Back

Vamshi Yadav

•

SucSEED Ventures • 9m

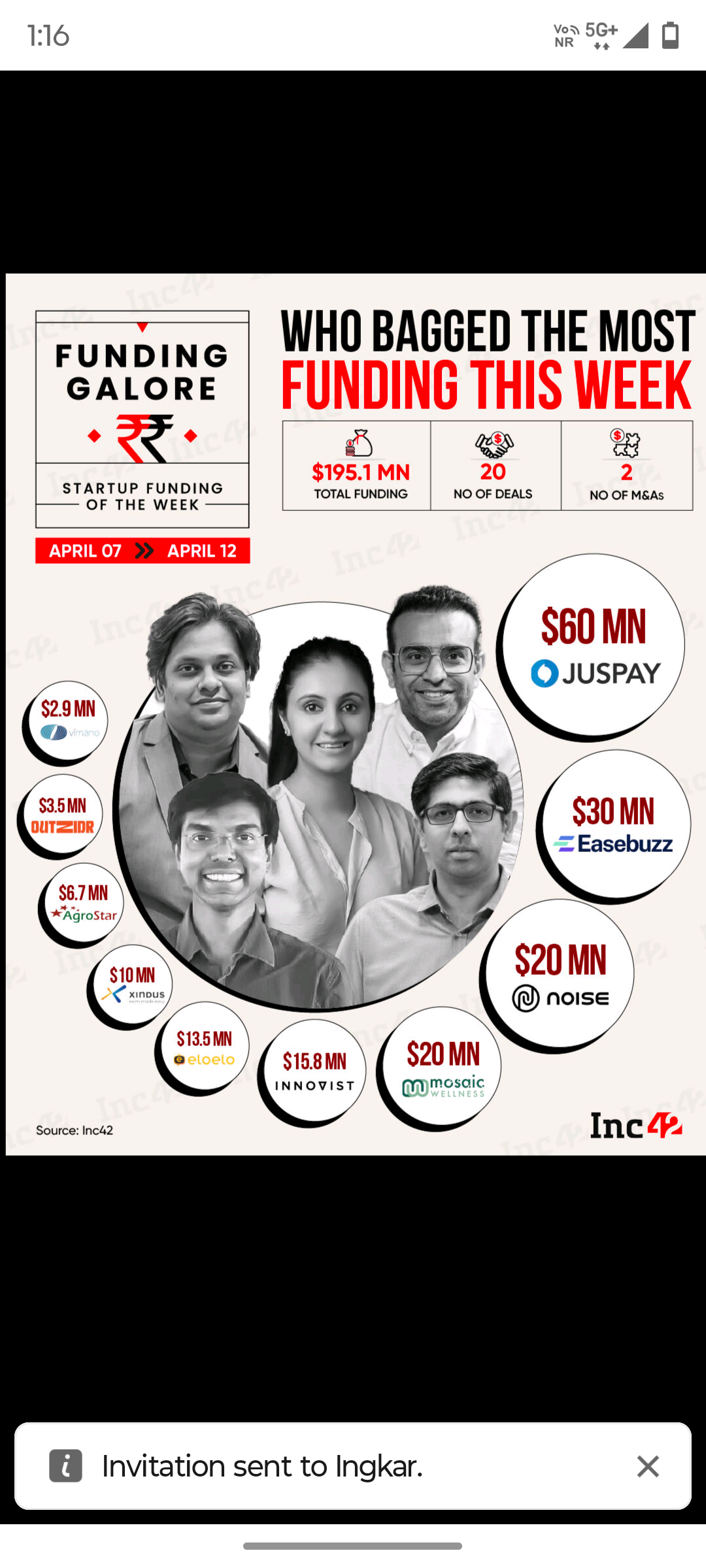

Early Stage Investment Trends: A Summary of Startup Funding in India (14th-19th April) 33.4 million dollars were deployed across 13 promising Indian startups last week. The following are interesting patterns in the way investors have prioritized funds for startups, below is the breakdown of these transactio: Noteworthy Funding Rounds • Optimized Electrotech Pvt Ltd (Defence Tech) stood the highest in week's funding at $6 million | Blume Ventures • Magma (Industrial SaaS) raised $5 million | Capria Ventures • Peppermint Robotics (Robotics) raised garnering $4 million | IAN Group (formerly Indian Angel Network) Emerging Sectors Funding It is noticeable what these investments are increasingly leaning towards: • Advanced materials - Jewelbox (lab-grown diamonds) raises $3.2 million | V3 Ventures • EV Infrastructure - IPEC $3 million round | Gruhas • Space tech - Eon Space Labs bags $1.2 million funding | MountTech Growth Fund - Kavachh Growth Fund Consumer-Focused Deals D2C brands displayed market traction: ⤷ Nothing Before Coffee (QSR)- $2.3M | Prath Ventures ⤷ GOOD MONK (Superfoods Valley Pvt. Ltd.) (nutrition products)- $2 million | RPSG Capital Ventures ⤷ Pujashree Products Global Private Limited (D2C Wellness)- $1.5M ⤷ NOTO - Healthy Ice Cream (health-conscious ice cream)- $700K | Inflection Point Ventures ⤷ That Sassy Thing (intimate wellness)- $700K | Inflection Point Ventures ⤷ CURA CARE (Home Healthcare)- $586K | Zeropearl VC Edtech Highlights ⤷ CENTA (Edtech)- $2.3M | Colossa Ventures Geographic Distribution Investments spanned seven towns, mainly in Bangalore, Mumbai, and Pune. Market Observations 1) Defense and deep tech absorb substantial early-stage funding 2) EV infrastructure yet another preferred sector after all its recent struggles 3) Niche D2Cs are garnering mass confidence from investors. (Data: Tracxn, VCCircle and LinkedIn) #StartupInvesting #VentureCapital #IndianStartups #FundingTrends

Replies (2)

More like this

Recommendations from Medial

Nawal

Entrepreneur | Build... • 9m

You could raise up to $2 Million USD for your early stage startup by applying to these funding programs closing by 1st June '25. 🔥 Inflection Point Ventures $250K-$2M USD Deadline: 30th May 2025 Callapina Capital $100K-$250K USD Deadline: 30th Ma

See More

ProgrammerKR

Founder & CEO of Pro... • 10m

Nuro Raises $106M, Now Valued at $6 Billion Nuro, known for its autonomous delivery robots, raised $106 million in fresh funding, boosting its valuation to $6 billion. The funds will help scale operations and enhance delivery robotics technology. #

See MoreDownload the medial app to read full posts, comements and news.