Back

FounderFund Connect

Bridges Founders wit... • 1y

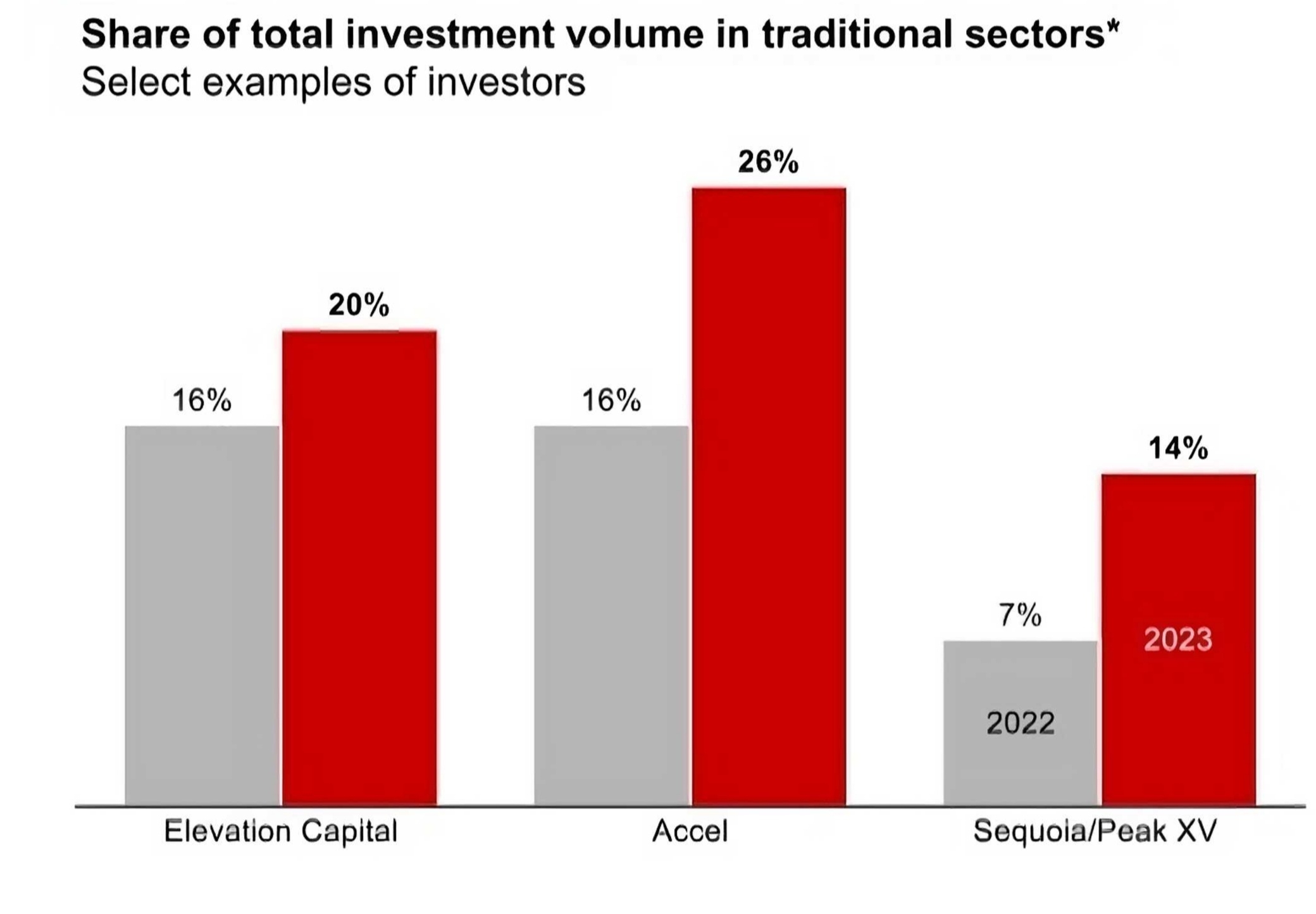

Venture capitalists (VCs) tailor their investment interests based on their existing portfolios, aligning with their expertise and strategic goals. For instance, Overlap Holdings focuses on early-stage tech and manufacturing startups, particularly in capital-intensive sectors like energy, space, and robotics, reflecting their specialized knowledge and investment strategy. Similarly, Acton Capital invests in tech-enabled business models such as platforms, SaaS, and online marketplaces, concentrating on sectors like fintech, mobility, healthcare, and direct-to-consumer models. This strategic alignment enables VCs to leverage their industry insights, manage risks effectively, and add value to their portfolio companies.

More like this

Recommendations from Medial

Vivek Joshi

Director & CEO @ Exc... • 5m

The Direct Comparison Family Offices vs. VCs: The Investor Showdown When you're a startup founder seeking capital, not all money is created equal. While both family offices and institutional VCs provide crucial funding, their impact and approach coul

See More

Vivek Joshi

Director & CEO @ Exc... • 3m

Building the future with Deep Tech, AI, & revolutionary business models? Excess Edge Experts Consulting is actively scouting technology-intensive, truly innovative pre-seed startups for investment and strategic partnership. We provide the strategic "

See More

Derek Sandrio

Tech Content Writer • 19h

Rajat Khare’s VC Firm Boundary Holding Eyes Novel Deep-Tech Investments After Strategic Exit from Cynapse Following its successful exit from Cynapse, Rajat Khare’s venture capital firm Boundary Holding is now focusing on next-generation deep-tech in

See MoreMuttu Havalagi

🎥-🎵-🏏-⚽ "You'll N... • 1y

HSBC Restructures Investment Banking Operations HSBC announced a significant reduction in its investment banking operations, particularly shutting down its Equity Capital Markets and Mergers & Acquisitions advisory businesses in the UK, Europe, and

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)