Back

chakshu asija

Hey I am on Medial • 11m

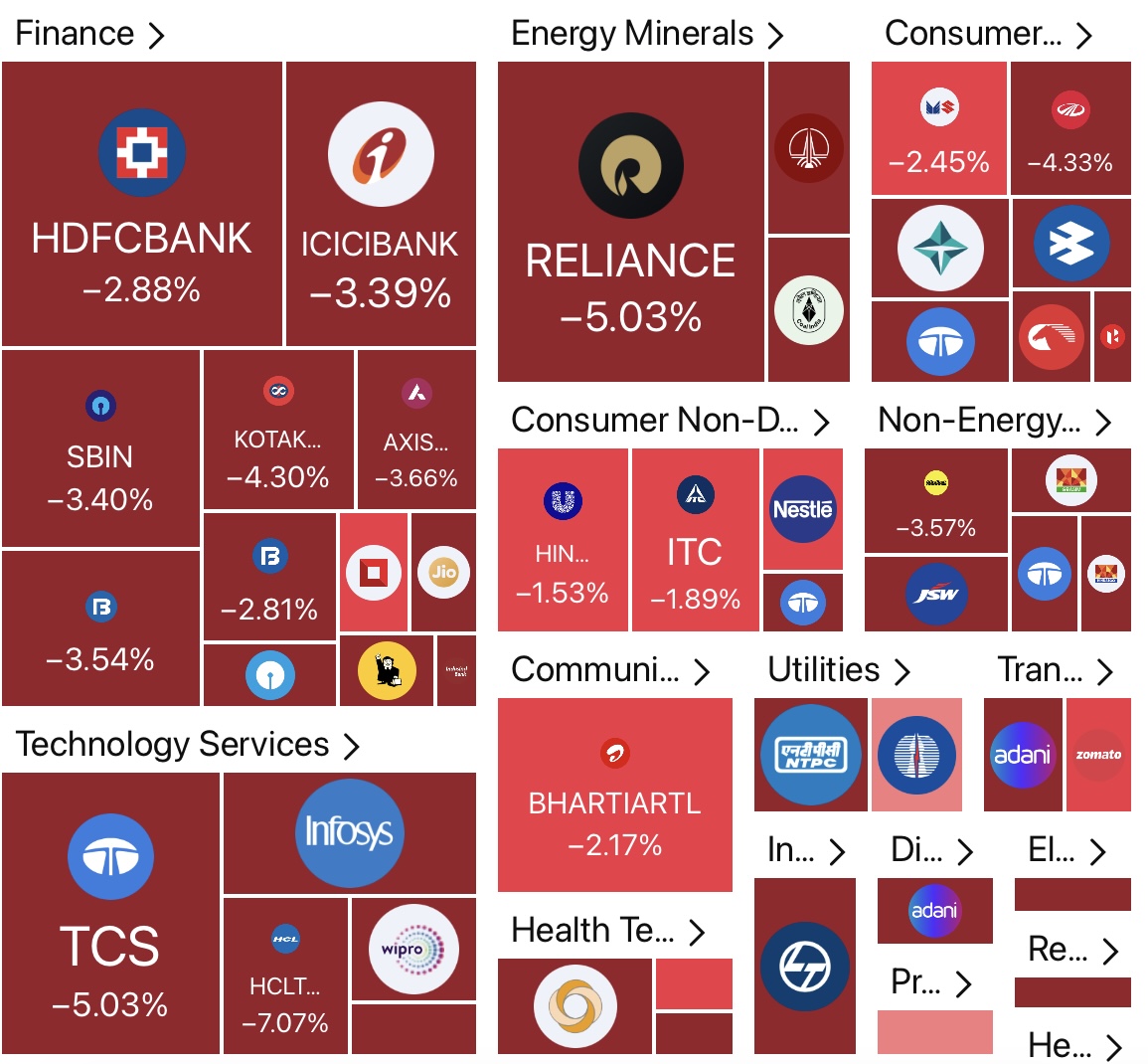

Market Update: CNX IT – The Deciding Factor for Nifty 22,700 Breakdown For the past two weeks, I have been highlighting CNX IT as the key sector that would decide whether Nifty’s 22,700 support holds or breaks. Now, 22,700 has broken, and the market is trying to sustain below it, but every intraday upmove is being sold into due to relentless selling in Nifty IT. Major IT stocks like TCS have seen three consecutive red candles on the weekly chart, with a 21% fall from all-time highs. What’s Next for Nifty & IT? There are support levels in both IT stocks and the sector, but without a higher-timeframe reversal from discount zones, the fall or consolidation may continue. A clear reversal pattern is needed before any sustainable recovery. Why is the IT Sector Struggling? 1️⃣ Economic Slowdown: Global slowdown is reducing IT spending, impacting demand and revenue. 2️⃣ AI Disruption: Rapid AI adoption is reshaping job roles and forcing companies to adapt. 3️⃣ Geopolitical Uncertainty: Global tensions are affecting key IT export markets, leading to cautious spending. 4️⃣ Interest Rate Hikes: Higher rates make borrowing costlier, causing companies to cut back on IT investments. Key Takeaway: Until CNX IT stabilizes, Nifty will struggle to regain momentum. Watch for signs of accumulation or reversal in IT stocks before expecting any meaningful recovery. #Nifty #BankNifty

More like this

Recommendations from Medial

financialnews

Founder And CEO Of F... • 1y

Nifty 50 Index: Signs of Reversal Amid Risky Patterns The Nifty 50 index is exhibiting patterns that signal potential market volatility and a possible reversal. Recent technical indicators, such as overbought levels and resistance zone challenges, s

See MoreRohan Saha

Founder - Burn Inves... • 1y

Now the market just needs to sustain above 22800 and wait for the budget. The valuation of Nifty small cap and midcap is still very high despite the significant fall in all the stocks. There could be more correction in mid and small caps, but if Nift

See Morefinancialnews

Founder And CEO Of F... • 1y

Technical Analysis for Nifty and Bank Nifty: Key Support, Resistance, and Market Outlook Following a four-week decline, the Nifty index is approaching a critical support level near 24,000. Ajit Mishra, SVP of Research at Religare Broking Ltd, notes

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)