Back

Vamshi Yadav

•

SucSEED Ventures • 9m

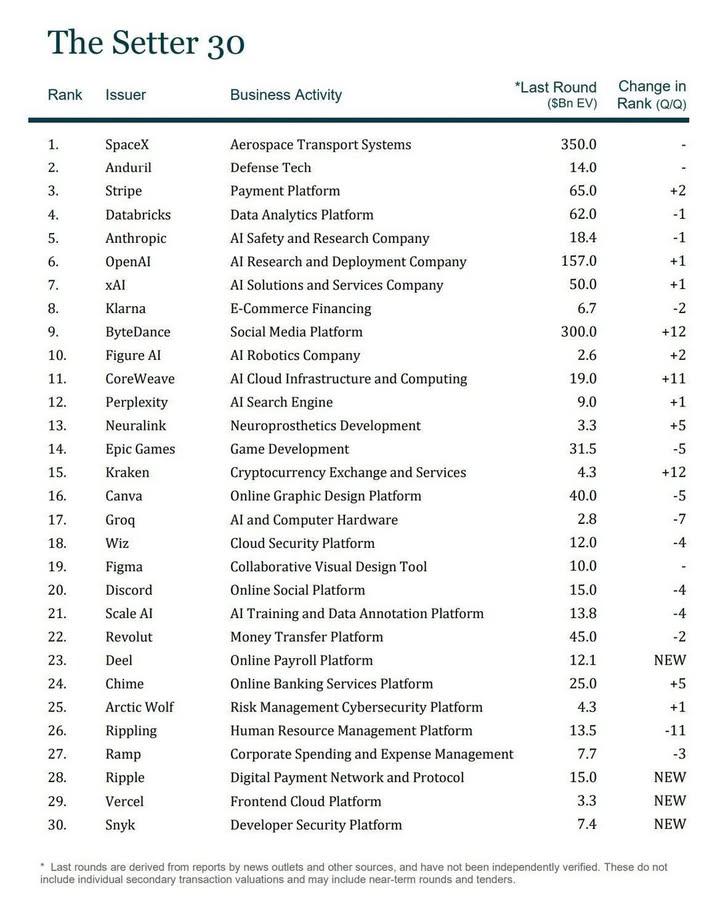

The VC Playbook Is Getting Rewritten, So Here's What's Next The biggest names in Silicon Valley—Lightspeed Ventures, a16z, Sequoia, and Thrive—are no longer mere veil of ventures. They are morphing into tech-powered private equity titans with seismic repercussions for startups, investors, and market dynamics. The Great Pivot: From VC to an RIA Lightspeed's view of affiliating himself in becoming a Registered Investment Advisor is no mere formality. This permits him now to: ✅ Purchase stocks publicly ✅ Pick up secondary shares ✅ Roll-up PE-style ✅ Acquire controlling stakes It means less IPO waiting time. Less passive betting. VCs just became operators. Why the Old Model Died The classic VC model—spray 25 bets, pray for 2 unicorns—is dying. Constraints like: 🔸 20% Rule: Only 20% of capital could go to non-startup assets 🔸 Liquidity Traps: Locked capital for 10+ years 🔸 Passive Governance: Limited influence over portfolio companies Forced firms to reinvent or fade away. The New Power Players a16z: In 2019, became an RIA Set up crypto/wealth arms | Led the Twitter take-private Sequoia: Abandoned 10-year funds for an evergreen pool Thrive: Launched the $1B+ Thrive Holdings to build/buy AI-driven companies General Catalyst: Bought a hospital system | Reincarnated as a Transformation Company The RIA PLAYBOOK vs. Old School VC Traditional VC New RIA Strategy Bet early, wait 10 years Buy, build, reboot Pray for unicorns Engineer exits via roll-ups Passive board seats Active ownership & control IPO/M&A exits Secondaries, public stakes The Secondaries Explosion Startups are turning private for longer, trapping a cool hundred billion dollars in unrealized value (up from 25B in 2012). Firms such as Lightspeed are grabbing the opportunity with arms wide open while hiring ex-Goldman MDs to lead secondary strategies. The Operator's Edge: AI + Roll-Ups The new game? → Build AI-native companies in-house → Buy legacy firms (hospitals, retailers) → Reboot them with AI as the core engine General Catalyst is now trialing healthcare AI across its hospital system. And then: • AI-Driven Roll-Ups: Vertical domination in fintech, healthtech, infra • Secondary Platforms: Dedicated liquidity engines for private stakes • Public Market Plays: Ownership from pre-IPO into post-IPO • Extinction of Mid-Tier VCs: Only scaled RIAs survive The Bottom Line This is no VC version 2.0 per se: it is a new asset class that combines the risk appetite traditionally associated with venture with PE-scale control. So that means for founders, ✔️ new exit options (secondaries, roll-ups) ✔️ cut-throat competition, from rivals whose own investors built ✔️ longer-term capital, tighter oversight #VentureCapital #PrivateEquity #TechInnovation #FutureOfFinance (Inspired by industry shifts | Not an investment advice)

More like this

Recommendations from Medial

Vamshi Yadav

•

SucSEED Ventures • 10m

Venture capital, in its utter importance in recent days, is on the threshold of change—namely, tech private equity. This turning point in venture capital is a giant one because the great names in Silicon Valley-Lightspeed, a16z, Sequoia, and Thrive-

See MoreRohan Saha

Founder - Burn Inves... • 8m

I just noticed that Groww has introduced an option for NCD IPOs allowing users to bid directly on new issues but when I tried looking up bonds in the secondary market it showed ISIN not found so they are offering access to primary issues but not to t

See MoreRohan Saha

Founder - Burn Inves... • 1y

PhonePe has planned its IPO in India, and Navi is also set to follow. Groww and OYO are preparing their IPO papers as well. In a few days, we will see many mainboard IPOs. Many famous startups are shifting from private funding to IPO plans. I hope th

See MoreRohan chavan

Strategic AI integra... • 2m

Top talent prefers companies with automation — not chaos. 🧠⚙️ They don’t leave for salary first — they leave for clarity, flow, and systems that respect their time. Chaos doesn’t feel exciting when you’re inside it. It feels like: 🔸 Constant cont

See More

Kishan Kabra

Founder & CEO • 1y

What's the reason behind of OYO valuation crash? They were struggling to get approval from SEBI for IPO back in 2021, Finally got a approval but they withdrew their application and looking to raise from private investors at $2.3 Billion which was $9

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)