Back

Jayant Mundhra

•

Dexter Capital Advisors • 9m

I had predicted this 13 months ago. And it has now started happening word to word. On 15 April 2024, I posted a viral note about how, despite Vodafone Idea raising a Rs 18,000 crore FPO, a year from now, company management will start holding the Government to ransom. And ditto that has played out now. My message to all investors: Numbers, balance sheets, and liabilities never lie, but they are often easily ignored. Sharing below my entire analysis and note, which I had shared a year ago (updated for today), which holds 100% even today. .. Vi had raised Rs 25k crore from the two promoters in 2019. Then another Rs 4.9k crore from the duo in 2022. And now, it was asking for a Rs 18k crore via a FPO, along with Rs 2k crore from Aditya Birla Group. So, almost Rs 50k crore raised in five years. And despite all of this, it has to pay the Govt Rs 23k crore in FY26. And subsequently, for the next five years, the annual payments to the Govt for past dues will be Rs 43k crore. Why? Because, in a relief to Vi and help it survive, Govt had imposed a 4yr moratorium on AGR due payments. That moratorium ends at the end of FY26. And the company has no such profits to pay that kind of money. .. Yes, the company has reduced the dues to some extent. How? By converting some of the dues into equity. As a result, Govt now owns 49% of the company. But, the relief only works for FY26, and after that, for 5yrs, it will still have to pay an avg of Rs 40k crore. And it can’t convert more of the dues into Govt equity, because then it would become a Govt PSU, and the Govt would end up with the responsibility to pay the bank dues. .. So, the solution? Vi needs its ARPU (avg revenue per user) to shoot up by a massive 250-280% (basis whichever brokerage analysis you believe), to generate enough money to pay the dues. Sure, if it can generate that much ARPU growth, then it works. But, its practically impossible, and we all know it super well. Outcome? The company is set to die (sorry for my words- it is what it is), and: 1 - All those people who invested in the Rs 18k crore FPO, lured by pathetic investment bankers like Axis (they earned ~Rs 300 crore in fees), are set to see their money go to zero 2 - Govt will never earn back the money it is owed, and whatever money it has received in the form of shares, that’s anyway going to be worth zero 3 - Banks will suffer from massive NPAs - They already know this, which is why they have already diverted present profits for advance provisioning .. This is not investment advice. This is common-sense advice. Apply the brain when investing in a stock. Do some simple math. Or else, an easier way to burn your hard-earned money is to light a bonfire.

Replies (3)

More like this

Recommendations from Medial

Jayant Mundhra

•

Dexter Capital Advisors • 1y

3k crore of taxpayer money burnt in the last two years 📛📛 And Modi Govt is set to burn another Rs 1.2k crore in FY25 for what is clearly another Air India in the making. For what? And worse, this time, there may be no buyers either. .. FY23: Go

See More

Vikas Acharya

Building Reviv | Ent... • 11m

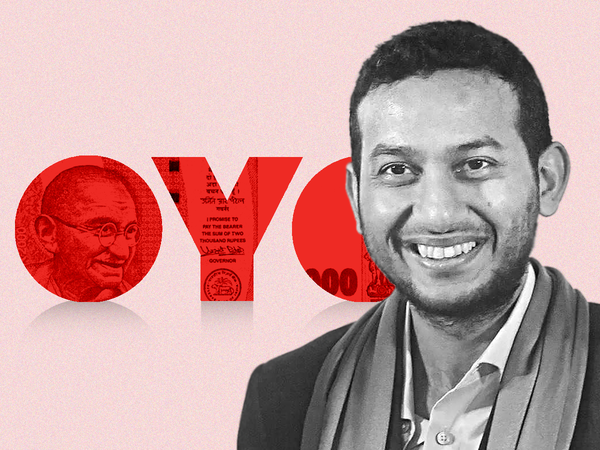

Oyo estimates Rs 1,100 crore PAT for FY26: Founder Ritesh Agarwal Travel tech unicorn OYO estimates its profit after tax to touch Rs 1,100 crore in the next financial year 2025-26, according to projections shared by Founder Ritesh Agarwal with the c

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)