Back

Havish Gupta

Figuring Out • 1y

How Donald Valentine Started Sequoia Capital >Donald was Born in 1932, in USA >He Graduated from Fordham University >Started his career in sales & marketing at Raytheon (military weapon manufacturer) >Joined Fairchild Semiconductor as a sales executive >Joined National Semiconductor, working as a senior sales and marketing executive >Started Sequoia Capital in 1972 So, unlike other VC firms, Sequoia Capital wasn’t founded by an entrepreneur who sold his company for millions or billions. In Sequoia’s case, it was started by more of a job person who likely saved money or had stock options from his previous company, along with initial funding from others. Anyway, after starting, it focused on making small investments in risky tech companies. As a result, it backed Apple, Google, YouTube, PayPal, WhatsApp, Instagram, LinkedIn, Airbnb, Nvidia, etc Today, Sequoia Capital is one of the most powerful VC firms in the world, with over 2000 investment and 100s of exits

Replies (7)

More like this

Recommendations from Medial

Account Deleted

Hey I am on Medial • 1y

Top 10 Venture Capital Firms : 1.SoftBank Vision Fund 2: $151B 2.Sequoia Capital Global Growth Fund: $138.5B 3.Tiger Global Management :$126B 4.Blackstone Growth (BX): $110B 5.Insight Partners: $92B 6.TCV: $87B 7.General Atlantic: $83B 8.Thoma Bravo

See More

Account Deleted

Hey I am on Medial • 2y

As we know, SoftBank, Sequoia Capital, and many venture capital firms are investing in AI startups like LLM companies and companies that use LLM model API to integrate in their backend. What do you think, where is technology going? 🤔 Let me know yo

See MoreAccount Deleted

Hey I am on Medial • 1y

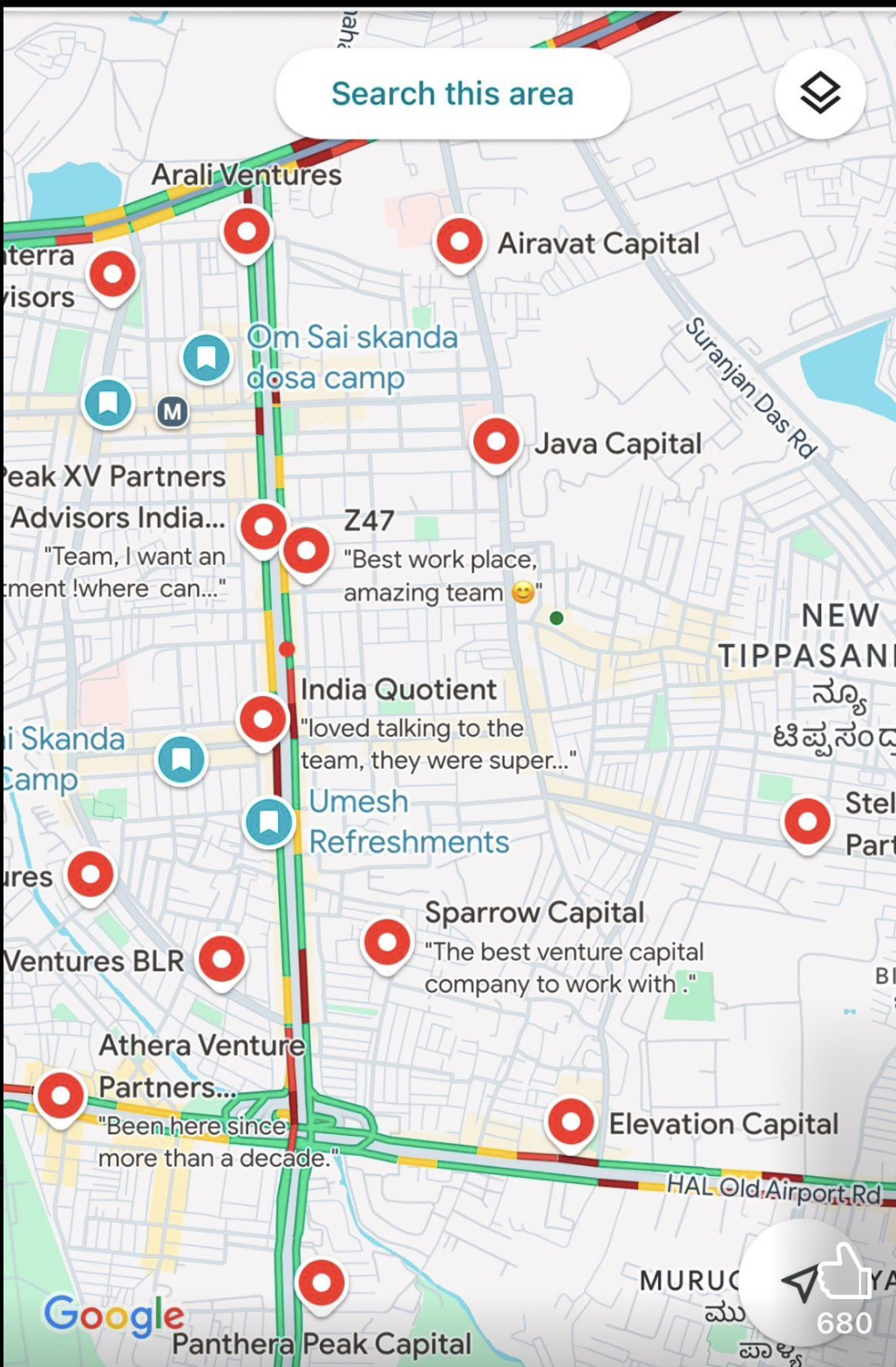

Today's topic is : Sequoia Capital Venture Capital Firm🚀📈🤑 I. Introduction : • Sequoia Capital was founded by Donald Valentine in 1972 and current partner is My favourite Roelof Botha ♥️. • Sequoia Capital created new fund called 'Peak XV Pa

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)