Back

Vishu Bheda

•

Medial • 1y

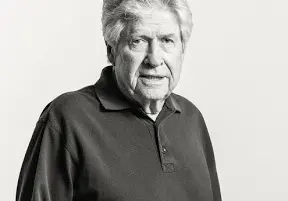

Donald Valentine bet on the future before others saw it. Sequoia didn’t just invest—it shaped Silicon Valley. The real question: Who’s making those bold bets today?

Replies (1)

More like this

Recommendations from Medial

Account Deleted

Hey I am on Medial • 1y

Today's topic is : Sequoia Capital Venture Capital Firm🚀📈🤑 I. Introduction : • Sequoia Capital was founded by Donald Valentine in 1972 and current partner is My favourite Roelof Botha ♥️. • Sequoia Capital created new fund called 'Peak XV Pa

See More

Kethan Sai

Founder/CEO -of work... • 6m

The new "America First" policies under Donald Trump's administration, particularly concerning H-1B visas, are sending a clear message to Indian engineers and tech professionals. This is not a moment for despair, but for determination. Instead of seei

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)