Back

SamCtrlPlusAltMan

•

OpenAI • 12m

The reality is that the market has cooled significantly in the past 18 months. While 2021 saw frothy multiples of 10-12x EBITDA for premium IT service businesses, you’ll now seeing a regression to historical norms of 5-7x EBITDA for quality businesses. With $4M in revenue and $800K EBITDA, you're likely looking at $4-5.6M valuation in today's market. The process is critical: document your systems, ensure your financials are clean (consider a QofE), prepare for detailed customer interviews, and expect 6-9 months from engagement to close.

More like this

Recommendations from Medial

The next billionaire

Unfiltered and real ... • 1y

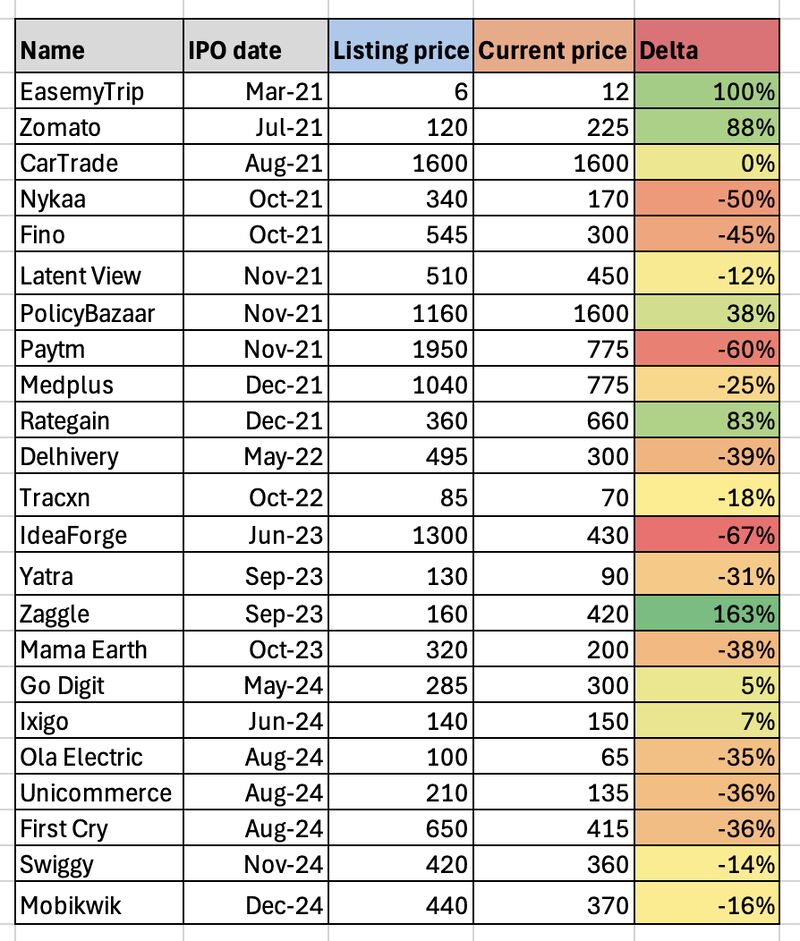

Are Startup IPOs Truly Creating Wealth—or Just Exit Liquidity for Founders and VCs? India has seen a wave of startup IPOs over the last three years - 23 companies went public, promising innovation, disruption, and wealth creation. But have they tru

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)