Back

Aman meshram

Finding business gap... • 9m

What are the products and services can an entrepreneur start with for India 2 with annual income of 2.55 lakh and population chunk of 300 million

More like this

Recommendations from Medial

Sameer Patel

Work and keep learni... • 1y

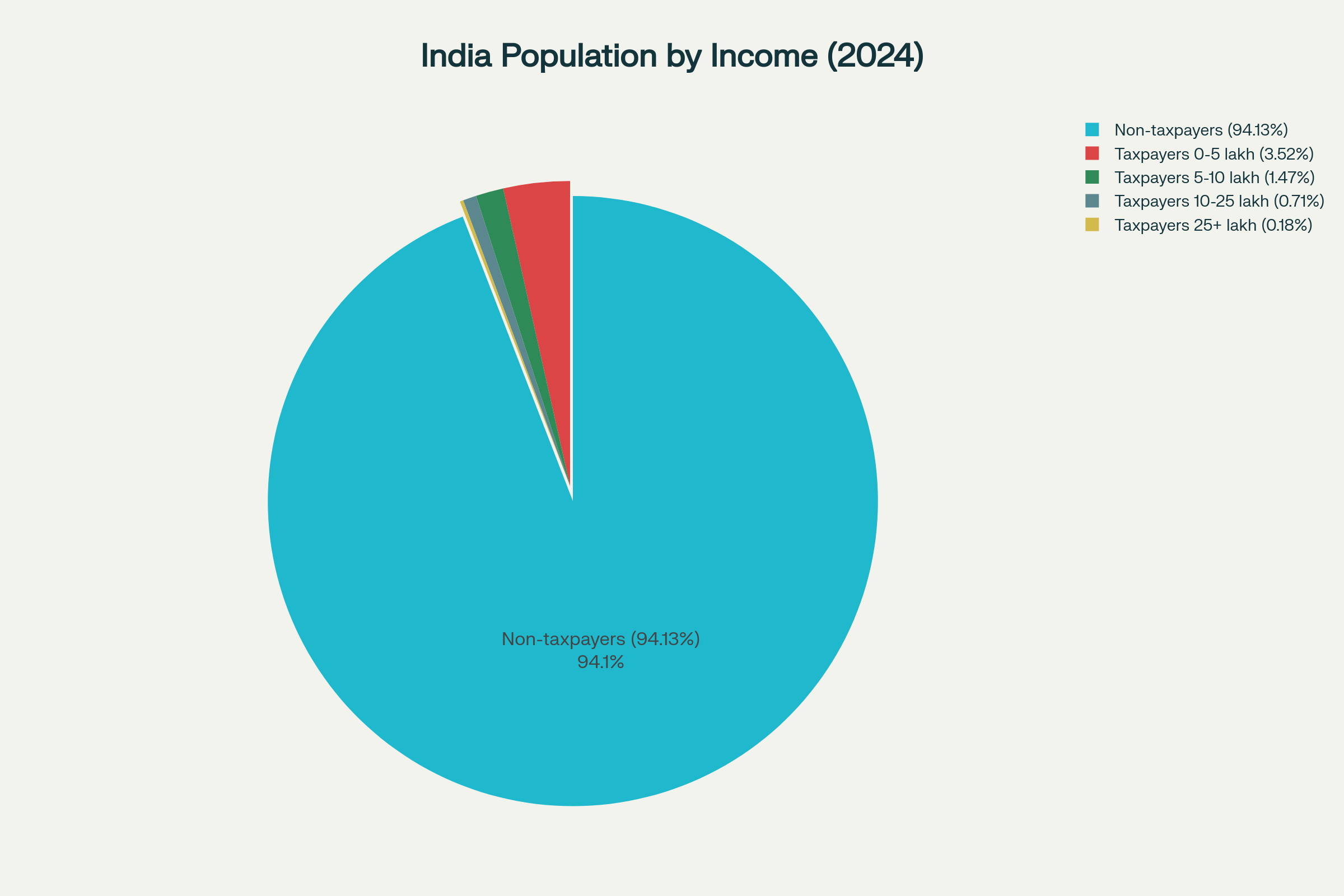

Financial knowledge Indian Tax slabs Income tax slabs categorize taxpayers based on their annual income, determining the applicable tax rates. Here's a breakdown: 1. Nil Tax: Annual income up to ₹2.5 lakh for individuals below 60 years. 2. 5% Tax: I

See MoreP sai Krishna

Hey I am on Medial • 1y

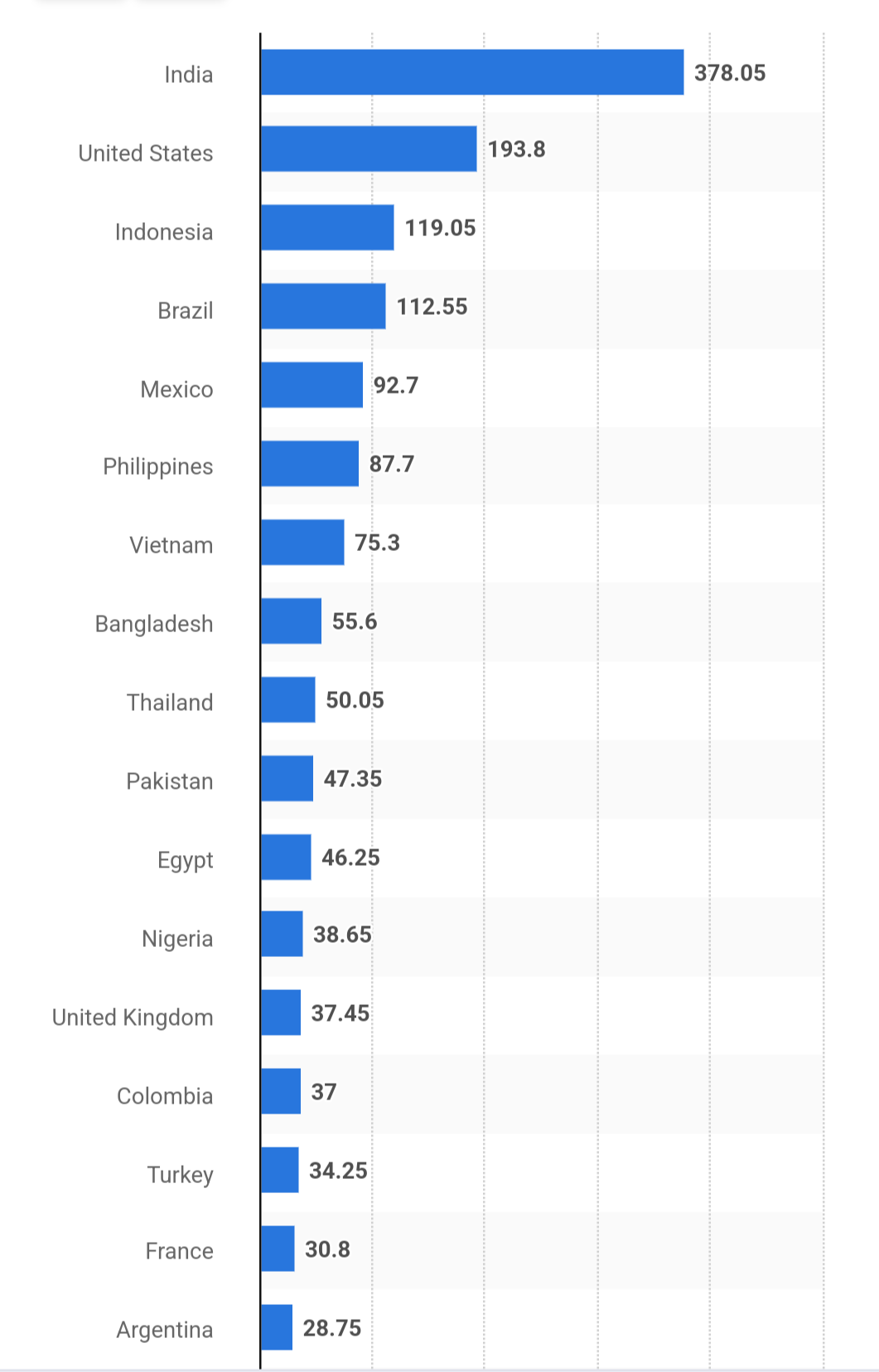

There are more than 378 million Facebook users in India alone, making it the leading country in terms of Facebook audience size. To put this into context, if India’s Facebook audience were a country then it would be ranked third in terms of largest p

See More

Armaan Nath

Startups | Product • 1y

Unfiltered thoughts (5/5) There are 3 types of India: India-1 ~Population of 110 Mn ~Per capita income of $10k ~Buys from Flipkart, watch Netflix, drink Starbucks coffee ~Contributes to 40% of India GDP ~Fluent with English ~35Mn credit card users

See MorePoosarla Sai Karthik

Tech guy with a busi... • 3m

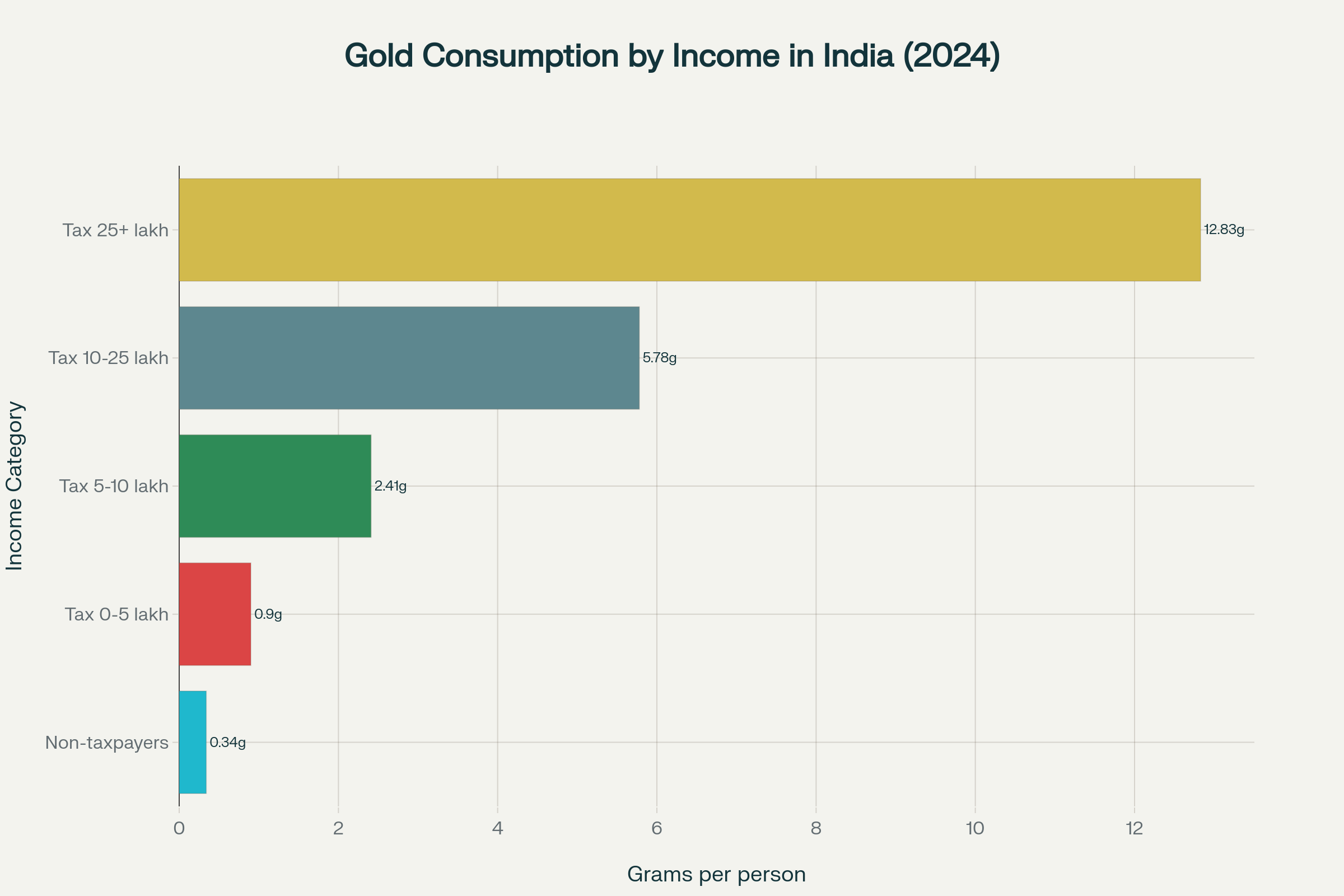

Why India’s Tax Stats and Gold Love Tell a Unique Investment Story Did you know only 5.9 percent of India’s vast population pays income tax, but nearly every household treasures gold not only as jewellery but as a trusted financial foundation? Here

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)