Back

Yash Bramhadev Pandey

Leading Organic Mark... • 9m

Hello everyone, I’m looking for guidance regarding funding through CGTMSE for a ₹5 crore loan at the ideation stage via SBI Bank. I’m setting up a proprietorship business in the services and renting sector, based in Navi Mumbai. I already have a basic business plan/project report prepared. Can anyone experienced help me understand: How to proceed with SBI for such a case? What documents should I carry with me when visiting the bank? Any tips on how to better present the idea at this early stage? I’d really appreciate advice from anyone who has done this before or knows the process in detail. Thanks in advance for your support! #CGTMSE #Funding #StartupLoan #SBI #Entrepreneurship #NaviMumbai

Replies (1)

More like this

Recommendations from Medial

Yash Bramhadev Pandey

Leading Organic Mark... • 10m

Hello everyone, I am currently in the ideation stage of my service-based startup and looking to raise initial funding through the CGTMSE scheme for a loan of ₹5 Crores. If anyone has experience, contacts with banks, NBFCs, or consultants who can gui

See MoreRohan Saha

Founder - Burn Inves... • 9m

Currently, SBI is planning to sell its entire 24% stake in Yes Bank. Assuming SBI sells this stake at a price range of ₹19-23 per share, the deal is expected to generate a net post-tax return of approximately ₹6,500 crore for SBI, which is about 9-10

See MoreVIJAY PANJWANI

Learning is a key to... • 4m

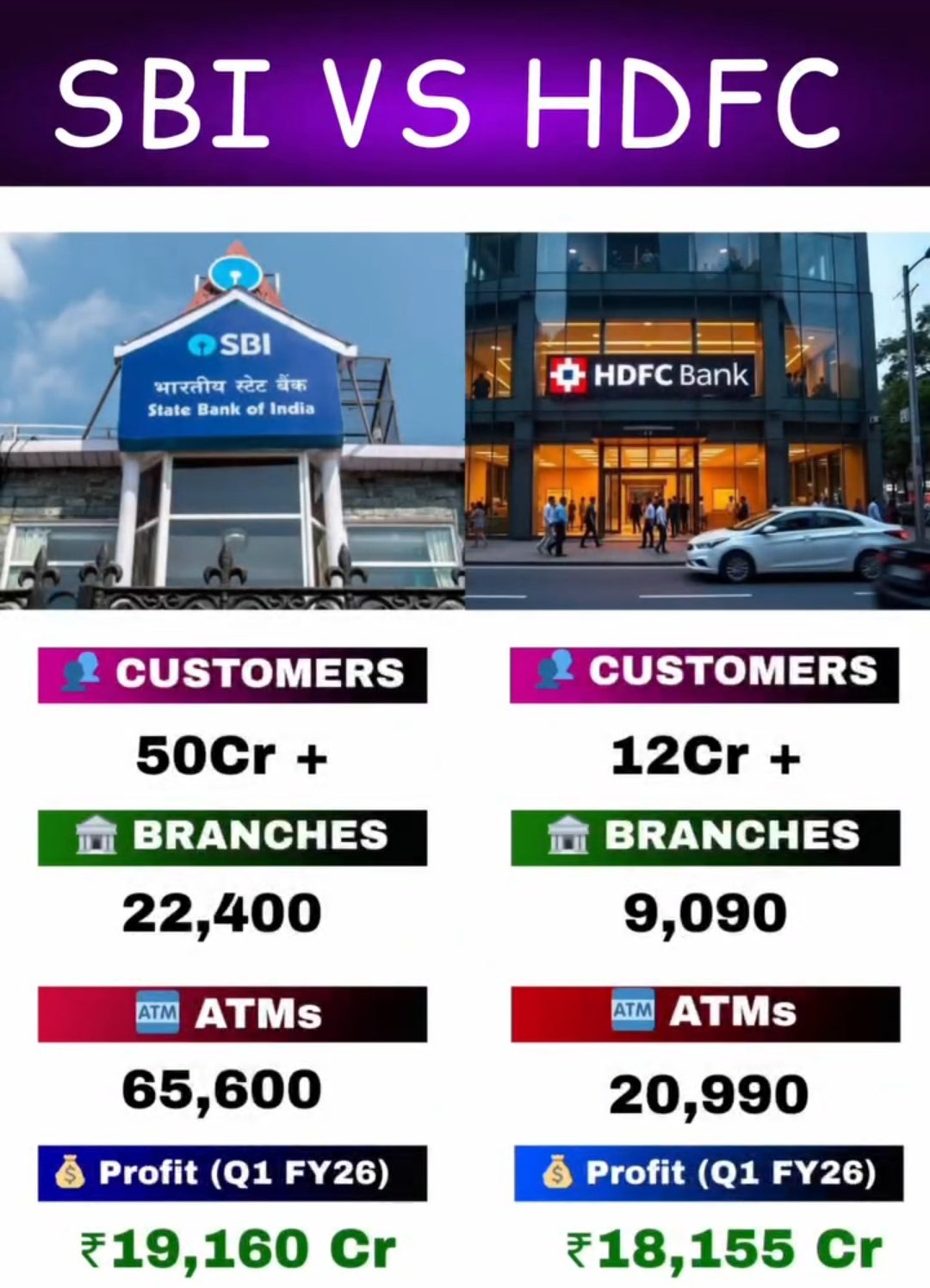

SBI vs HDFC Bank – The Battle of India’s Banking Giants! 🇮🇳 SBI: 50 Cr+ customers | 22,400 branches | ₹19,160 Cr profit 🏦 HDFC Bank: 12 Cr+ customers | 9,090 branches | ₹18,155 Cr profit 👉 Who’s the real king of Indian banking? Comment your o

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)