Back

Rohan Saha

Founder - Burn Inves... • 8m

Selling Nifty Defence might just be my biggest mistake this year. I felt the valuations were too high, so I sold thinking I'd re enter after a dip. But instead, it shot up 24-30%, and the index just hasn’t come down since. Looking back, I really shouldn’t have exited completely.

More like this

Recommendations from Medial

Rohan Saha

Founder - Burn Inves... • 8m

If we see a decline in defence stocks starting next week, I won't be surprised at all. No doubt, there is scope in the defence sector, but the current high valuations are not justifiable from any angle. Overall, a healthy correction of 10% is possibl

See MoreAryan patil

Intern at YourStory ... • 1y

SEBI warned ⚠️ investors about Stock market bubble is about to burst anytime soon 📉 because The price-to-book (P/B) ratio of the Nifty Midcap 150 index is 4.26, and the Nifty Midcap 50 index has a P/B ratio of 3.64 This Means valuations of the Mid/s

See MoreRohan Saha

Founder - Burn Inves... • 8m

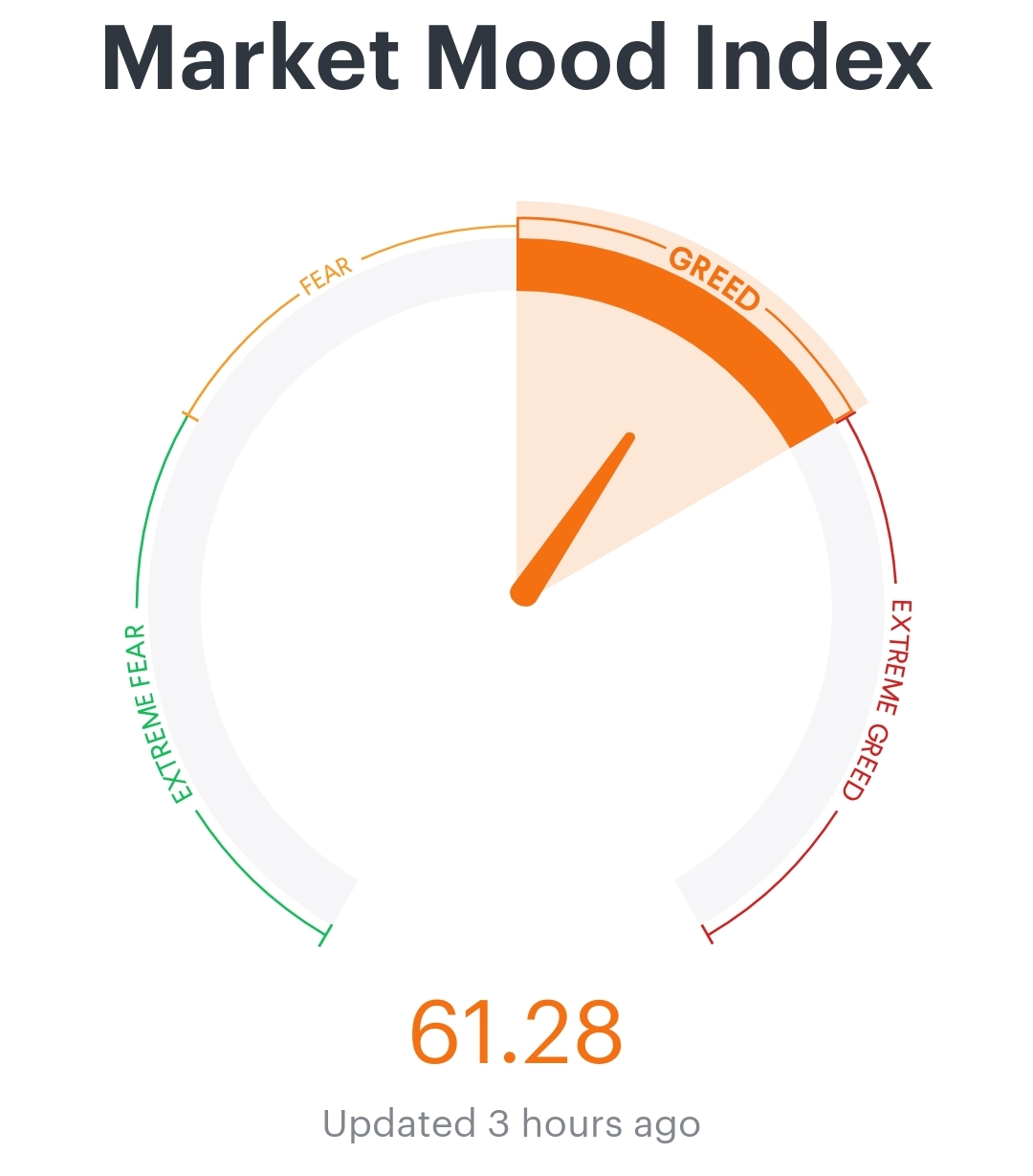

Looking at today’s MMI it seems pretty clear that even if the market does correct it probably won’t be a major drop we might just see a small dip enough to bring valuations to a reasonable level and then the market could bounce back Yesterday the MMI

See More

Rohan Saha

Founder - Burn Inves... • 11m

In my opinion, many people, when they are new to index trading, often make a mistake by engaging in sector-specific trading. It would be better if they traded in broader indexes like Nifty 50, Nifty Next 50, Smallcap, or Midcap. This is because these

See MoreRavi Handa

Early Retiree | Fina... • 1y

"Most active funds don't beat the benchmark" - got index funds after hearing this multiple times. AND NOW: Most of the active funds I have - have beaten the index funds (Nifty 50) I have. Quite comfortably. 🥲 Hoping the story changes soon otherw

See Morefinancialnews

Founder And CEO Of F... • 1y

"Nifty Smallcap 100 Drops 3.5%: 17 Stocks Plunge Over 5%" The Nifty SmallCap 100 index saw a sharp decline of 3.5% in today’s intraday trade, dropping below the 18,200 mark to 18,149. This is the lowest level for the index since mid-August, reflecti

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)