Back

Rohan Saha

Founder - Burn Inves... • 9m

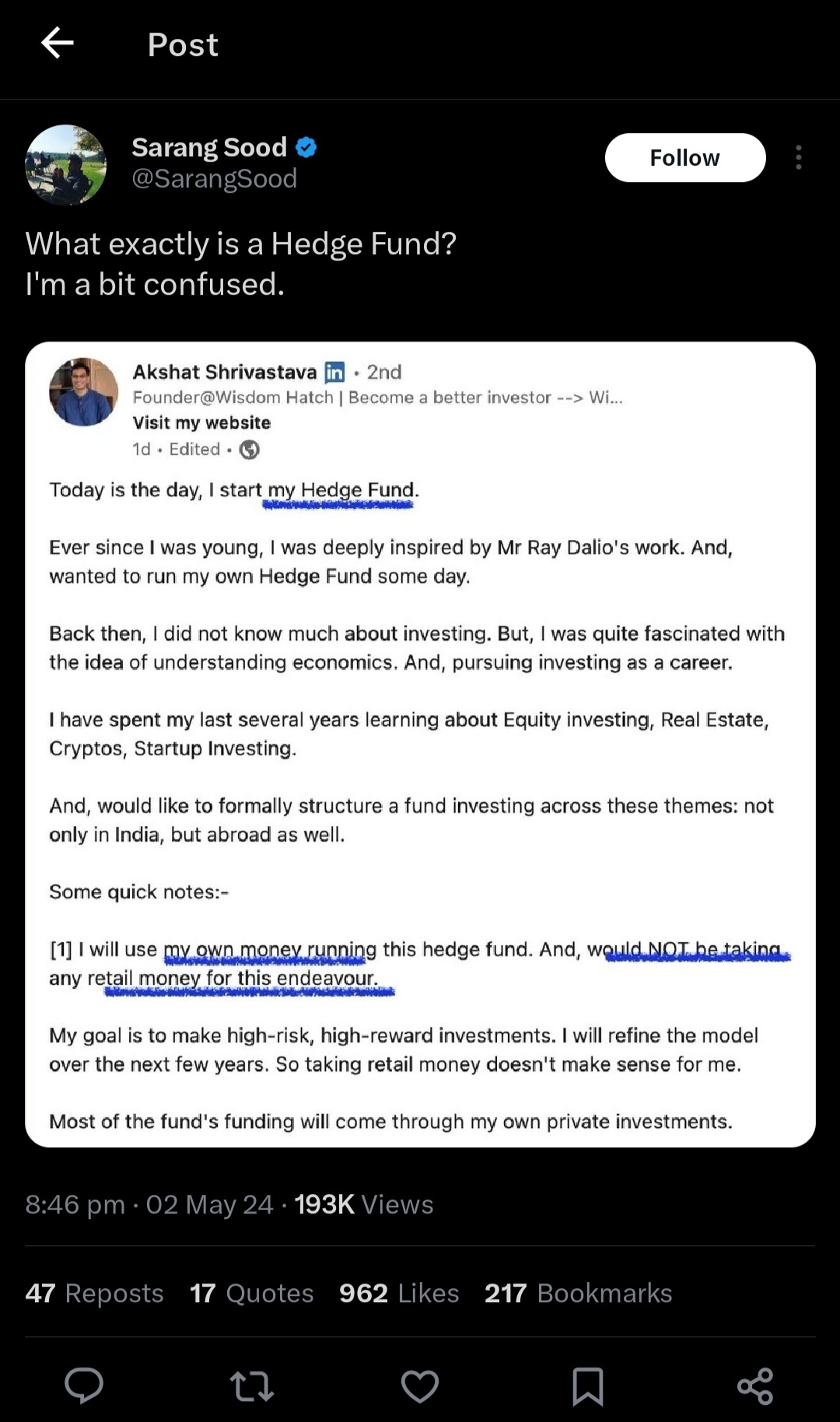

Yesterday, after I posted about MF trading, I found myself randomly scrolling through YouTube, something I rarely do. I decided to search "MF TRADING" just to see if others were talking about it. At the top of the results, I came across a video from one of India’s biggest finance influencers. I won’t name him, but you can probably guess who it is. In that video, he outright called MF trading a scam and warned against investing in mutual funds. Honestly, his arguments were pretty flimsy. This guy runs his own hedge fund in Dubai and sells a ₹25,000 stock trading course in India. I can almost guarantee he doesn’t have a SEBI license. I watched the entire video, and his points were mostly about how mutual funds have lower returns (yah baat puri tarike se sach nahin hai) and high expense ratios, claiming these fees will eat up all your profits. But he conveniently left out the fact that trading through a DEMAT account also comes with regular charges like STT, DP fees, and other transaction costs, which add up every time you buy or sell - often more than mutual fund fees. It’s worrying to see some finance influencers going to such lengths to sell their courses, even questioning well-regulated financial products. And what’s with this Dubai hedge fund thing? Is it really so easy to set one up that anyone can just walk in and start one? Anyway, it’s a bit concerning that these YouTubers are pushing the boundaries of what’s ethical, and people still support them. I’m sure you know who I’m talking about - he makes his videos in English.

Replies (3)

More like this

Recommendations from Medial

Rohan Saha

Founder - Burn Inves... • 9m

Dude, I had looked into F&O and swing trading before, but today I came across mutual fund trading as well. The funny thing is, its returns are usually higher than those of regular traders because it doesn't have the extra costs that we have to pay du

See MoreRohan Saha

Founder - Burn Inves... • 8m

Many people think that if they buy mutual funds from different platforms and keep them, it will be difficult to track them. But that's not true. There's a platform called MF Central, which is SEBI-regulated and keeps records of MF folios and manages

See MoreGargi Jain

Cloud | DevOps | Ill... • 1y

What's the best way to explain my Dad - Mutual Funds is better option than FD and MF gives higher returns. His statement is that "it is risky and might have to bare the loss sometimes and can't remove the cash whenever required (has lock in period)

See MoreRohan Saha

Founder - Burn Inves... • 8m

I don't know how many people are aware of this but if someone invests in mutual funds and is looking for a good platform to check mutual fund details I was using trendlyne MF Screener just now It is next level stuff man everything is available in one

See MoreRohan Saha

Founder - Burn Inves... • 9m

When I first mentioned MF trading, I didn't fully grasp how it worked. But after diving deeper, I found it's a lot more popular than I initially thought. Many HNI and institutional investors actively use this strategy, which you can spot if you pay a

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)