Back

ANURAG

Revolutionizing and ... • 9m

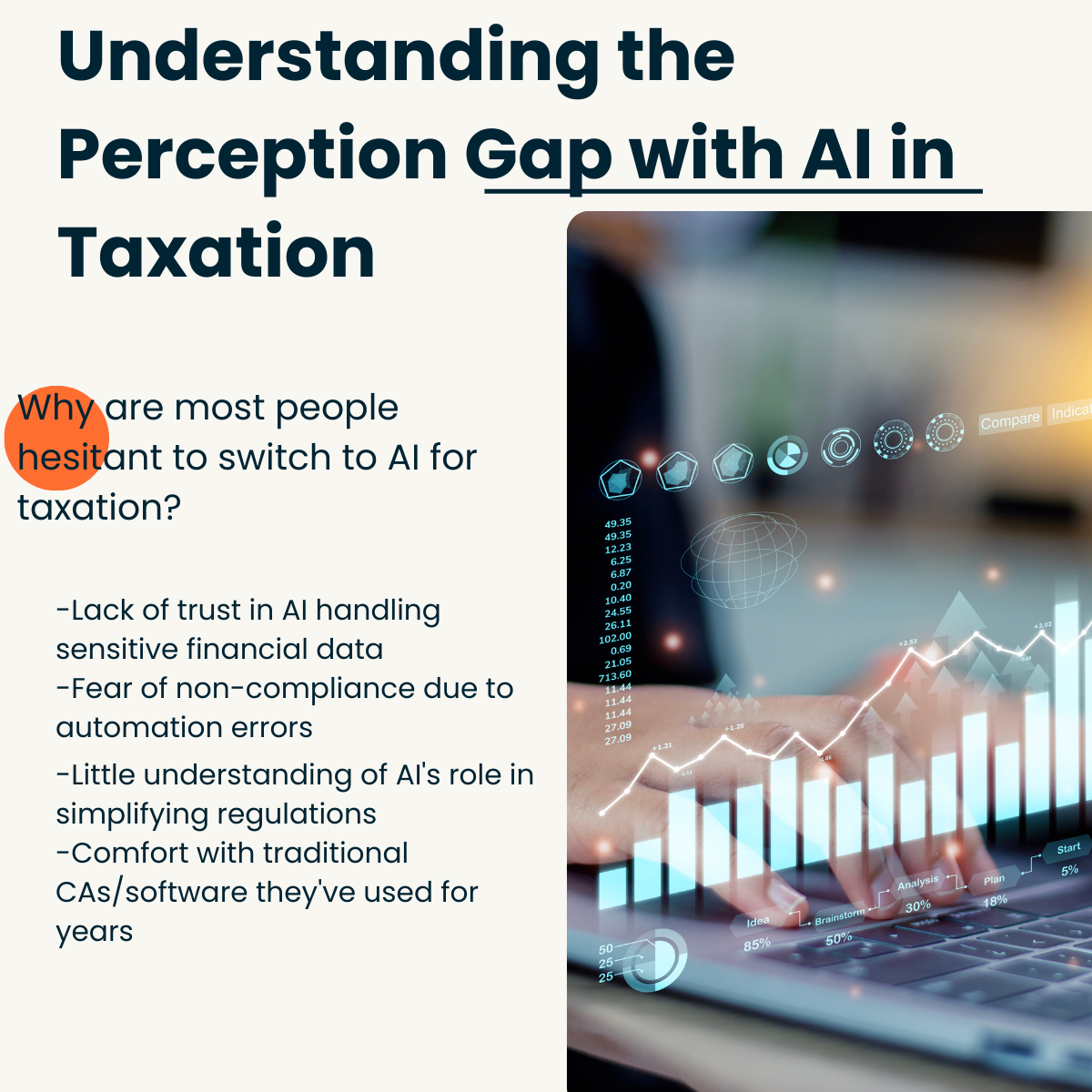

You're absolutely right. The key now is to shift the perception of AI from an inscrutable "black box" to a transparent and compliant "smart assistant." Taxellence AI aims to bridge the gap between the current cautious mindset of tax filers and the regulatory need for control by developing AI solutions that prioritize transparency, auditability, and adherence to existing tax laws, thereby fostering trust and facilitating responsible AI adoption within the established regulatory framework.

More like this

Recommendations from Medial

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)