Back

spectar

the best closer • 9m

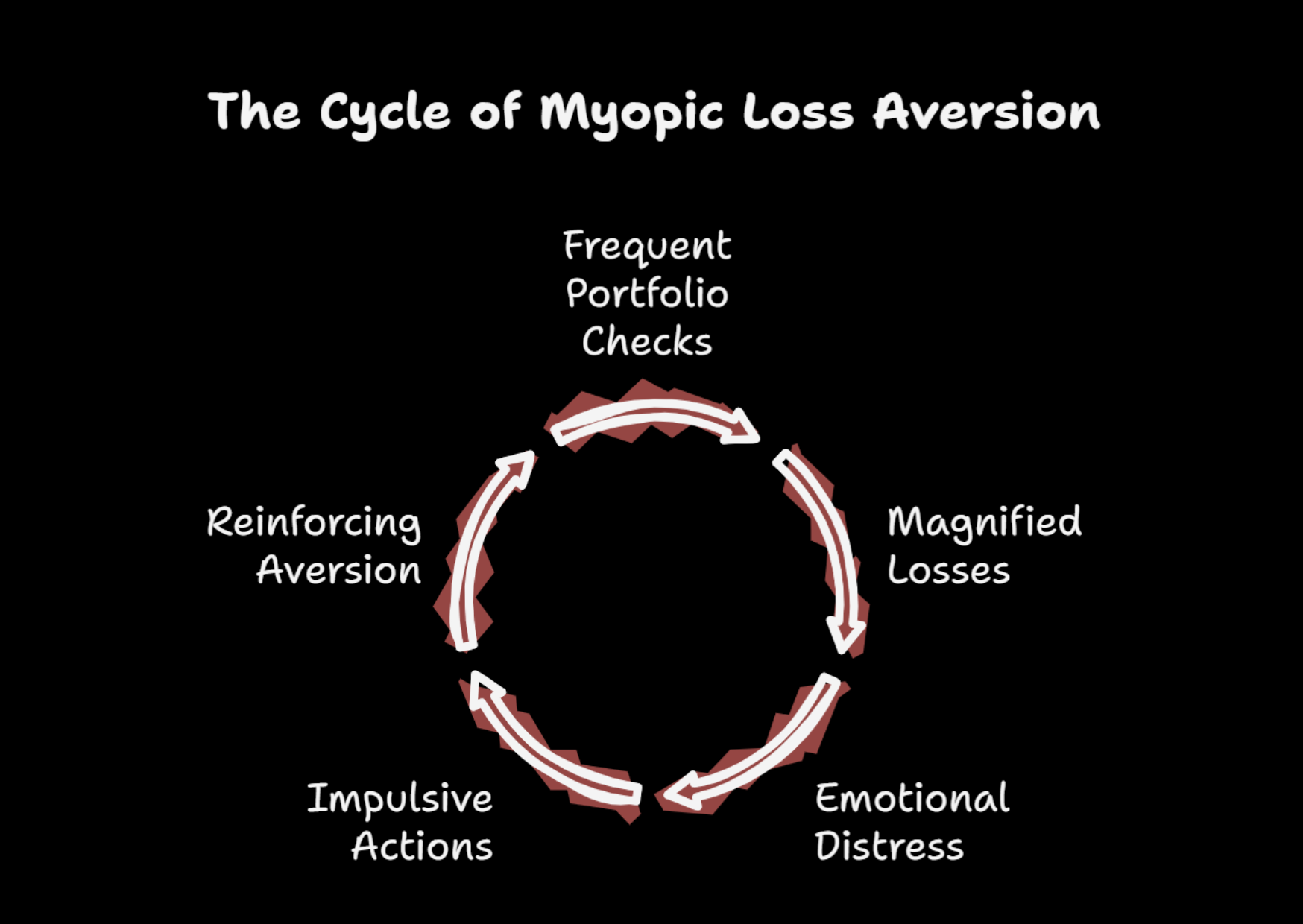

Why Looking at Your Portfolio Too Often Feels Like "a Losing Game" Ever feel like you're always losing money in the stock market, even when the news says markets are up? It’s not your imagination — it’s Myopic Loss Aversion. It’s the idea that when we check our investments too often, we magnify the pain of small losses. Even if we’re growing wealth in the long run, these short-term dips make us feel like we’re failing. Here’s what data says: If you invest for just 1 day, you have only a 51% chance of seeing gains. Hold for a year? That jumps to 70%. Stay for 10 years? You’re almost guaranteed to be up. Despite India’s Sensex delivering ~15% annually since 1979, many still feel nervous about equities. And the reason is psychological, not financial. The cure? Stop watching your money every day. Invest in quality. Hold for the long term. Let compounding do its work. You don’t need to act every day to build wealth. You just need to stay put. #Investing #BehavioralFinance #StockMarketIndia #WealthCreation #MyopicLossAversion #LongTermThinking

Replies (2)

More like this

Recommendations from Medial

Only Buziness

Everything about Mar... • 3m

The Framing Effect shows how the same fact can feel entirely different depending on how it’s presented. When a brand says “95% success rate,” customers feel confident — but if it says “5% failure rate,” they hesitate, even though both mean the same.

See MoreTHE CHETZZ

Stoic : Boundless • 1y

How come @Olacabs @Uber India@inDrive @rapidobikeapp @nammayatrithey don't hold one-day seminars on howto use their services for inexperiencedauto and taxi drivers? As a result, they arecurrently losing between fifty and sixtypercent of their revenue

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)