Back

More like this

Recommendations from Medial

Account Deleted

Hey I am on Medial • 9m

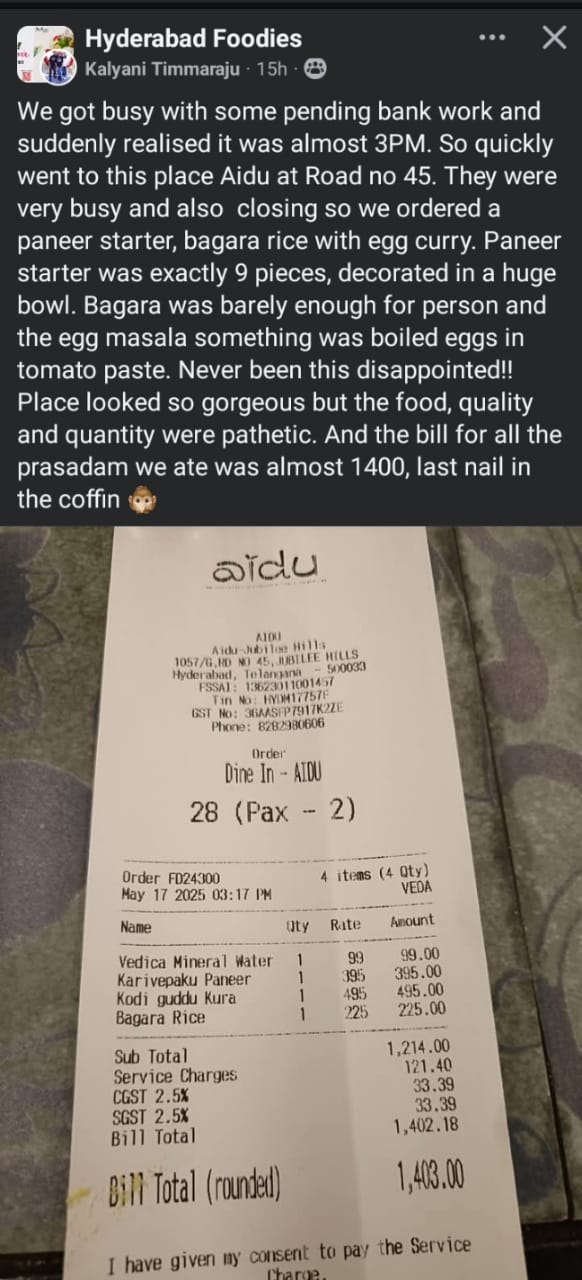

Why should you pay gst and sgst on service charges? That is illegal. If you are not happy why should you agree to pay service charges? I see they got cheated.. Tax should be on bill.. which means 1214 * 5% which 60.70 but they added gst on service c

See More

Pravesh Mourya

Young and energetic ... • 1y

Question of execution Why urban company is providing services by themselves and not making itself as a market place for services where service providers can list their services What's the reason behind it ? And can we make a marketplace for serv

See More

Anonymous

Hey I am on Medial • 7m

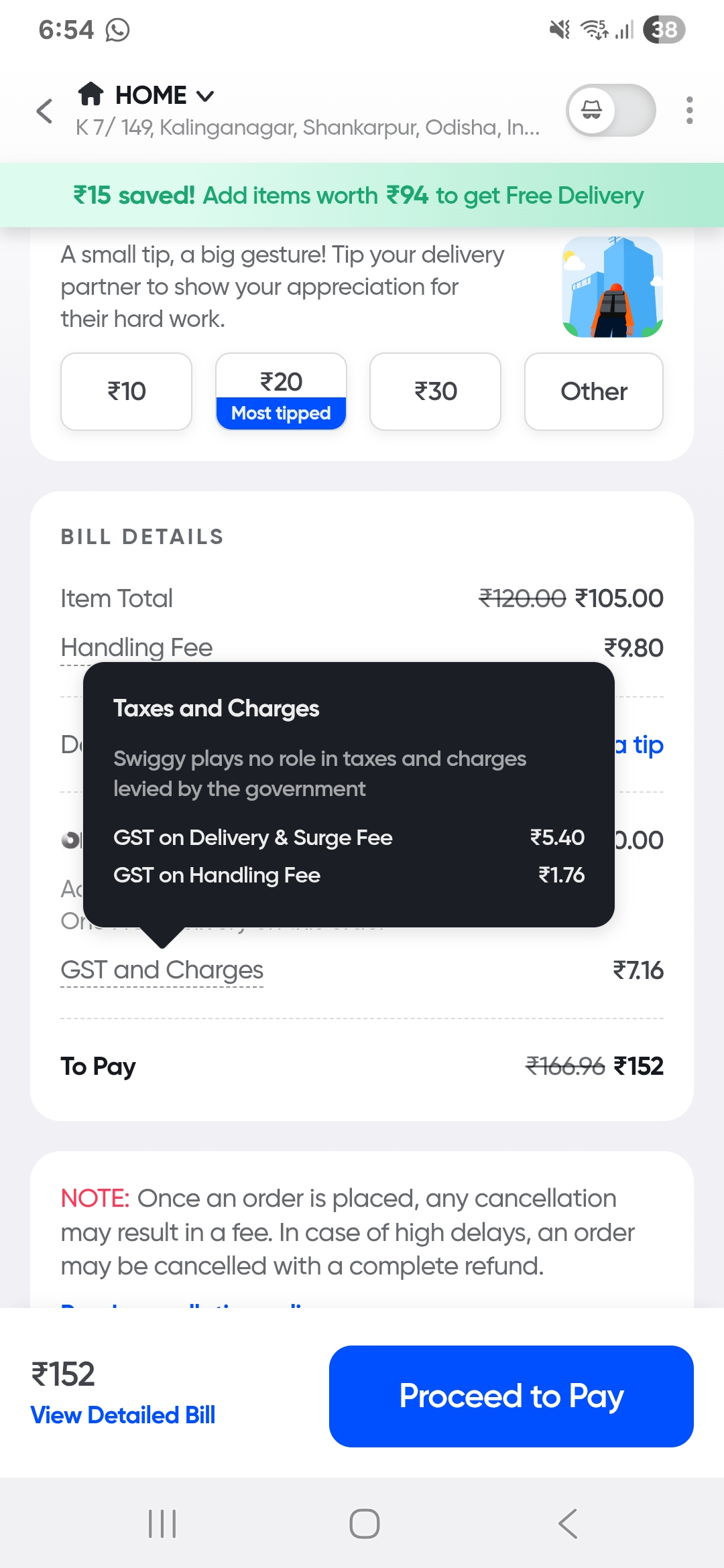

🔺🔺 Scam I Just noticed something disgusting from Flipkart. Ordered something → changed my mind → cancelled within 2 minutes. Item wasn’t packed, not shipped, literally nothing had started. And yet, I get charged a ₹4 “platform fee” — non-refundabl

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)