Back

Vamshi Yadav

•

SucSEED Ventures • 10m

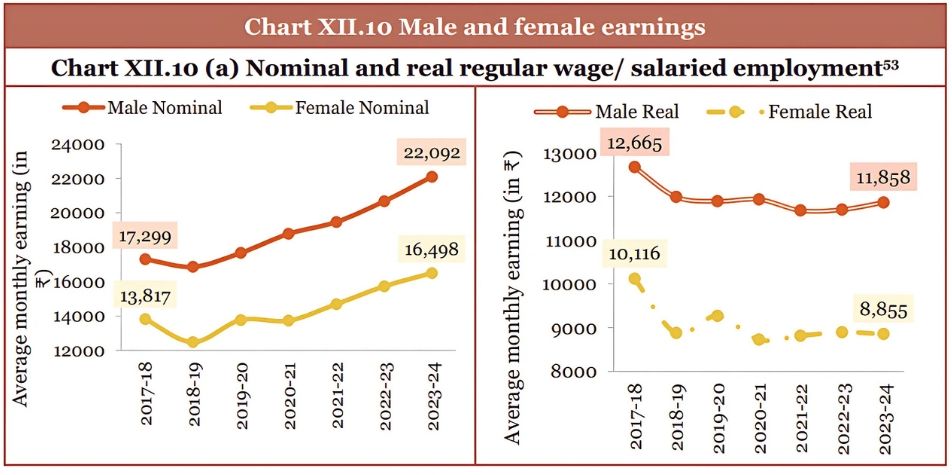

"Pakoda VC" is now a trend & I can understand why! It's India's broken system The numbers tell a grim story: middle-class incomes are shrinking as inflation (~6%) outpaces wage growth (~4%). While labor participation has risen to 60%, most new workers are forced into insecure self-employment. Corporate profits jumped 22% last year, yet employment grew just 1.5%, with CEOs' pay soaring to 40% while salaried jobs declined. Nominal Earnings Growth (2017-18 → 2022-23) Men: ████████████████████ 28% Women: ████████████ 19% Real Earnings Decline (Inflation-Adjusted) Men: ████████▼ 25% loss Women: ████▼ 40%+ loss Naturally, more people are turning to entrepreneurship, not out of ambition alone, but necessity. Many founders complain that VCs won't fund their "real businesses." But this misunderstands venture capital. VCs represent less than 2% of global capital and exist to fund explosive growth, not stable businesses. The real failure lies elsewhere: • Banks demand impossible collateral for loans • Government grants come with bureaucratic hurdles • Policy favors short-term handouts over real support The backing that we need: ✓ Accessible business loans ✓ Transparent grant systems ✓ Functional support infrastructure Private capital seeks returns. Public capital seeks votes. Meanwhile, actual entrepreneurs are left begging for scraps. Until this changes, India's business dreams will keep hitting the same walls.

Replies (4)

More like this

Recommendations from Medial

Rajesh Shukla

Hey I am on Medial • 5m

Designed to uplift sugarcane farmers and millers, Sugar Funding offers easy access to loans, subsidies, and growth capital. By supporting modernization, energy diversification, and financial stability, it drives sustainable growth, rural prosperity,

See MoreVivek Joshi

Director & CEO @ Exc... • 8m

Venture Capital (VC) is a vital funding source for high-growth startups, typically those too risky for traditional bank loans. VCs pool capital from Limited Partners (LPs) to invest in promising early-stage companies with significant scaling potentia

See More

Anuj Strides

Hey I am on Medial • 1y

Hosiery (Women and Men) Market Insights and Forecast 2023-2033: Key Drivers and Trends Explore the Hosiery (Women and Men) Market industry outlook with detailed market analysis and growth projections for 2025-2033. Understand the different types of

See MoreJagan raj

Founder & CEO of Tec... • 1y

Golden Nugget for Entrepreneurs In my POV, loans are ideal for early-stage businesses to build progress before pitching to VC, but remember, loans come with risk: • Loans help you establish your business, manage cash flow, and achieve short-term

See MoreAccount Deleted

Hey I am on Medial • 11m

A lot of founders think funding = validation, but that’s just step one. If you can’t turn that capital into real, sustainable growth, it’s just a countdown to running out of cash. Just because a startup raises VC money doesn’t mean it’s successful. V

See Morefinancialnews

Founder And CEO Of F... • 1y

JPMorgan Predicts S&P 500 to increase 8% to 6,500 by 2025 **JPMorgan Forecasts S&P 500 to Hit 6,500 by 2025, Driven by Earnings Growth and AI Investments** JPMorgan has set a bullish 2025 price target for the S&P 500 at 6,500, signaling an 8% upsid

See MoreVivek Joshi

Director & CEO @ Exc... • 7m

📈 Indian VC rebounds! PE-VC investments +9% to ~$43B in 2024, led by VC/growth at ~$14B (+40%) across 1270 deals (+45%). Consumer tech & SaaS lead. Public markets a key growth driver. VCs now prioritize AI with strong IP & early capital efficiency.

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)