Back

Chirag

•

&OTHERS • 10m

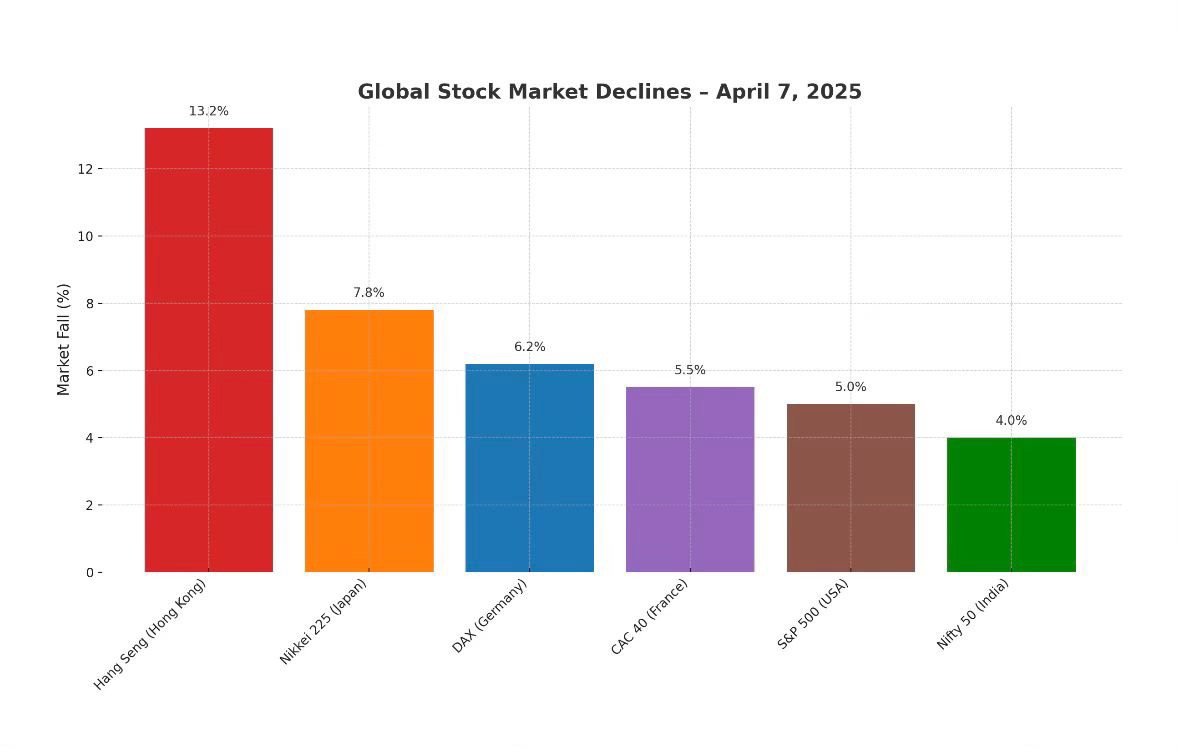

One Tweet. Trillions Lost. April 7, 2025, will go down as a masterclass in how fragile global markets really are. A single tweet about fake tariff news triggered a global selloff, wiping out billions across major economies. Look at this chart again: Hang Seng: -13.2% Nikkei: -7.8% DAX: -6.2% S&P 500: -5.0% But India? Nifty 50 fell just 4.0%. Here’s what the data is quietly screaming: • 150M+ retail investors. They don’t panic sell like the big boys do. • SIP inflows hit ₹19,000 Cr+ monthly. That’s long-term conviction money. • Private consumption = 60% of India’s GDP. We don’t rely on exports like others do. While the world runs on institutions, India runs on the investor next door. Is this a strength… or a warning? • Can this wave of retail faith sustain if real shocks hit us? • Are we becoming too reliant on SIPs as a “market shock absorber”? • What happens when this retail optimism turns? What do you think? Is India building an economic shield—or setting up a retail bubble?

Replies (3)

More like this

Recommendations from Medial

Mahendra Lochhab

Content creator • 1y

According to Cushman & Wakefield’s Main Streets Across the World report, Khan Market has once again retained its position as a global retail hotspot, ranking as the 22nd most expensive main street internationally with annual rents of over Rs 19,000 p

See More

Tushar Aher Patil

Trying to do better • 10m

Stock Market Today - Global Selloff Triggers Big Fall in Indian Markets 7 April 2025, 09:25 AM Today, Indian stock markets opened with sharp losses, reflecting global market jitters. Both the Sensex and Nifty 50 are trading deep in the red, as risin

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)