Back

Shivam Singh

"Igniting My Startup... • 11m

Hey everyone, I’m working on a new fintech idea around MSME financing. If there were a platform where MSMEs could quickly get funds based on their pending invoices or confirmed orders from reputed companies, would that be something useful? What challenges do you think could come with such a model? please give your genuine opinion on this

Replies (5)

More like this

Recommendations from Medial

Shivam Singh

"Igniting My Startup... • 11m

Hey everyone, I'm working on a new fintech idea around MSME financing. If there were a platform where MSMEs could quickly get funds based on their pending invoices or confirmed orders from reputed companies, would that be something useful? What chall

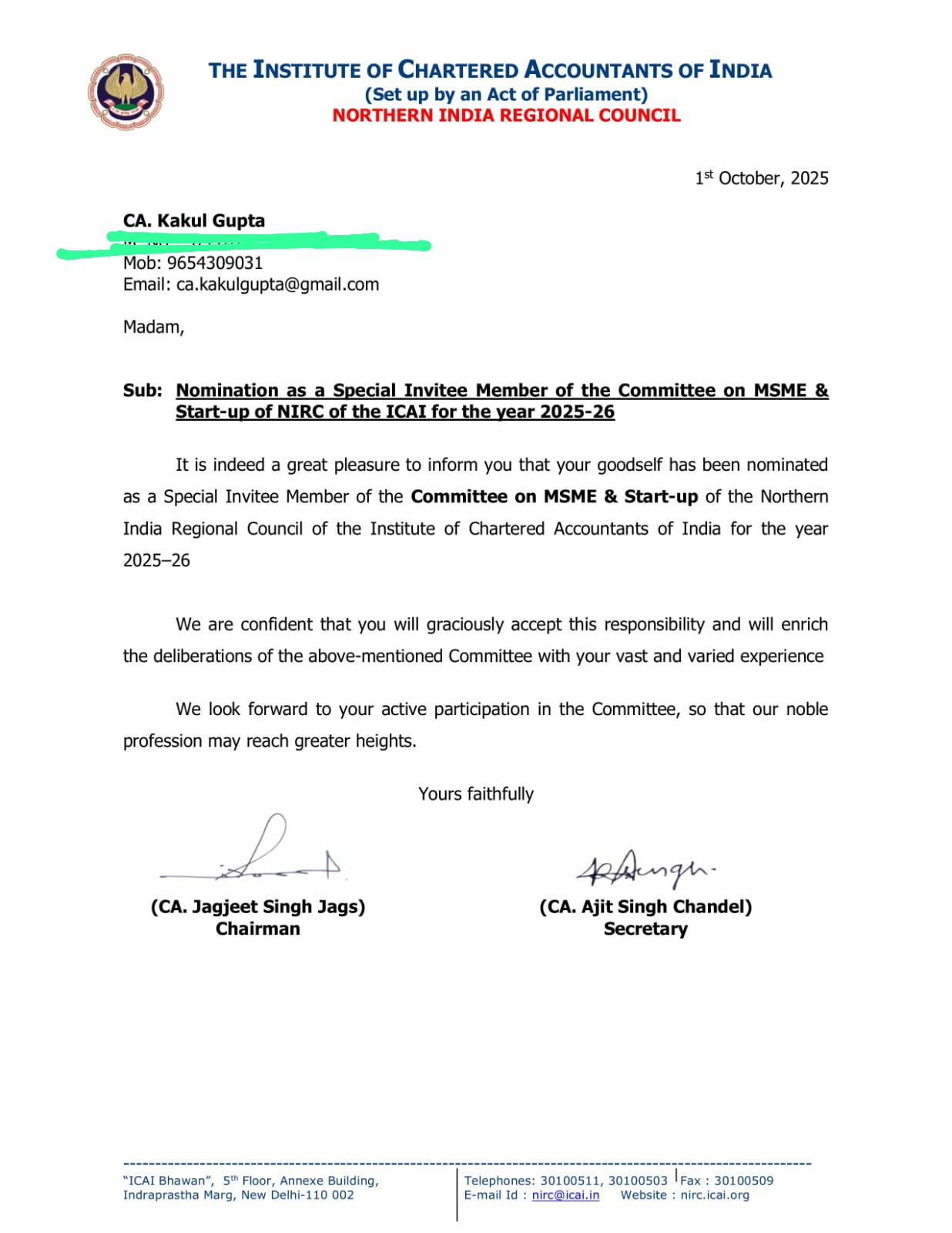

See MoreCA Kakul Gupta

Chartered Accountant... • 4m

Honored to share that I’ve been nominated as a Member to the Committee on MSME & Startup, NIRC-ICAI for FY 2025-26. Excited to contribute towards empowering MSMEs, Startups, and supporting fellow professionals in building a stronger entrepreneurial

See More

Shubham Jain

Partner @ Finshark A... • 11m

Mandatory TReDS Onboarding for Companies with Turnover Above ₹250 Crores As per Gazette Notification S.O.-4845E dated 7th November 2024, all companies with a turnover exceeding ₹250 crores are required to onboard the Trade Receivables Discounting Sy

See MoreNiket Raj Dwivedi

•

Medial • 1y

Union Budget 2024-25: Key Highlights for Startups and MSMEs 🚀 Finance Minister Nirmala Sitharaman mentioned 'startup' just twice in her speech, but there's plenty for the startup ecosystem, manufacturing, and MSMEs in this budget! Here's the scoop:

See MoreRohan Saha

Founder - Burn Inves... • 1y

The RBI is increasingly cracking down on unsecured lending. The NPAs (Non-Performing Assets) of unsecured loans are also increasing rapidly. Companies that used to provide loans against salaries are now changing their business models. The NPAs of MSM

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)