Back

Rohan Saha

Founder - Burn Inves... • 9m

The Nifty 500 is still holding its support level. The upcoming weekly closing will be crucial for understanding the market's next move.

More like this

Recommendations from Medial

Rohan Saha

Founder - Burn Inves... • 8m

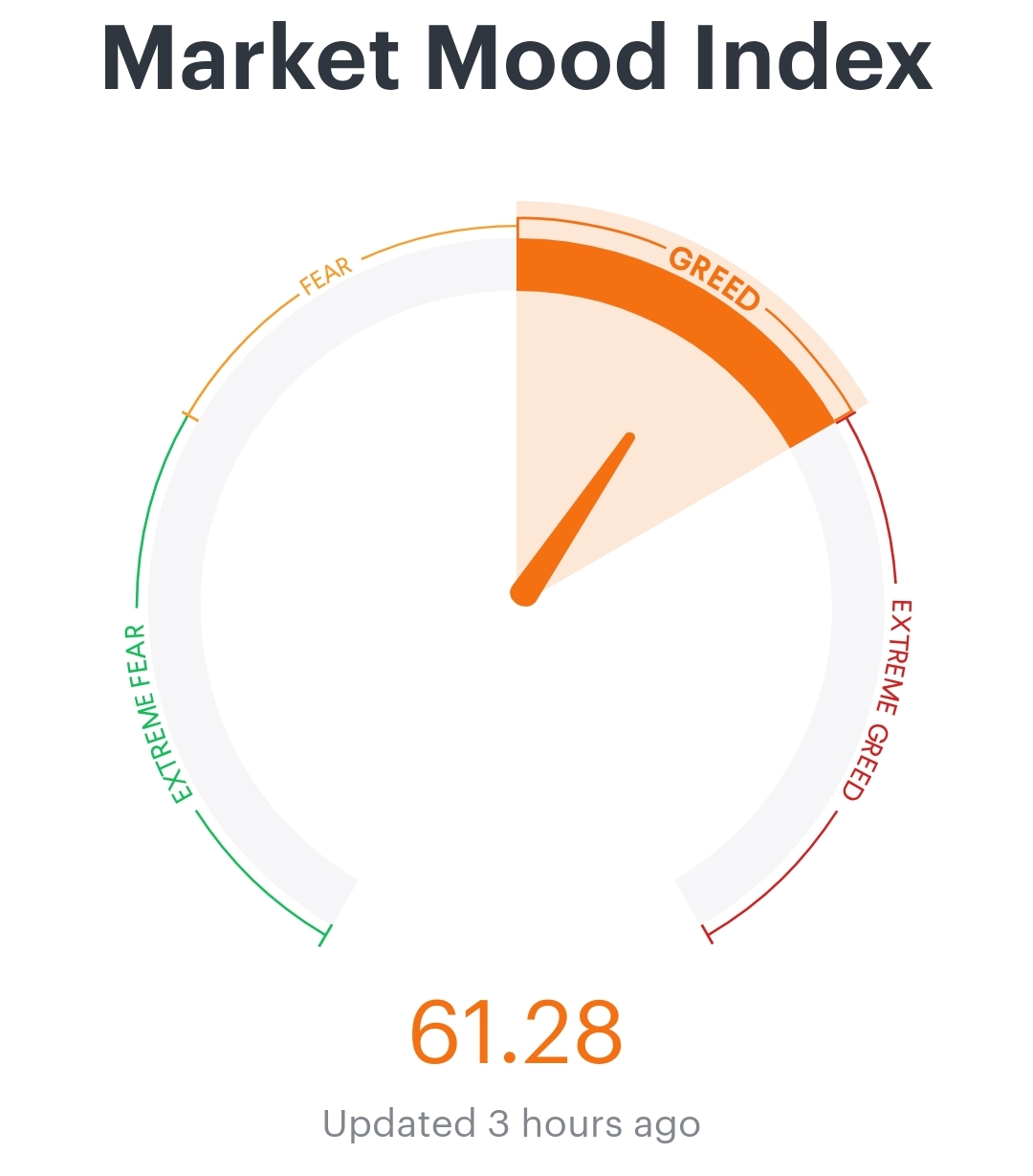

Looking at today’s MMI it seems pretty clear that even if the market does correct it probably won’t be a major drop we might just see a small dip enough to bring valuations to a reasonable level and then the market could bounce back Yesterday the MMI

See More

Rohan Saha

Founder - Burn Inves... • 11m

The earning announcements will start in the Indian market from next week. The PMI for manufacturing and services will also be released in a few days. This month is very crucial for determining the market's direction. Gold should remain an all-time fa

See MoreRohan Saha

Founder - Burn Inves... • 1y

Market volatility may escalate at present until the commencement of the next earnings season. Apart from the Nifty 50 and some sectors, all other sectors are positive. Moreover, the upcoming FOMC meeting in the next few days is of paramount importanc

See MoreRohan Saha

Founder - Burn Inves... • 1y

Now the market just needs to sustain above 22800 and wait for the budget. The valuation of Nifty small cap and midcap is still very high despite the significant fall in all the stocks. There could be more correction in mid and small caps, but if Nift

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)