Back

Anonymous 1

Hey I am on Medial • 8m

Bro said 14% like it's modest. that’s more than most mutual funds and way safer than options degeneracy 💸

More like this

Recommendations from Medial

Dr Sarun George Sunny

The Way I See It • 3m

SEBI’s New Rule: Mutual Funds Must Say Goodbye to Pre-IPO Deals The Securities and Exchange Board of India (SEBI) has recently stepped in to bring a meaningful change in the way mutual funds invest in the IPO space. From now on, mutual funds can no

See More

Gargi Jain

Cloud | DevOps | Ill... • 1y

What's the best way to explain my Dad - Mutual Funds is better option than FD and MF gives higher returns. His statement is that "it is risky and might have to bare the loss sometimes and can't remove the cash whenever required (has lock in period)

See MoreRohan Saha

Founder - Burn Inves... • 8m

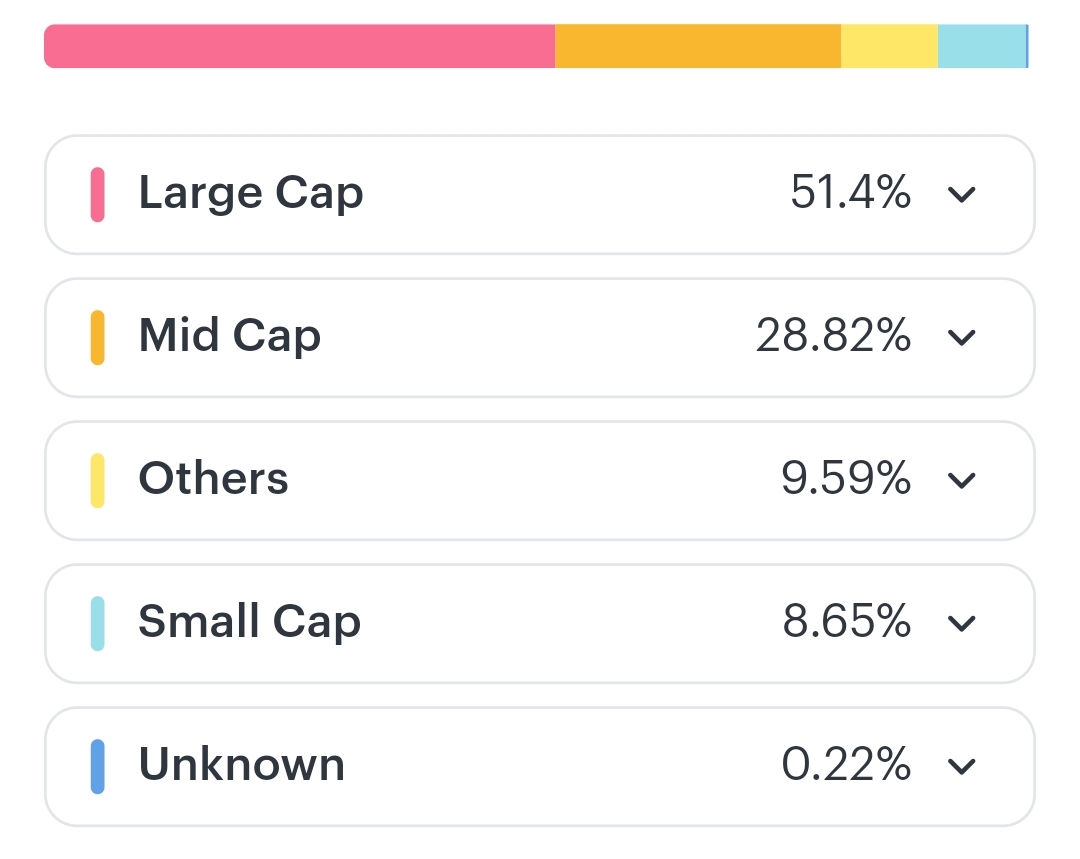

Over 51 percent of my portfolio is in large cap stocks yet I have delivered better returns this year than many mutual funds It makes me wonder what is it that holds fund managers back? Is it the way they manage cash or is there something else going o

See More

Tarun Suthar

•

The Institute of Chartered Accountants of India • 10m

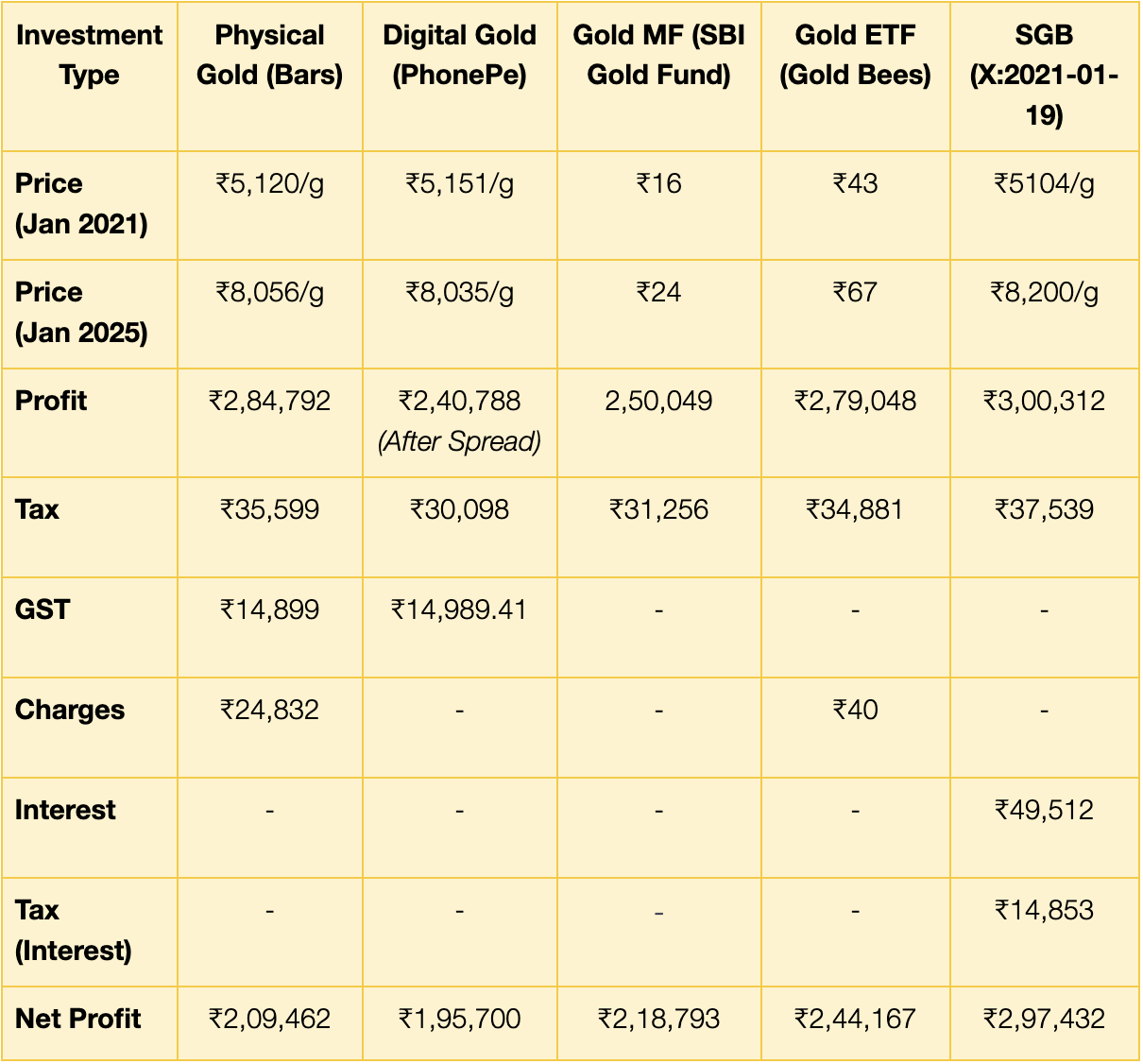

Different Ways to Invest in Gold 🪙 If you invest ₹5 Lakhs for a period of 5 years, what could your ROI look like across different gold investment options? There are commonly 5ways to invest in gold. 🪙 Physical Gold (Jewelry, Coins, Bars) 🪙 Digi

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)