Back

Pruthviraj Dahiya

Hey I am on Medial • 10m

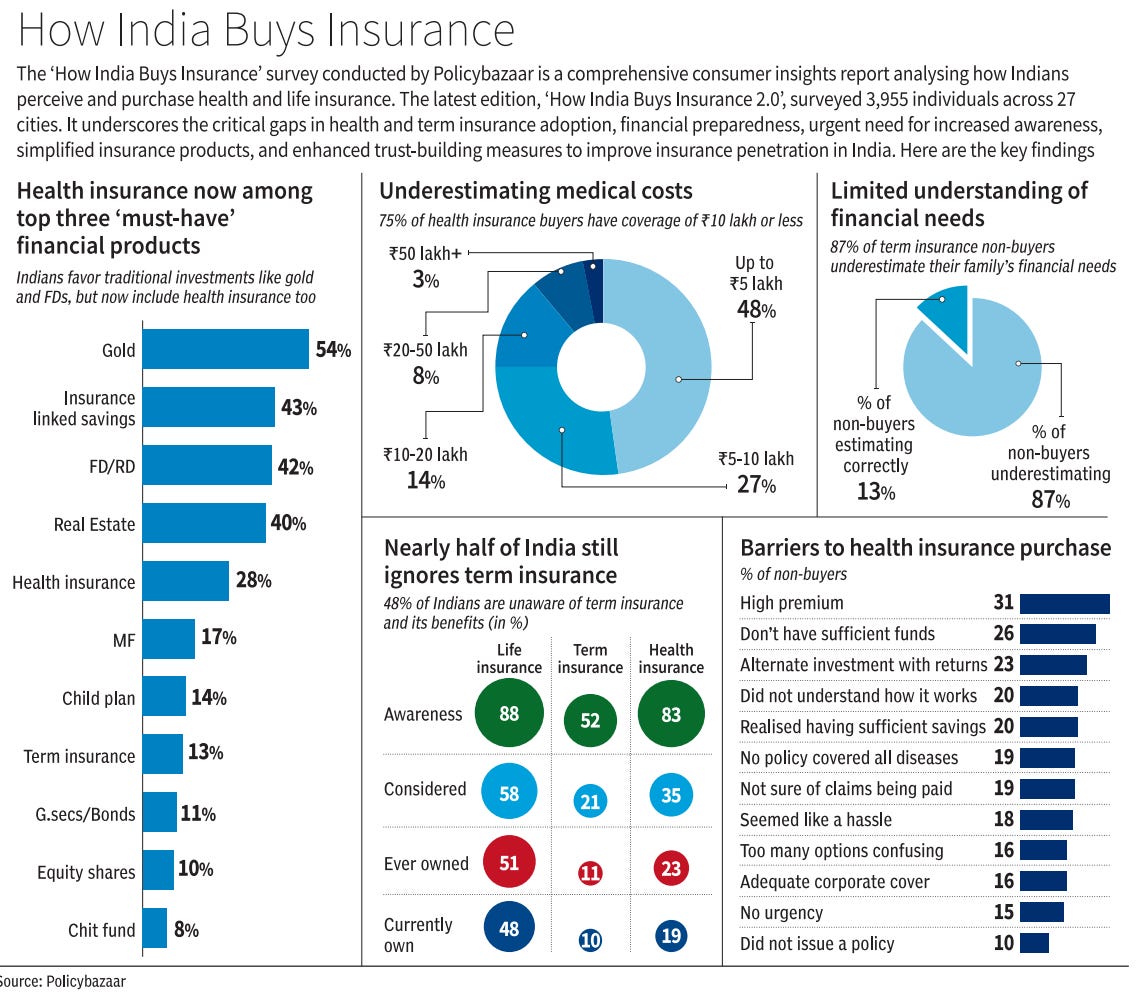

My friend wants to build an AI that replaces your financial advisor Hey everyone, I'm not from a tech background, but I really wanted to get your thoughts on an idea a close friend of mine came up with. His goal is to make financial planning super easy for regular people using AI. Here’s how it works (or at least how he explained it to me): The platform would be completely free for users. People enter some personal and financial details, and the AI helps them create a plan—like how much to invest in SIPs, which type of insurance they might need, how to reach certain financial goals, etc. It doesn’t sell its own products. Instead, it partners with fintech companies (mutual fund providers, insurance firms, etc.). If someone ends up buying or signing up through his platform's suggestions, the company earns a commission from that fintech partner. Eventually, the idea is to charge these partner companies a subscription fee too—once the user base and conversions grow. For now, it’s just going to be a website, but there are plans to turn it into an app later. The idea is that financial planning is overwhelming for a lot of people—especially young adults who don’t know where to start. So, this platform would act like a friendly, AI-powered financial guide. I personally think it sounds promising, but I also know there are already big players in the finance space. So I wanted to ask you all: Does this sound like it could work in the real world? Would you trust an AI to help you make personal finance decisions? And if you've seen similar platforms, how did they do? Any feedback positive or critical is more than welcome.

More like this

Recommendations from Medial

jaspreet Singh

Time equals to money... • 2m

Fintech Industry – Detailed Overview 1. Introduction to Fintech Fintech (Financial Technology) refers to innovative technologies that improve, automate, or transform financial services. It blends finance + technology to create faster, smarter, and

See More

Kabir Kataria

President - SyncMate... • 11m

Fintech: Transforming the Future of Finance The fintech industry is booming, revolutionizing how we manage money. From digital wallets and UPI payments to AI-driven lending and blockchain, fintech is making financial services faster, smarter, and mo

See More

Vedant SD

Finance Geek | Conte... • 1y

The Rise of Fintech in Bangalore: Trends and Opportunities * Trends: Mobile payments, digital lending, insurtech, blockchain, wealth management, regulatory sandbox. * Opportunities: Financial inclusion, increased access to credit, personalized fina

See MoreVighnesh Battu

Exploring new busine... • 1y

How about starting an fintech startup related to marriage businesses Where subscribers need to pay the premium every month for their policy of their own respective money and claim the amount on their particular year. As like as insurance companies.

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)