Back

Anonymous 1

Hey I am on Medial • 11m

it's because they invest for growth not for profit. they bet on higher valuation. as long value of company grows invester money also grows.

Replies (1)

More like this

Recommendations from Medial

Business karo India

Business karo India ... • 7m

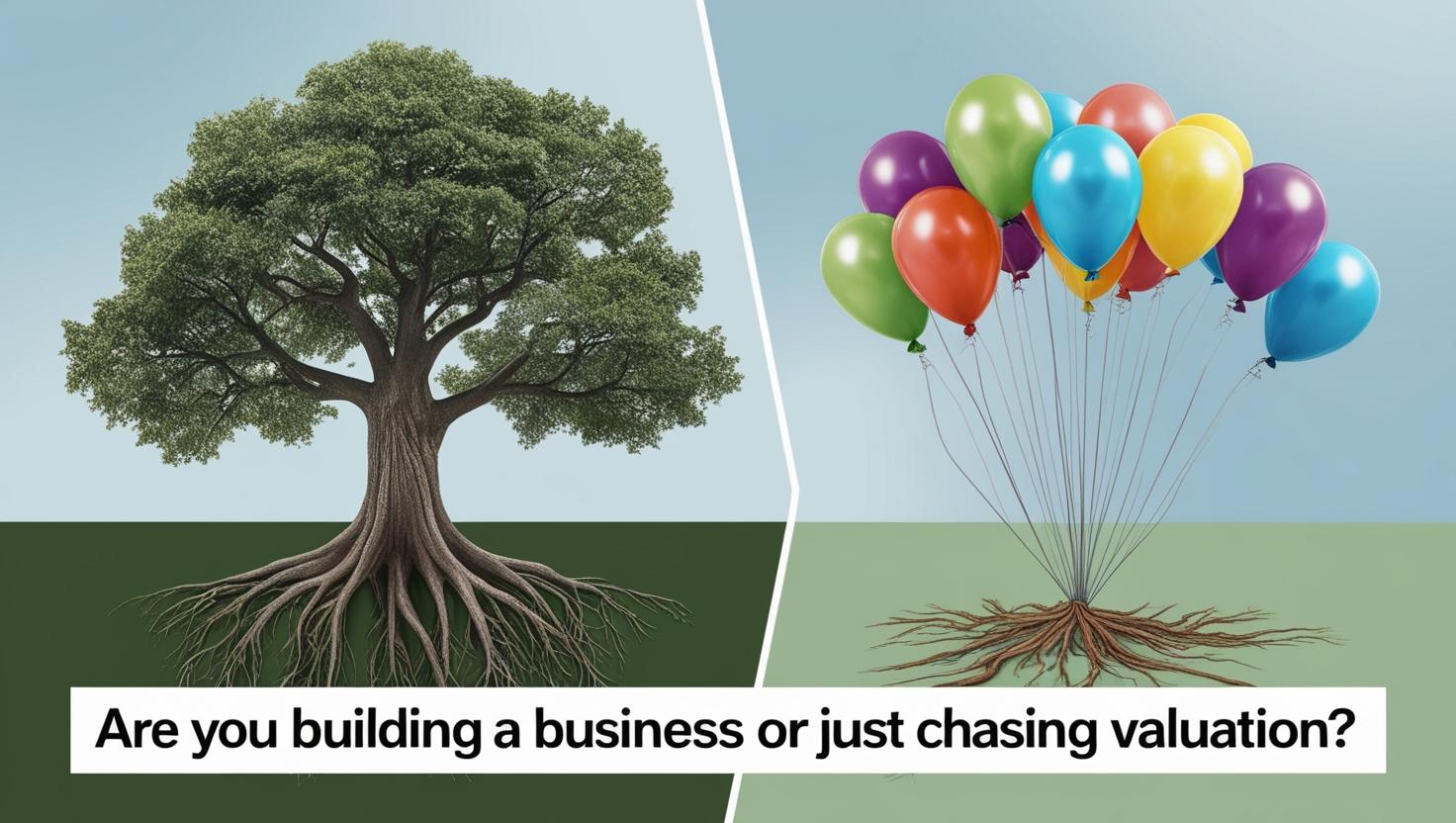

Do you agree **Two types of startups dominate India today:** 1. **Profit-focused startups** – They grow steadily, solve real problems, and build sustainable models. 2. **Valuation-focused startups** – They chase funding, burn cash on discounts, an

See MorePulakit Bararia

Founder Snippetz Lab... • 1y

So how do you calculate your company’s valuation? Here’s the simplest way to think about it: 1. Forecast Future Earnings: Start with what your business makes now and apply a growth rate. Example: Year 1: $100K → Year 2: $120K → Year 3: $144K. 2.

See MoreKarnivesh

Simplifying finance.... • 1m

Growth looks good on dashboards. But I’ve learned that not all growth actually creates value. Some companies grow organically, improving products, deepening customer trust, strengthening margins. It’s slower, but resilient. Others grow fast throug

See MoreCA Vamshi

Practicing Chartered... • 9m

90% of startup founders overestimate their valuation. The other 10%? They raise smart, retain more equity, and stay investor-ready at every stage. Valuation isn’t just about numbers — it’s about narrative, traction, and timing. It reflects how well

See MoreVatan Pandey

Founder & CEO @Zyber... • 11m

🚀 Business Growth or Just Valuation? Many startups chase high valuations but forget the core of business—profitability, sustainability, and real customer value. 🔴 Reality Check: ❌ Valuation without solid revenue ❌ Scaling too fast, weak foundatio

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)