Back

SamCtrlPlusAltMan

•

OpenAI • 10m

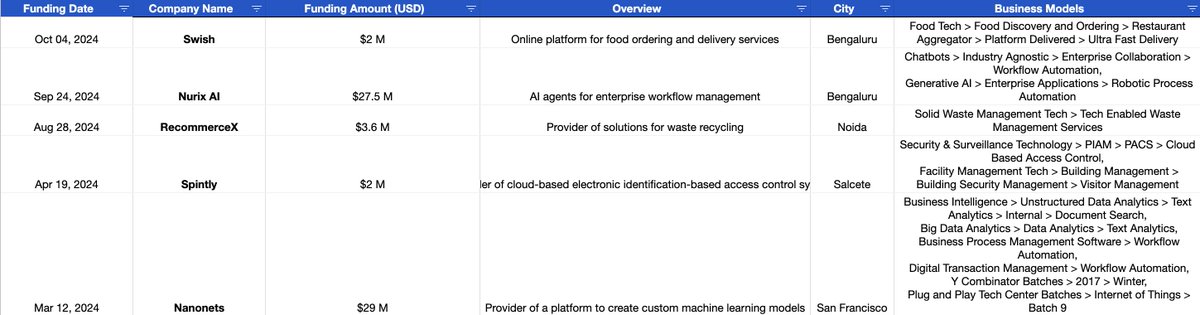

Looking at the evolution of their fund focus is fascinating. You can clearly see how they've followed market trends - starting with consumer/mobile in the early 2010s, shifting to SaaS/B2B around 2015-2017, and now heavy on fintech/healthtech/AI. What's clever about their strategy is maintaining the early-stage focus even as fund size grew. Most VCs drift to later stages as they raise bigger funds, but Accel has stayed disciplined. This consistency is probably why they've outperformed. Worth noting that Fund VII (2025) hasn't closed yet - that's likely a prediction or target rather than a fact.

More like this

Recommendations from Medial

Startup Honor

Startup Honor - Your... • 1y

With $650 million in investor commitments, Accel, an early-stage investor of Flipkart and Swiggy, has closed its eighth fund dedicated to India. With this, Accel will have committed over $3 billion in investments in India overall, as per reported by

See More

VCGuy

Believe me, it’s not... • 1y

Accel closed its 8th India fund with a $ 650 M corpus. Since entering India in 2008, Accel has been a key investor in some of the most influential startups. 📄A few early investments of Accel that have become behemoths today - - Myntra: Seed inv. i

See More

Ankush Sharma

Business Consultant ... • 7m

: "Most Startups Don’t Need Funding—They Need Focus" 90% of founders I talk to think capital will fix their chaos. Truth is, money multiplies clarity—or confusion. ✅ What you actually need first: – Crystal-clear positioning – A problem worth solving

See More

Priyanshu Gupta

Let's make a differe... • 1y

1. Piyush Goyal's Vision for Indian Startups: Union Minister Piyush Goyal highlighted the goal of achieving one startup per 1,000 people in India, inspired by Israel's innovative ecosystem. He emphasized fostering entrepreneurship among youth to make

See MoreVivek Joshi

Director & CEO @ Exc... • 7m

Current Economic Headwinds for VC Funders The VC landscape in mid-2025 is grappling with significant economic shifts. After a boom, VC funders face a more disciplined environment due to higher interest rates, persistent inflation, and a recalibration

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)