Back

LIKHITH

•

Medial • 10m

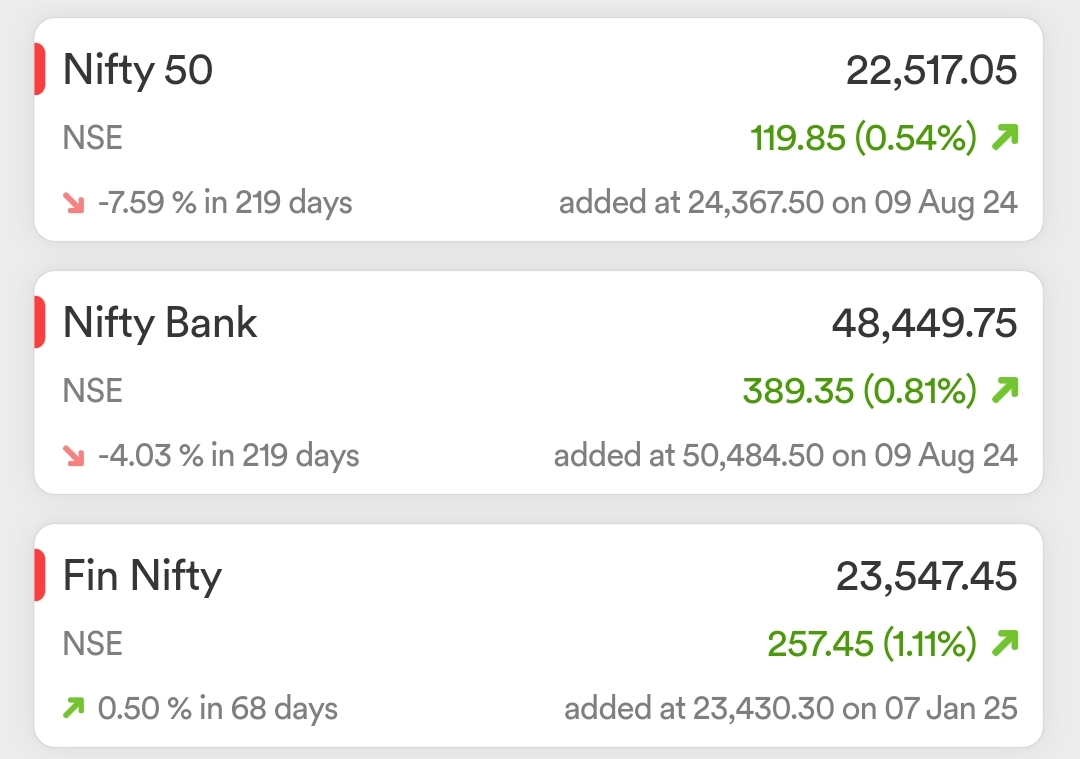

Nifty ka 22,500 level is acting as a strong support. right ?

Replies (1)

More like this

Recommendations from Medial

Dr Bappa Dittya Saha

We're gonna extinct ... • 1y

OI trends! ⚠️ In the money put removed! Nifty strong above 22000. Deep In the money Call removed. 22500 still a strong resistance! Above it is strong support! 23k - 23.5k this is max nifty can go It's a sell on rise! And building position in under

See Morefinancialnews

Founder And CEO Of F... • 1y

Technical Analysis for Nifty and Bank Nifty: Key Support, Resistance, and Market Outlook Following a four-week decline, the Nifty index is approaching a critical support level near 24,000. Ajit Mishra, SVP of Research at Religare Broking Ltd, notes

See MoreAdarsh Km

Worked in startups a... • 1y

🚨Market Alert! #Nifty in continuous decline and all eyes are now at 200 EMA support, which is normally the last hope for any corrective reversal. Below this, a further deep correction will be seen.? Is this a dip that shall be bought, or should we

See More

Download the medial app to read full posts, comements and news.