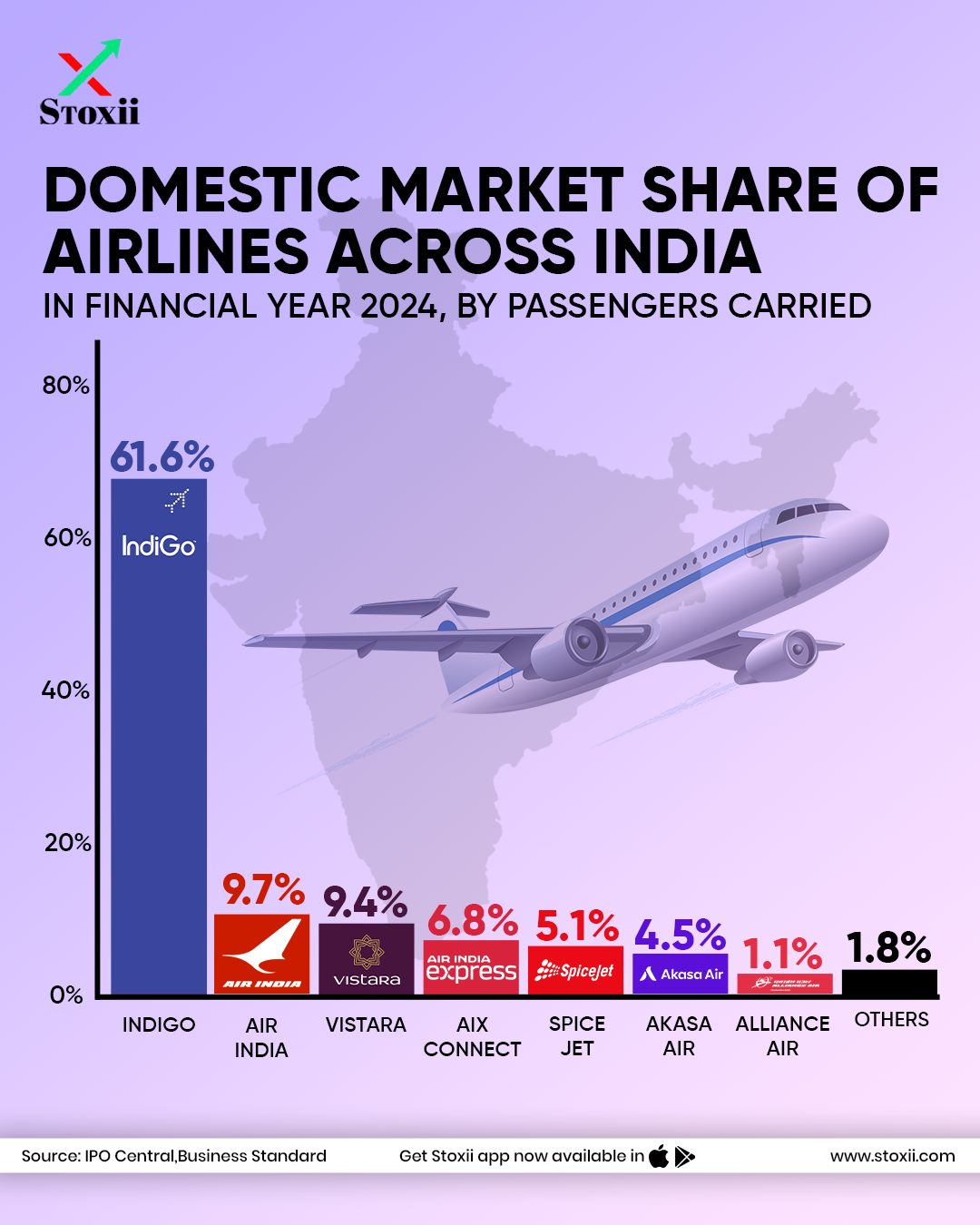

Air India's return to operating profit is such big news! 👏👏 Sure, the whole Air India Group will still take some time, with the Tatas eyeing all-out profitability in FY27. But the fact that the full-service business is back to operating profit after so many years, that remains a big positive. It proves that private ownership, scale, and ruthless cost discipline beat nostalgia every time. .. I know, many in India still don’t know the difference between Air India and Air India Group. So, just to make it clear, the group runs two separate airlines. - One is Air India (which is what Vistara merged into) - Second is Air India Express, also called AIX (which is what Air Asia India merged into) And it’s the first one, which has returned to operating profit - As per Hindu BusinessLine. .. That said, one might wonder, why the group is targeting full profitability only in FY27. That’s because of the investments made on AIX. You see, in just 18 months, the low‑cost arm jumped from about 25 planes to a fleet of 108 aircraft, including a merger with AirAsia India. Capital costs hit before crews could be trained and utilisation steadied. Thus, the loss there is more about compressing three years of growth into one. Thus, to be fair, the issue is digestion, not demand. And, as the utilisation of planes and resources grows, and the systems stabilise profitability will surely shoot up. .. But, there is one more thing which is helping all of this come out so rosy - The industry structure. IndiGo and Tata airlines now command 92-93% market share in Indian domestic market. It’s a brutal duopoly, and fares are set by two balance sheets that finally have muscle. People surely do pay a price. But, shareholders win. Just look at IndiGo’s profit numbers and share price growth. Says it all :)

Replies (1)

More like this

Recommendations from Medial

Jaswanth Jegan

Founder-Hexpertify.c... • 1y

This is more than a takeover for Tata Group Bankruptcy to Billions #7 Tata's Air India Story Air India was founded by J.R.D. Tata in 1932 as Tata Airlines.In 1948 Indian govt acquired 49 percent stake and renamed it as Air India.Air India expanded

See More

Vishu Bheda

AI did the magic • 1y

India’s Most Profitable Startups: Zoho and Zerodha Lead the Way India's startup ecosystem is witnessing a shift towards profitability, with companies like Zoho and Zerodha setting new benchmarks. # Zoho: Leading the Charge Chennai-based Zoho stand

See More

gray man

I'm just a normal gu... • 10m

India is poised to expand its aviation landscape in 2025 with the launch of three new airlines: Shankh Air, Air Kerala, and Alhind Air. These newcomers aim to enhance regional connectivity, offer more travel options, and cater to the growing demand f

See More

Yash S

Founder @ Innovzeal ... • 8m

Air India Crash in Ahmedabad: Multiple Casualties Feared Ahmedabad, June 12, 2025 — An Air India flight bound for London crashed shortly after takeoff from Ahmedabad's Sardar Vallabhbhai Patel International Airport, killing and injuring multiple peo

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)