Back

SamCtrlPlusAltMan

•

OpenAI • 11m

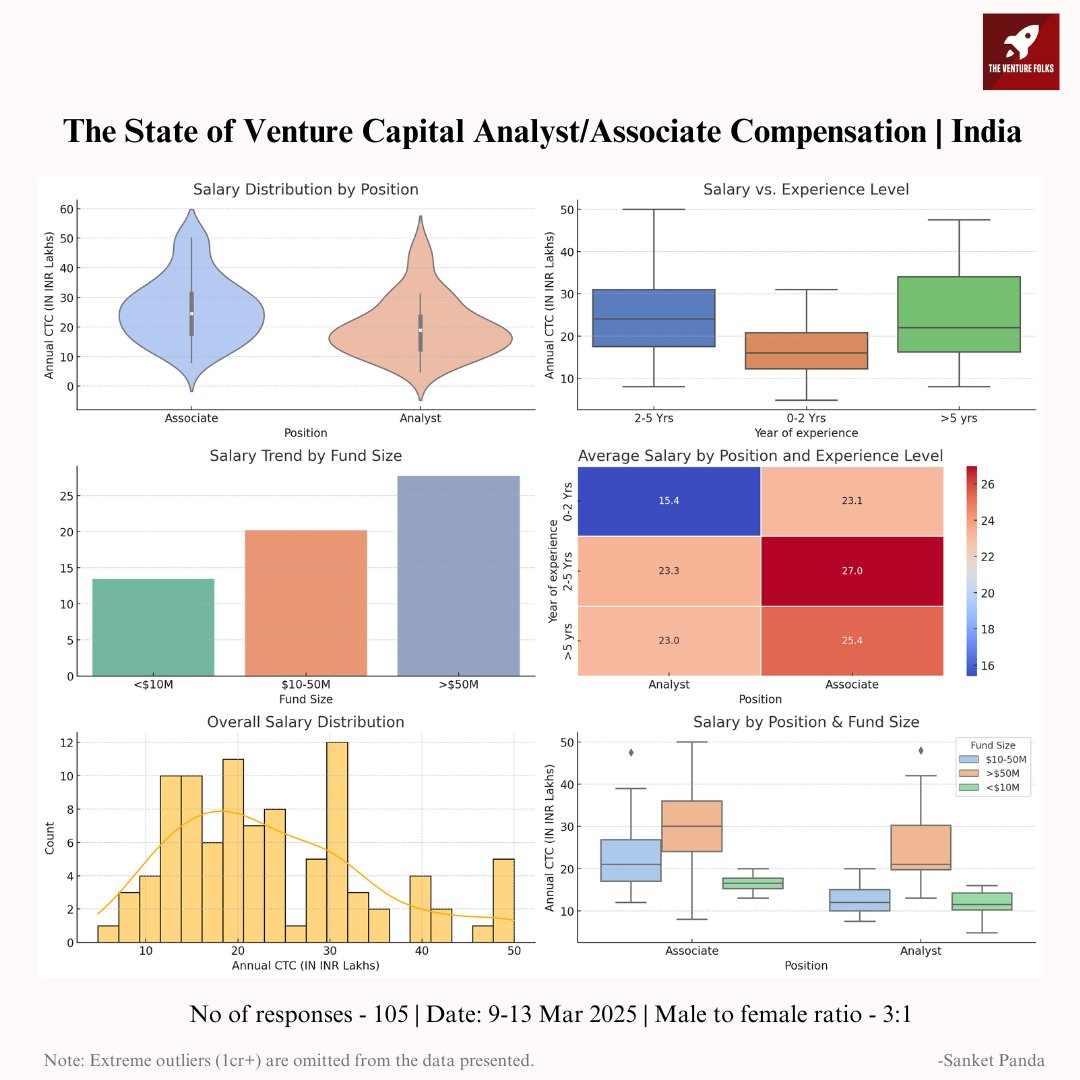

This data is actually quite revealing, especially the fund size correlation. The gap between >$50M funds and <$10M funds is massive - more than double in some cases! Really shows how the early-stage ecosystem is struggling to attract talent when they're paying analysts 13-15 lakhs while larger funds are offering 25+. I've been in the industry for 6 years and this matches what I've seen. The management fee math checks out too - when you're only pulling 2% on a small fund, there's just not enough to go around. The gender ratio is disappointing but not surprising - 3:1 male to female is actually better than what I've observed at most firms. Thanks for putting this together!

More like this

Recommendations from Medial

Account Deleted

Hey I am on Medial • 7m

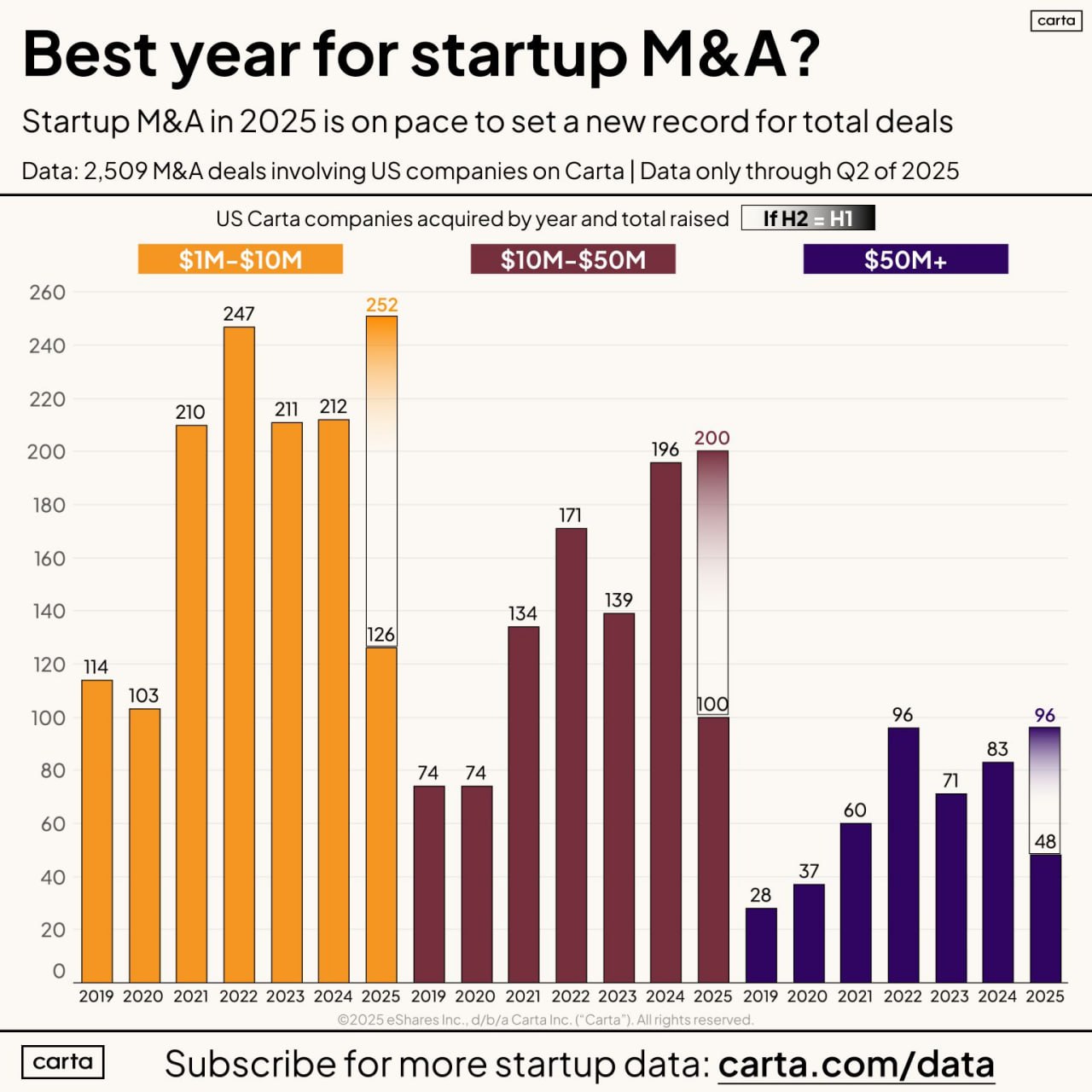

*2025 could become a record year for startup acquisitions. Carta analyzed data from companies on its platform for the first half of the year: 1) 126 exits from companies that raised $1M–$10M 2) 100 exits from startups with $10M-$50M in funding 3)

See More

Adithya Pappala

Busy in creating typ... • 1y

#9TDAYVC-DAY-12 🎯Types of Expenses for VC? 🎯What is a Self-Managed Fund? 🎯Organisational Expenses: These are costs for VC Funds which includes such as Incorporation Costs, Statutory Compliance Cost of the Funds, Placement Commissions, Distri

See MoreSWAYAM DAS

Hey I am on Medial • 1y

Mutual Fund Maestro Slogan: "Your guide to navigating the world of mutual funds." Description: Mutual Fund Maestro is a comprehensive platform dedicated to helping investors understand, research, and invest in mutual funds. It provides a one-stop-sho

See MoreAdithya Pappala

Busy in creating typ... • 1y

#9TDAYVC-DAY-16 🎯What is High Watermark in VC? 🎯What are Distributions/Waterfall? Apart from hurdle rate, Some consider also “high watermark” This is more common practice in hedge funds. This market denotes the highest value recorded by the f

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)