Back

Jayant Mundhra

•

Dexter Capital Advisors • 10m

CASH FLOW +VE - Really happy about what Ankush & ShareChat shared day before yday! 🙏🙏 It has been a harrowing two years. I had already considered them dead. And I was wrong - hats off to these folks! Let’s track all that happened! .. Founded in 2015, SC became a big deal in 2021. - Fuelled by cheap investor money, it went on a fundraising binge - Not only did SC become a unicorn that year, but also raised $913mn from names like Google, Temasek, Tiger Global, Snap, Twitter, Lightspeed & Elevation Capital .. But, what to do with all that money? SC had a 3-pronged plan. 1 - Continue growing its great vernacular app which was a great hit, particularly among Telugu & Bengali users, and was not burning much money 2 - Launch a real money gaming platform (Jeet11) and mint great money as other RMG companies like MPL and Dream11 were doing 3 - Scale up its TikTok clone app - Moj (+ TakaTak), which was facing tough competition from Instagram Reels and YouTube Shorts which had access to most users with deeper pockets .. But, it did not work out as well 🙏🙏 Dream11 and MPL’s growth and profits were exciting, but they obscured the difficulty of building a viral gaming business. Thus, after burning big on it, in Dec 2023, Jeet11 was shut down, hundreds were laid off. But it didn’t end there. And they kept laying off more and more in every few months, officially, and also unofficially by placing large sets of people under PIPs. .. Meanwhile, SC built a global standard content recommendation engine for its Moj platform under Debdoot Mukherjee (now at Meesho). Its AI and ML chops were acclaimed as unparalleled in India - But, its massive cloud server load led to humongous expenses, all of which made Google richer. And there seemed like no end to it - And, it was not even making a decent fraction of revenue compared to what it was burning on this whole thing Somehow, the company reduced that bill to a fraction (I’m not sure how small - but less than half, basis what my friends there tell me). .. Amidst all of this, two of the company’s three founders left to build another venture together, leaving only Ankush. Thus, if the company were to turn around now, credit would all be his. But, if it were to go dead - It would also always be on him. Sentiments were obviously low, as during this time, the company saw its valuation crash from $4.9bn to $1.5bn - just $100mn over the $1.4bn it has raised to date. Against those odds, Ankush went big on monetisation pipes while lowering costs dramatically (harrowing, but a series of layoffs was a big factor

Replies (4)

More like this

Recommendations from Medial

Account Deleted

Hey I am on Medial • 1y

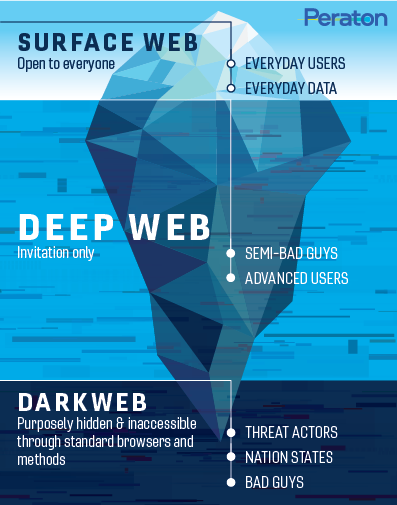

Today I accessed the Dark web , and what i saw is very horrifying like literally can explain what i saw , like the dark you think I saw more than that , m***** video, r*** video , c****p*** v**** etc , there were many people datas wer selling like ,

See More

Anonymous

Hey I am on Medial • 1y

This is ironic. Turns out security and anti-phishing company KnowBe4 didn't know before it hired someone that they were a North Korean hacker. Incredibly, the "fake IT worker" passed through four separate video interviews and cleared multiple back

See More

prabhas bhargav

Always be Happy but ... • 1y

Well today I had a change to listen to an entrepreneur, and they were charging pretty handsome for their service but and had a really big proposal, with over 20 services but when I carefully listed to their conversation and analysed it I realised th

See MoreAnsh Kadam

Founder & CEO at Bui... • 9m

This is how Bajaj sold 1.8+ Cr. Pulsars — not just with an engine, but with emotion. Back in the day, Bajaj was dominating Indian roads with its iconic Chetak scooter — so much so that people were willing to wait 10 years just to get one. But the w

See More

ReepinderGoyal

Hungry? DM me • 1y

Today, saw a webinar Allen conducted, many students were watching it, Allen was promoting their ca and clat classes and forcing children to join them, they were saying again and again, it's too easy to crack ca and join our coaching now in 11th grade

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)