Back

More like this

Recommendations from Medial

CA Kakul Gupta

Chartered Accountant... • 5m

🏠 GST & Real Estate Update Realtors are waiting for govt clarity on how GST input tax credit benefits should be passed on to homebuyers. This decision will directly impact whether home prices go up or come down under the new GST regime. What do you

See More Reply

4

CA Kakul Gupta

Chartered Accountant... • 5m

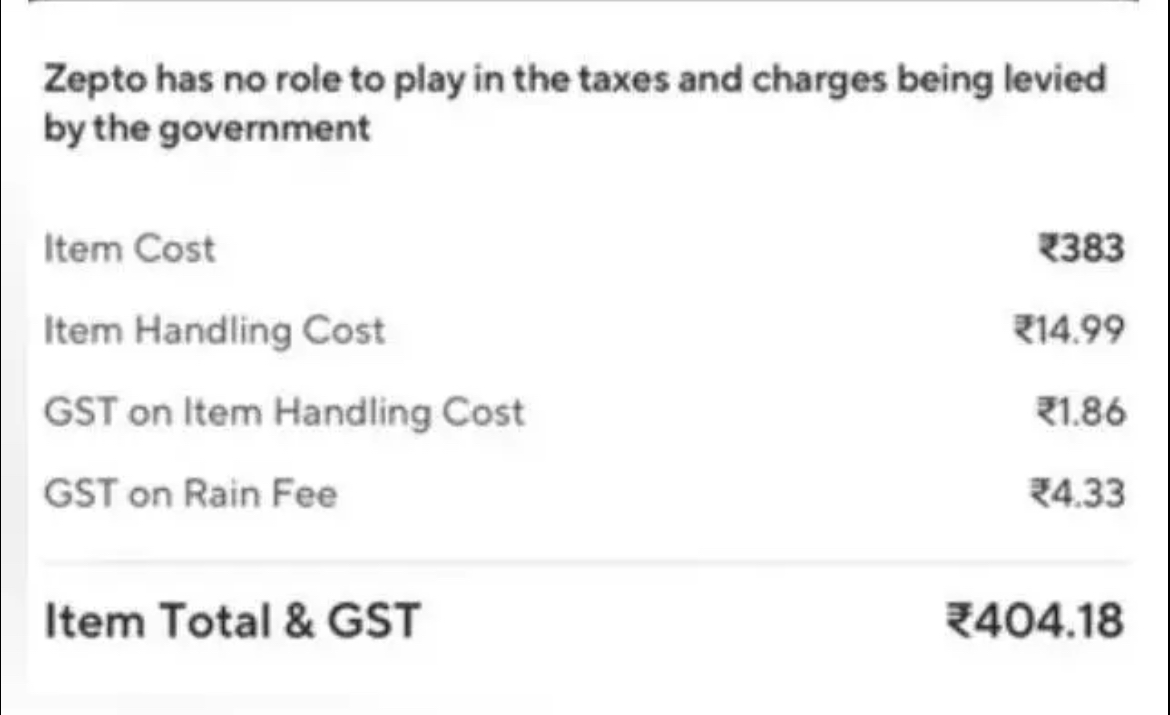

GST Rate Change – Important Clarification The Govt. has clarified that new GST rates will apply on all deliveries made on/after 22nd September. 👉 Even if you have booked your order, issued invoice, or made advance payment pehle, the new rate will

See More Reply

11

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)