Back

Inactive

AprameyaAI • 1y

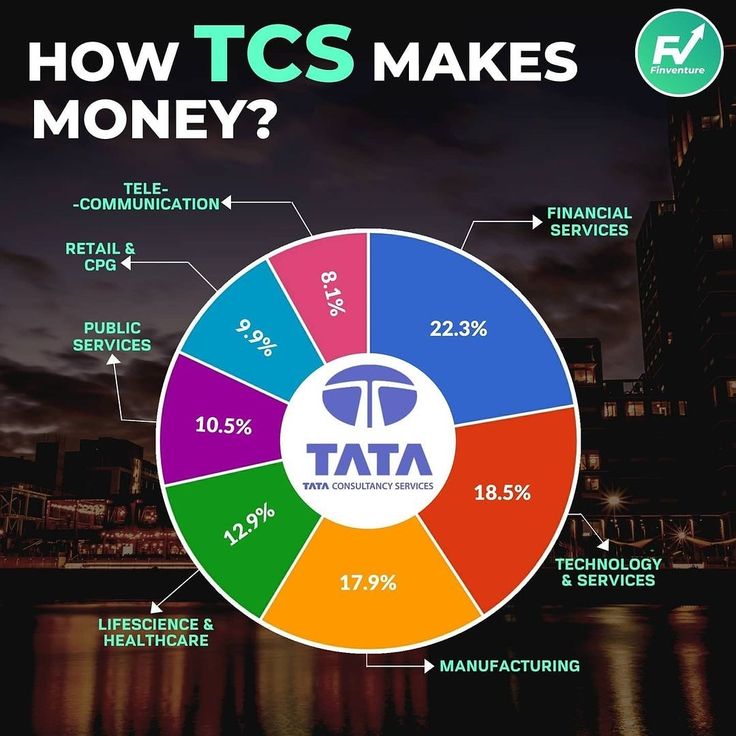

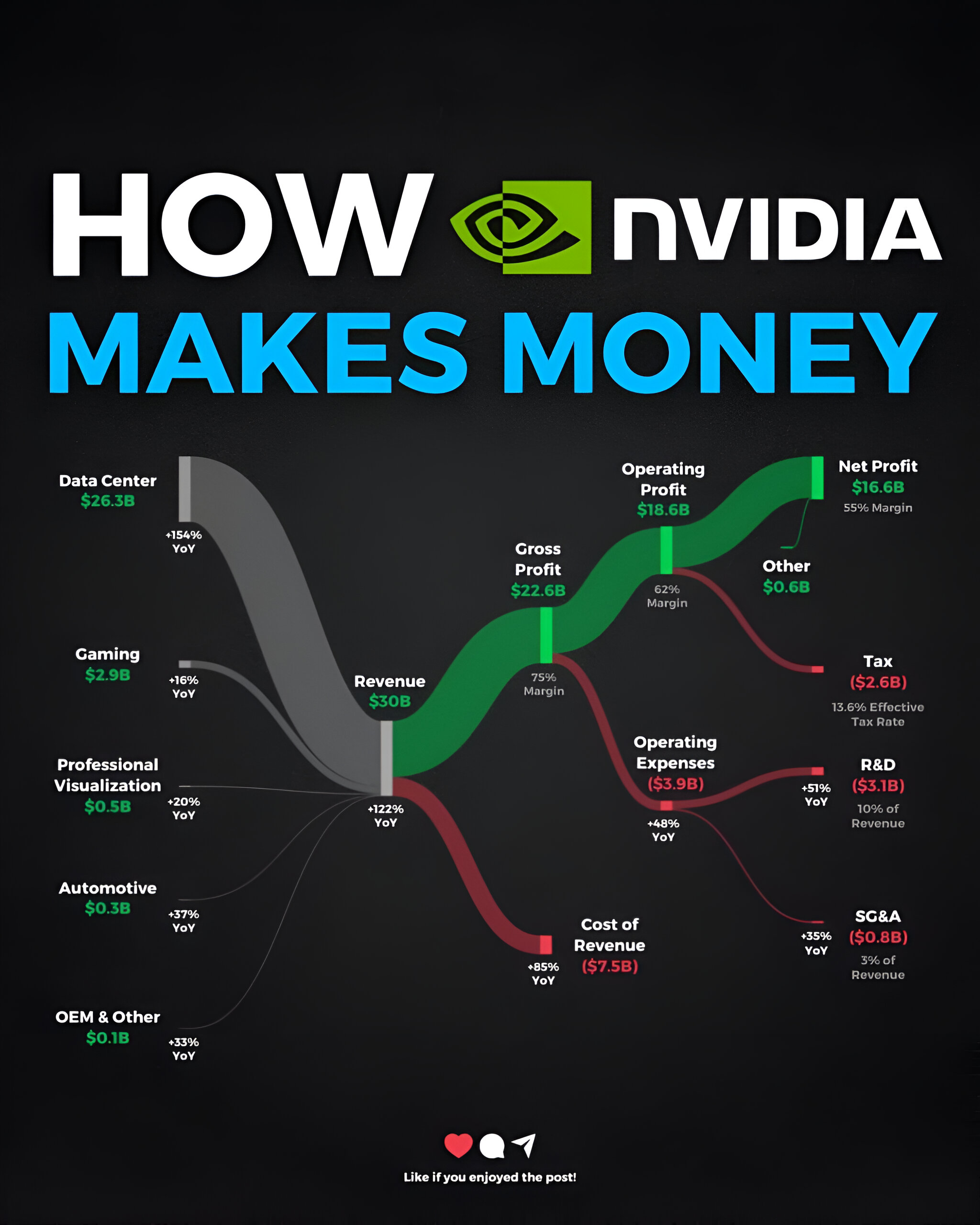

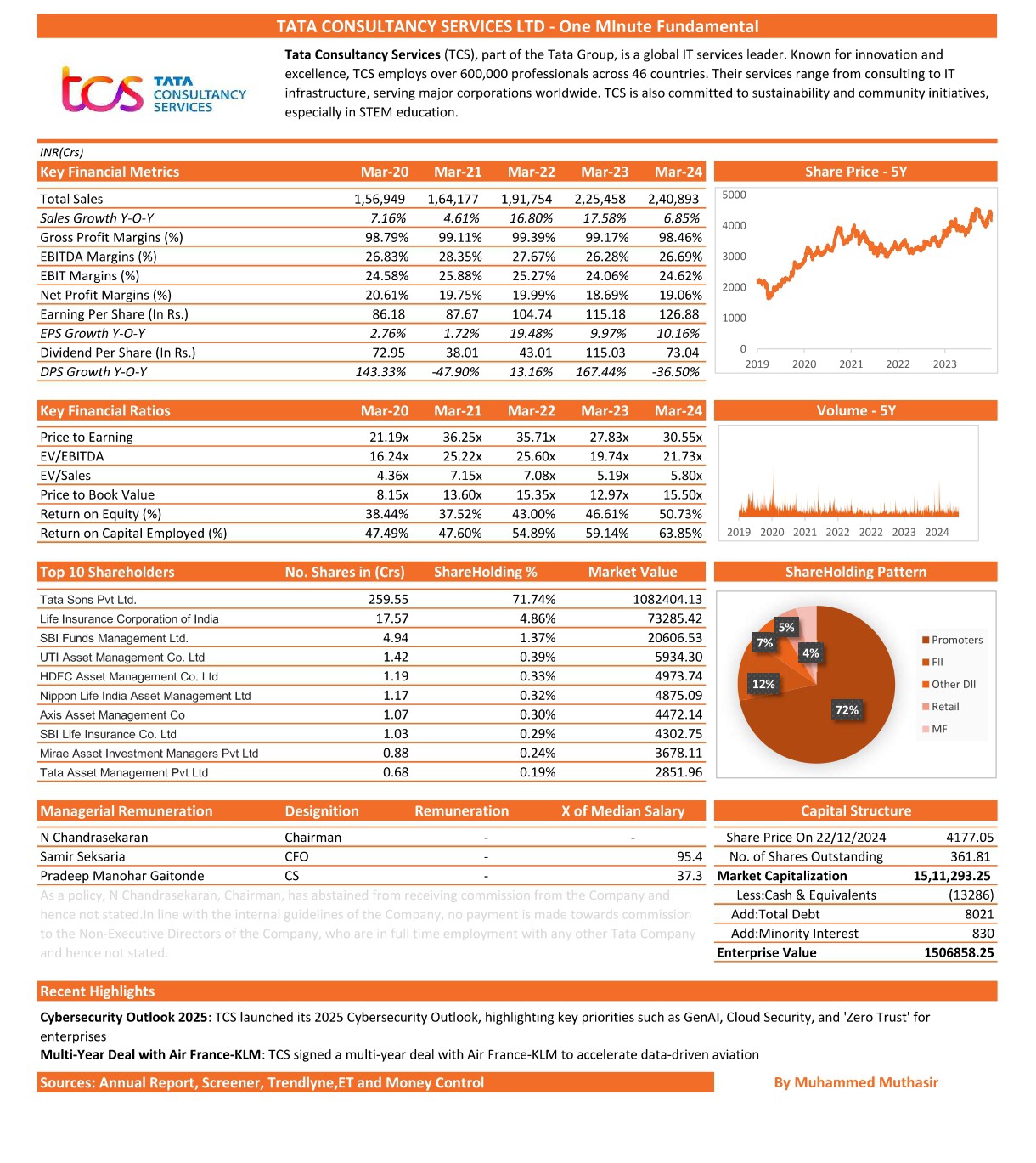

Financial Analysis of TCS And Earnings!!! Revenue Growth: TCS has demonstrated consistent revenue growth, with recent reports indicating a year-over-year increase of approximately 10%, reflecting strong demand for its services across various sectors3 . Profit Margins: The company maintains healthy profit margins typically around 25-30%, indicative of efficient operations and strong demand for its offerings. Cost Structure: TCS has a well-defined cost structure with significant investments in R&D and technology to maintain competitiveness while managing operational costs effectively.

Replies (1)

More like this

Recommendations from Medial

Startup Savvy

Entrepreneur is What... • 1y

Signs of Fundamentally Strong Business :- 1) Brand Credibility 2) Financial Stability 3) High Performance Team 4) Future Plan 5) Demand For Product 6) Economic MOAT 7) Dispute Management 8) Innovation 9) Increasing Sales Year on Year 10) Increasing

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)