Back

LEKSHMAN M J

Hey I am on Medial • 1y

Market News: Nerolac, Cummins, Page, Sula Kansai Nerolac Paints, a manufacturer of paints and industrial coatings, registered a lower single digit revenue growth. During the quarter, the demand for decorative paints was impacted due to higher inflation leading to lower spend on discretionary products and tight liquidity. The growth in the performance coating business was led by a good order pipeline. The 2.9% improvement in EBITDA was driven by improvement in mix, cost optimization and control on overheads. Going forward, the company sees a gradual recovery in demand. It is expected that the recent budget announcement will help improve the consumption cycle which would positively impact demand. In the long run, the good growth in infrastructure, automobile and real estate is likely to have a positive effect on the overall demand of paint. Cummins India, one of the leading manufacturers of diesel and alternate fuel engines, reported a highest ever quarterly revenue driven by robust demand across the segments and its continuous execution of profitable growth strategy. In Q3, the company's domestic sales grew by 18% and exports grew by 43%. Looking ahead, With adoption of new emission norms, the company is cautiously optimistic about the demand outlook in the near term and is optimistic about the long term prospects. In terms of exports, the company is optimistic about the recovery in exports demand. Page industries, an exclusive licensee for manufacturing, distribution and marketing of JOCKEY brand in some of south Asian and Middle East countries, has reported a 7.1% growth in revenue and 34.3% growth in profit. The profitability of the company is driven by consistent increase in revenue and control over operating expenses. Though the Indian apparel retail sector faced temporary headwinds due to weak consumer sentiment, in the long run, the sector remains bullish due to rising disposable income and rapid increase seen in the trend of purchasing athleisure and inner wear from organized or branded markets. Another funny fact is inner wear sales number is one of the key economic indicators, because during economic slowdown, inner wear is the product that is given the last priority to purchase by most of the people. Sula Vineyards, India's largest wine producer, reported a 0.6% decline in revenue due to broad-based slowdown in urban consumption and election-related disruptions. EBITDA took a hit of 160 bps due to lower WIPS credit for the quarter. Despite challenges, revenue from over 10 states show double-digit growth, with own brand sales contributing 50% of revenue. Wine tourism also recorded its highest ever q3 revenue, growing 11.6% YoY. Going forward, having started the production at Nashik unit, from FY26, the company is well placed to realize 100% of the potential WIPS(). The company is also focused on driving profitable growth and target a significant expansion in earning from FY26 as the consumer demand recovers.

More like this

Recommendations from Medial

Anonymous

Hey I am on Medial • 1y

✨ Ceo IQ test question ✨ You are the founder of a tech startup that has developed an innovative software platform. After several months of rapid growth, your company is facing a strategic decision: whether to continue bootstrapping or seek venture c

See MoreMedial Startup Trivia

Trivias Around start... • 1y

Amit Syngle: Millionaires You Won't Hear about anywhere else. Amit Syngle's journey from a modest upbringing to becoming the CEO of Asian Paints—a company with a market capitalization of over $40 billion—is a powerful story of resilience, hard work

See More

Aakash kashyap

Building JalSeva and... • 1y

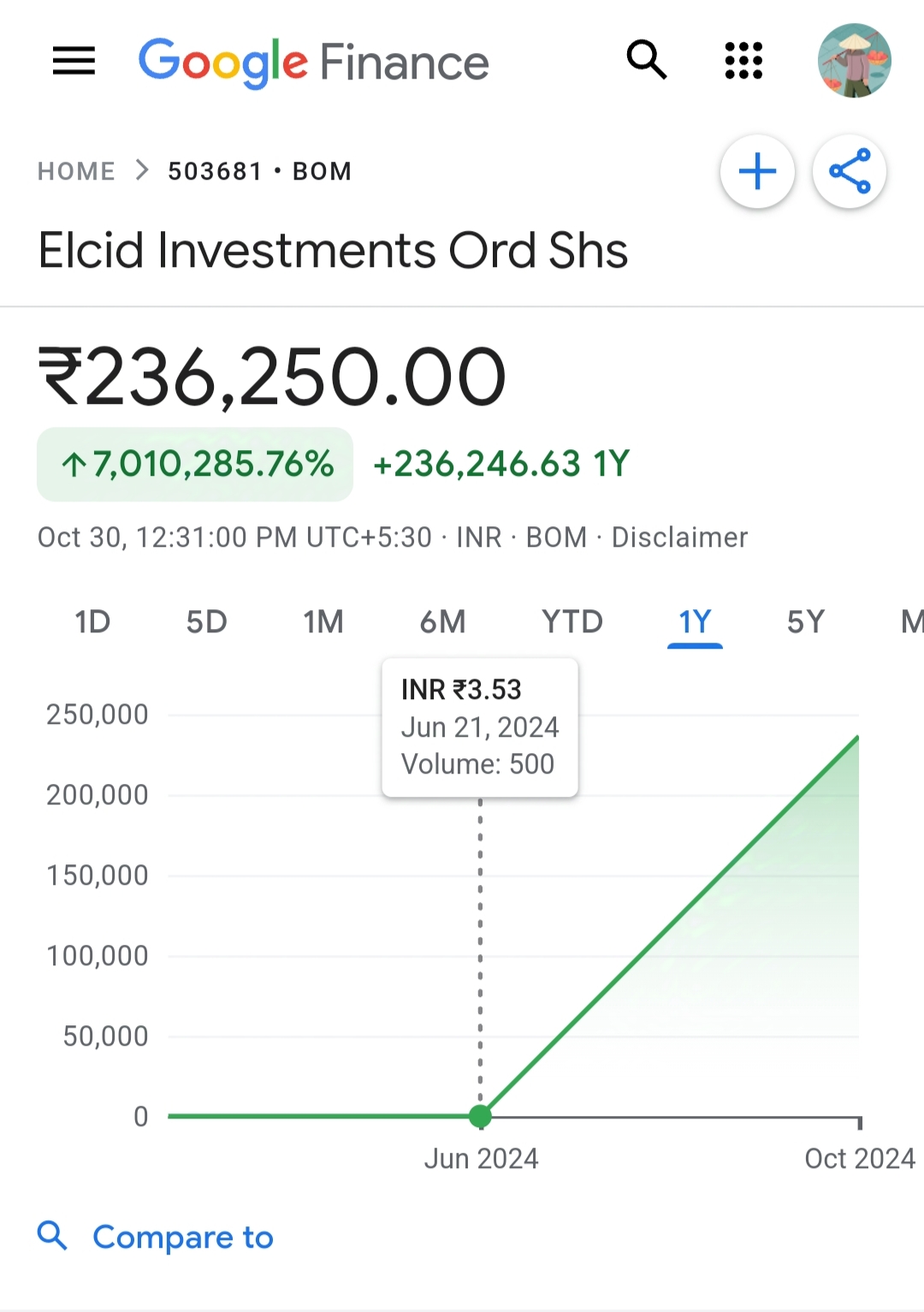

Elcid Investments Ltd's share price skyrocketed to ₹2,36,250 after its relisting on the Bombay Stock Exchange in October 2024.🔥 Elcid Investments Ltd operates as an investment holding company. It primarily holds stakes in other companies, with a si

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)