Back

Adithya Pappala

•

Hustle Fund • 9m

𝗜𝘀 𝘁𝗵𝗲 "𝗣𝗮𝘆 𝗳𝗼𝗿 𝗙𝘂𝗻𝗱𝗿𝗮𝗶𝘀𝗲" 𝗺𝗼𝗱𝗲𝗹 𝗮 𝘀𝗰𝗮𝗺? Let’s reveal these serious issue many founders face. → I’ve watched countless founders lose thousands to this model. For example, one founder lost 25,000 to an agency. Another lost $18,000. These horror stories are common, and I should know—I onboarded 9 startups to this model years ago. None secured funding, yet I still got paid for my time & did relevant work back. Surprisingly, it’s not just about the agencies. After speaking with over 110 founders and 100 investors, a key issue emerged: It's not that these agencies lack connections. They just fail to have a streamlined process. Here’s the math: A pre-seed fintech founder seeking $100K will raise 10X faster by pitching to 5 pre-seed investors than by pitching to 200 series-stage investors. Sadly, Most agencies chase quantity & fancy Investors over the right Investors. It’s all about relevance over reputation. Founder-Investor Fit! So, how can you navigate this landscape? 1. Focus on the right investors. Fancy names in the network doesn't fund you but a right investor does. Ex- Shahrukh Khan doesn't fund you even if they have in their network 2. Talk to previous founders. Ask tough questions to uncover the truth. 3. Investigate social proof. Check agency social media and feedback from others. Remember, the truth is fundraising is a full-time job requiring experienced minds. Avoid falling prey to sharks in the waters. P.S-As I have been on both sides of the table,We are running as a G.P Stakes Fund for VC'S Investing in Startups. So,If you're still struggling to fundraise, I am open to 6½ Minute chat on Medial. DM relevant problems!

Replies (3)

More like this

Recommendations from Medial

Adithya Pappala

Busy in creating typ... • 9m

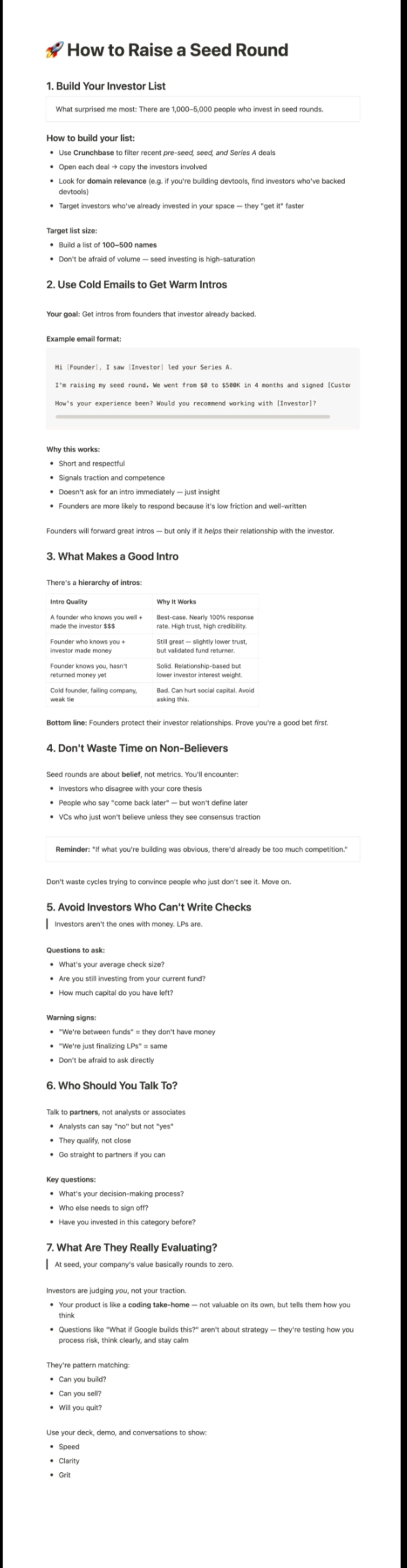

Raise the funds within 2 months! No more B.S Fundraise Advices.. So, I grabbed a doc that I wish I had this to my portfolio of founders on day 1. This list isn't a feel of good-tips. It's the actual playbook that raised more than $2M+ What's in

See More

Hundred X Startups

📍100x Startups | Pu... • 5m

Not every idea makes it to the big stage. ★From 8,000-10,000 applications, shortlist 150-250 founders who show promise. ★A Mentor IC of successful entrepreneurs further filters this to 40-60. ★Over the next few weeks, these founders go through pre

See More

Jeet Sarkar

Technology, Developm... • 1y

Gujarat-based Vodafone Idea (Vi) has raised about Rs 5,400 crore from anchor investors, including GQG Partners, Fidelity Investments, UBS Fund Management, Jupiter Fund Management, and Australian Super, besides Indian investors such as India Infoline,

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)