Back

SKT Cabs

Don't pack until you... • 8m

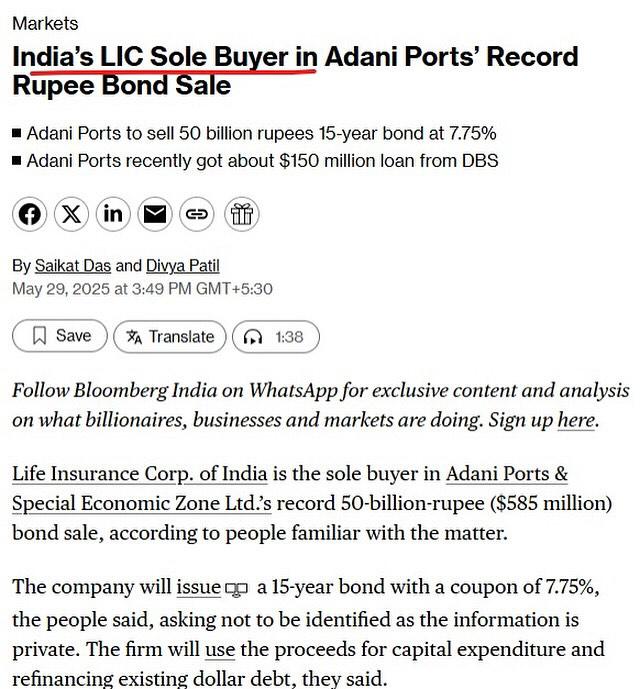

Indian government-owned companies are often used to provide funds to large Indian private corporates. There’s a strategic reason behind this. If a corporate group like Adani were to go abroad for funding and, by chance, defaulted, the foreign investors would aggressively pursue recovery — legally and financially — from the top management. They would extract every penny they could. But if the same funding is routed through a government entity like LIC — which holds the savings of India’s middle class — and a loss occurs, the narrative is simply that "LIC suffered losses," and citizens are told their money is gone. No serious accountability, no pressure on the corporate management, and no real consequences. It’s simple: public institutions bear the risk, while private corporates enjoy the gains. see the example of banks

More like this

Recommendations from Medial

Karan Kumar

Building a startup f... • 1y

In a business, how important is corporate training and how much corporates spends on corporate training. If you guys have information let me know in the replies. Because most of here are from startups and corporates so In startup as well as employ

See More

Vivek Joshi

Director & CEO @ Exc... • 9m

Discover the dynamic differences between startup leaders and corporate leaders in our latest video! Learn why startup leaders embrace risk and uncertainty, prioritizing speed and innovation, while corporate leaders focus on stability and structured d

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)